Annual Salary = Hourly Rate × Hours per Week × 52 Weeks per Year

This free hourly to annual salary calculator shows you what any hourly rate means in yearly terms. Whether you’re hiring, evaluating a job offer, or planning labor costs, you’ll learn how to calculate, interpret, and track salary conversions efficiently. We’ve also included a free Excel and Google Sheets template you can download and use right away.

Ready to convert? Let’s start.

Hourly to Annual Salary Formula Explained

Annual Salary = Hourly Rate × Hours per Week × 52 Weeks per Year

For a standard full-time job:

Annual Salary = Hourly Rate × 40 × 52 = Hourly Rate × 2,080

Let’s break down each part:

Hourly Rate: The amount paid for each hour of work. This is your base pay before taxes, benefits, or deductions.

Hours per Week: Standard full-time is 40 hours per week in the US. Part-time roles work fewer hours—typically 20 to 30 hours weekly. Knowing the exact weekly hours is critical for accurate conversions.

52 Weeks per Year: Every year has 52 weeks plus one day (52.14 weeks exactly). We use 52 for standard calculations, which gives us 2,080 working hours annually for full-time staff.

Why 2,080 hours? This assumes zero unpaid time off. Real annual hours are lower once you factor in vacation days, sick leave, and holidays. For example, with 2 weeks vacation plus 10 holidays, actual working hours drop to about 1,960 hours per year.

What Is Hourly to Annual Salary Conversion?

Hourly to annual salary conversion translates an hourly wage into a yearly salary figure. This calculation helps you compare job offers, budget for hiring costs, and understand total compensation packages.

The conversion gives you the gross annual income before taxes, benefits, or other deductions. It’s a baseline number that doesn’t include overtime pay, bonuses, or employer-paid benefits like health insurance.

Who uses this metric?

HR professionals evaluating job offers and building compensation structures across hourly and salaried roles.

CFOs and Finance Directors forecasting annual labor costs and building departmental budgets.

Hiring managers comparing candidate compensation packages and justifying salary ranges.

Job seekers evaluating whether an hourly rate meets their income goals.

Fractional CFOs advising clients on optimal compensation structures for new hires.

How to Calculate Hourly to Annual Salary: Step-by-Step

Let’s walk through converting an hourly rate to annual salary with a real example.

- Start with the hourly rate

You’re hiring a customer support specialist at $22 per hour.

- Determine weekly hours

This is a full-time role at 40 hours per week.

- Calculate weekly pay

Multiply hourly rate by weekly hours:

$22 × 40 = $880 per week

- Multiply by 52 weeks

Take weekly pay and multiply by 52 weeks in a year:

$880 × 52 = $45,760 annual salary

- Account for actual working days (optional)

If this employee gets 2 weeks vacation (10 days) plus 8 holidays, they work 50 weeks:

$22 × 40 × 50 = $44,000 actual annual pay

- Consider part-time scenarios

For a part-time role at 25 hours per week:

$22 × 25 × 52 = $28,600 annual salary

- Interpret the result

At $22 per hour working full-time, this position costs $45,760 annually in base wages. Add 25-35% for employer taxes and benefits to get true cost—roughly $57,200 to $61,776 total annual cost.

How to Interpret Your Hourly to Annual Salary Number

Understanding what your converted salary means helps you make smart hiring and career decisions.

| Hourly Rate | Annual Salary (2,080 hrs) | Interpretation | Considerations |

| Below $15 | Below $31,200 | Entry-level wage – Below living wage in most US metros | • Often minimum wage or slightly above<br>• May require government assistance<br>• High turnover risk<br>• Consider local cost of living |

| $15 – $25 | $31,200 – $52,000 | Mid-level hourly – Skilled trades, support roles, early career | • Competitive for many markets<br>• Attracts reliable talent pool<br>• Standard benefits expected<br>• Room for growth path |

| $25 – $40 | $52,000 – $83,200 | Professional hourly – Specialized skills, experienced workers | • Market rate for skilled positions<br>• Strong retention potential<br>• Benefits package critical<br>• Compare to salaried peers |

| $40 – $60 | $83,200 – $124,800 | Senior hourly – Technical experts, senior contractors | • Highly specialized roles<br>• May prefer hourly for overtime<br>• Strong negotiating position<br>• Consider consultant rates |

| Above $60 | Above $124,800 | Executive hourly – C-suite consultants, fractional executives | • Fractional or interim leadership<br>• Project-based engagements<br>• May exceed salaried equivalent<br>• Evaluate against full-time cost |

Hourly to Annual Salary Benchmarks by Industry

Understanding typical hourly rates in your industry helps you set competitive compensation and budget accurately.

| Industry | Typical Hourly Range | Annual Equivalent (Full-Time) | Notes |

| Retail | $12 – $18 | $24,960 – $37,440 | Entry-level positions, high turnover, often part-time roles dominate |

| Healthcare Support | $15 – $22 | $31,200 – $45,760 | Medical assistants, home health aides, certification often required |

| Hospitality | $13 – $20 | $27,040 – $41,600 | Front desk, food service, tips may supplement in some roles |

| Manufacturing | $16 – $28 | $33,280 – $58,240 | Assembly, machine operation, varies by skill level and union presence |

| Construction | $18 – $35 | $37,440 – $72,800 | Wide range based on trade, experience, and regional demand |

| Technology Support | $20 – $35 | $41,600 – $72,800 | Help desk, IT support, certifications increase pay |

| Professional Services | $25 – $50 | $52,000 – $104,000 | Consultants, specialists, often project-based hourly billing |

| Skilled Trades | $22 – $45 | $45,760 – $93,600 | Electricians, plumbers, HVAC, licensing affects rates significantly |

These ranges come from Bureau of Labor Statistics data for 2024-2025. Actual rates vary by location, company size, and individual experience.

Benchmark Citations

Bureau of Labor Statistics Occupational Employment and Wage Statistics

Indeed Hourly to Salary Calculator

BLS Average Hourly Earnings by Industry

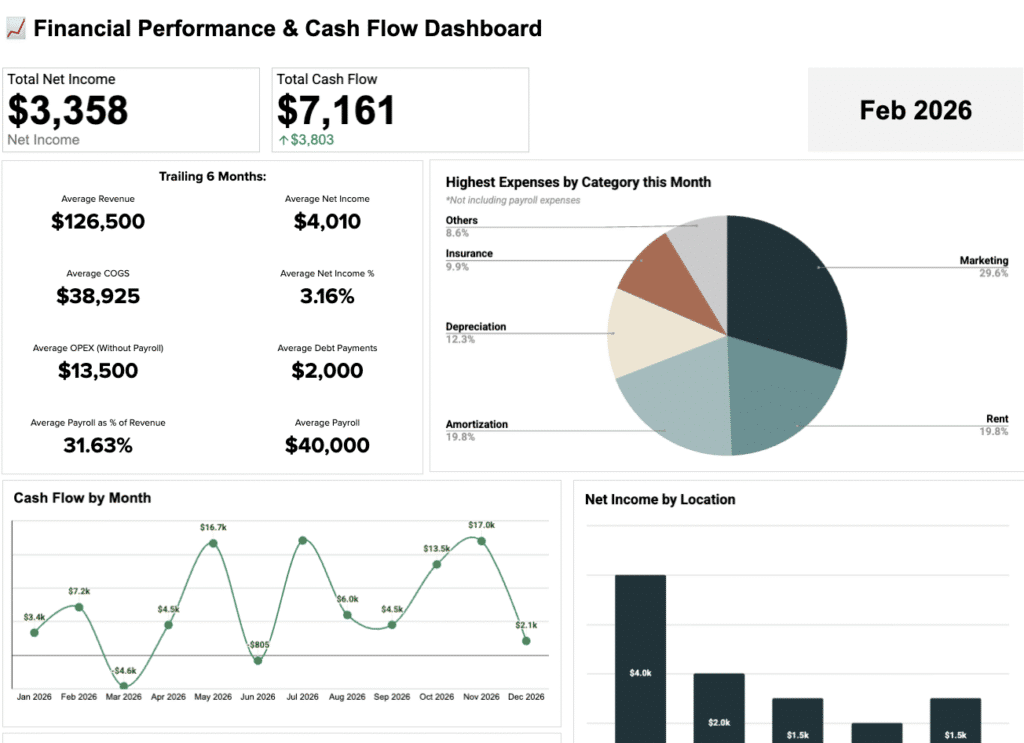

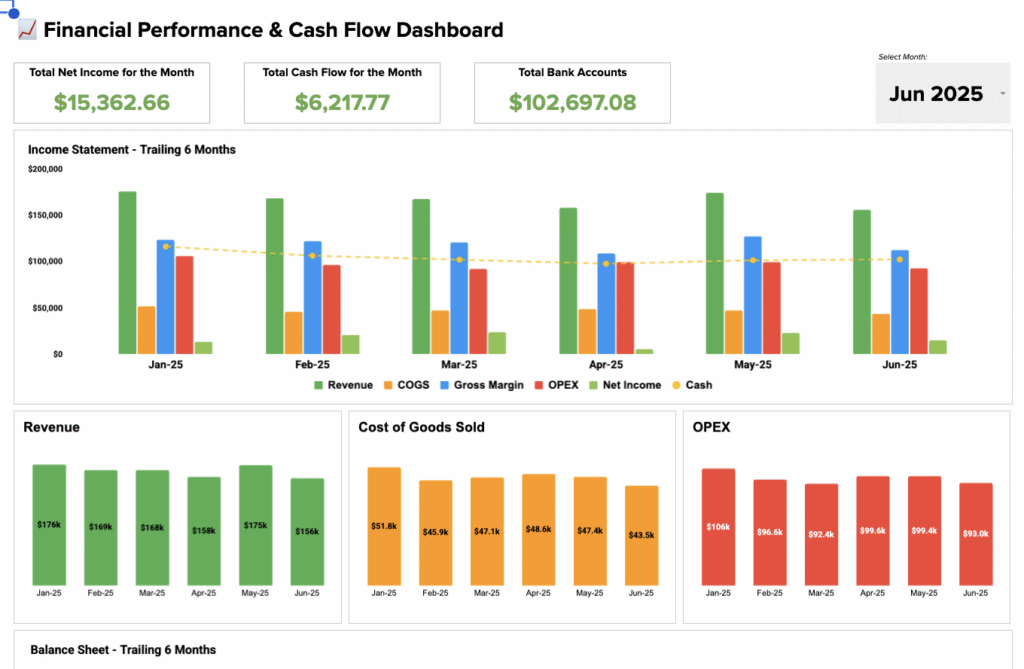

Automating Hourly to Annual Salary Tracking with Coefficient

Stop manually calculating annual costs from hourly rates every time you hire.

Coefficient connects your HRIS system or payroll software directly to Excel or Google Sheets, automatically pulling hourly rates, hours worked, and calculating annual equivalents. Your compensation analysis updates itself from live data.

Set up once, and your salary planning spreadsheets refresh automatically. Perfect for HR teams managing multiple positions and finance teams tracking labor costs across departments. Try Coefficient Free and eliminate manual calculations.

How to Improve Your Hourly to Annual Salary Calculations

Getting accurate conversions requires more than basic math.

Factor in actual working hours

Don’t use the full 2,080 hours. Subtract vacation days, holidays, and average sick leave. With 15 vacation days, 10 holidays, and 5 sick days, you’re at 1,840 actual working hours—that’s 240 hours less than the standard calculation.

Include employer costs beyond base pay

Add 25-35% to cover payroll taxes (7.65% FICA), unemployment insurance, workers comp, and benefits. A $25/hour employee costs you $32.50 to $37.50 per hour when you include these expenses.

Account for overtime patterns

If roles regularly require overtime at 1.5x pay, build that into your annual projection. An employee working 5 hours overtime weekly adds $6,760 annually at $26/hour base rate.

Compare to salaried equivalents in your market

Use salary surveys to see if your hourly-to-annual conversion is competitive. Sites like Glassdoor, Payscale, and industry associations publish market data for your region.

Calculate part-time conversions carefully

For part-time roles, use actual weekly hours, not 40. A 30-hour-per-week position at $20/hour is $31,200 annually, not $41,600. Accuracy here prevents budget overruns.

Hourly to Annual Salary vs. Hourly Wage vs. Annual Salary

Understanding the differences between these terms matters when hiring, budgeting, or negotiating pay.

Hourly to Annual Salary

A conversion calculation—it translates an hourly rate into what someone would earn annually if they worked full-time hours. It’s a projection, not actual pay. Use it for budgeting, job posting creation, and comparing positions.

Hourly Wage

The actual rate paid per hour worked. Employees clock in and out, and you pay only for hours worked. Hourly workers are typically non-exempt under FLSA, meaning they get overtime pay after 40 hours per week. This structure works well for variable schedules, seasonal staff, and roles where hours fluctuate.

Annual Salary

A fixed yearly amount paid in regular installments regardless of hours worked. Salaried employees often (but not always) are exempt from overtime. They receive the same paycheck whether they work 35 or 50 hours in a week. This structure suits management, professional roles, and positions requiring flexibility in hours.

When to use each

Pro tip for fractional CFOs: When advising clients on new hires, recommend hourly for roles with variable demand or project-based work. Switch to salary when someone consistently works full-time and you want to simplify payroll. The hourly-to-annual conversion helps you compare costs directly and show clients the breakeven point.

Make smarter hiring decisions

Hourly to annual conversions give you the clarity to compare compensation packages, budget accurately, and make informed hiring decisions.Get started with Coefficient to automate your salary calculations and focus on strategic workforce planning.