Mastering the Pro Forma Balance Sheet Template: A Comprehensive Guide

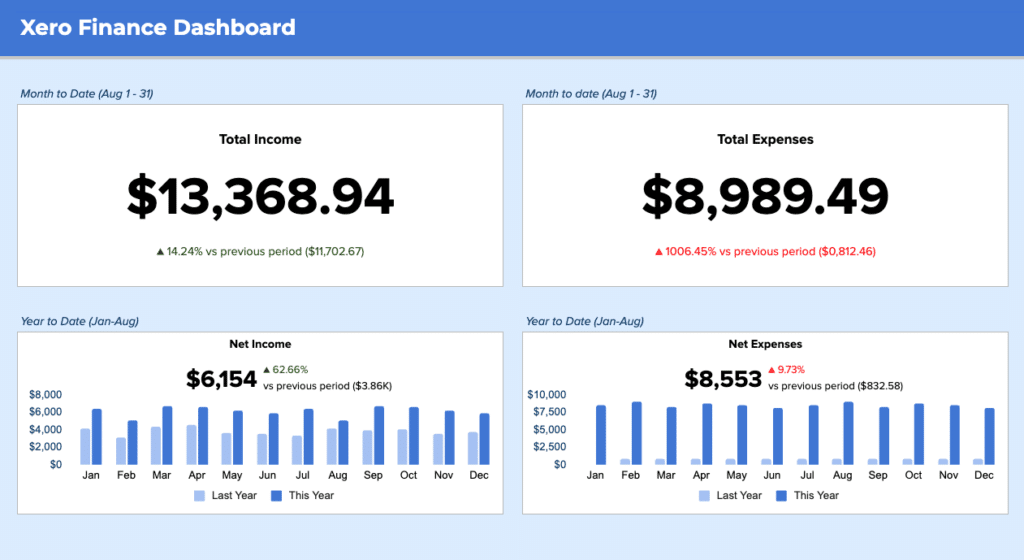

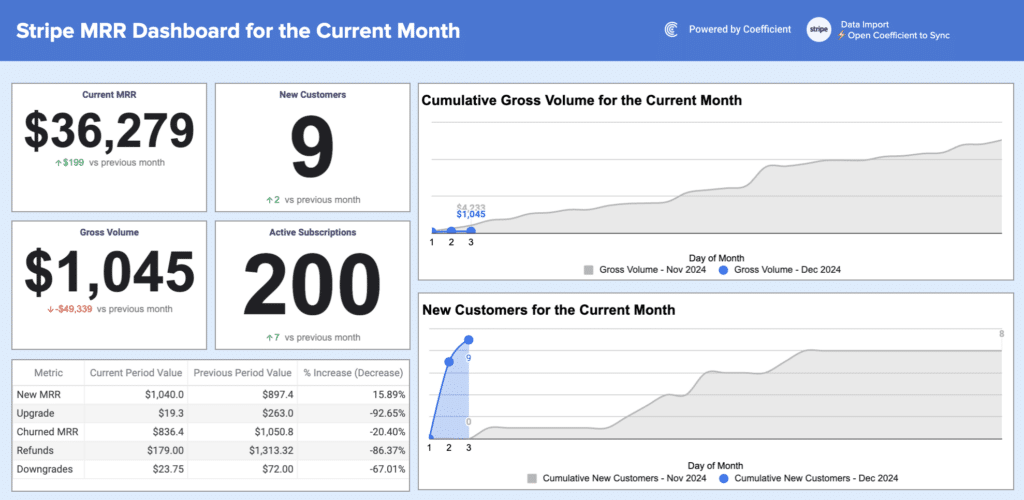

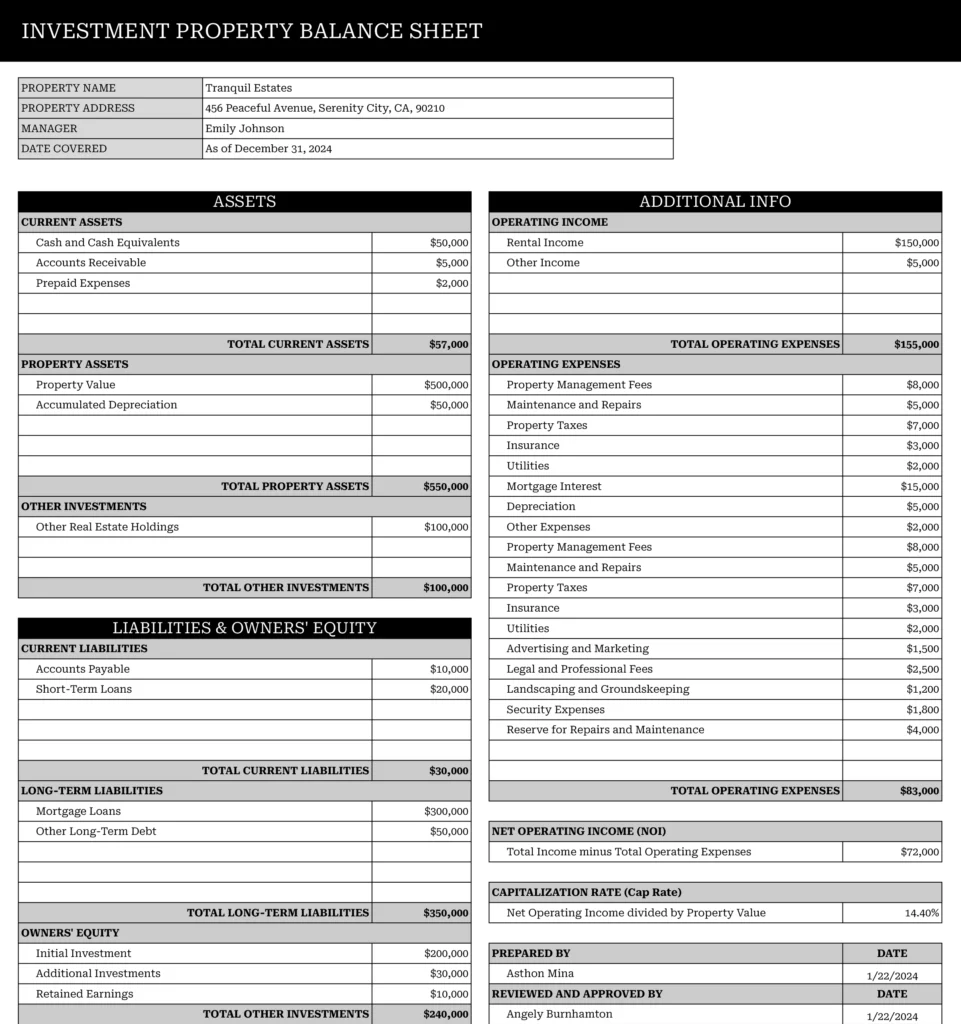

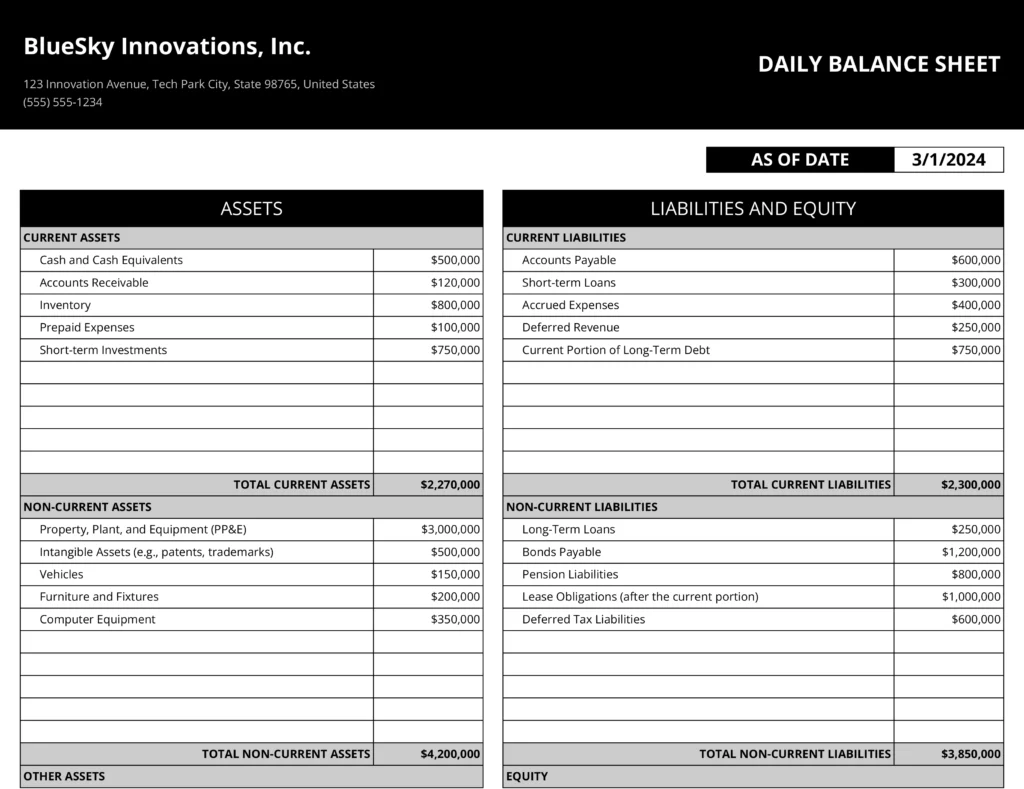

Pro forma balance sheets are pivotal in financial modeling and business planning. They offer a projected view of a company’s financial position, crucial for strategic decision-making. In this guide, we delve into creating and using pro forma balance sheet templates effectively.

Understanding Pro Forma Balance Sheets:

How do you create a pro forma balance sheet?

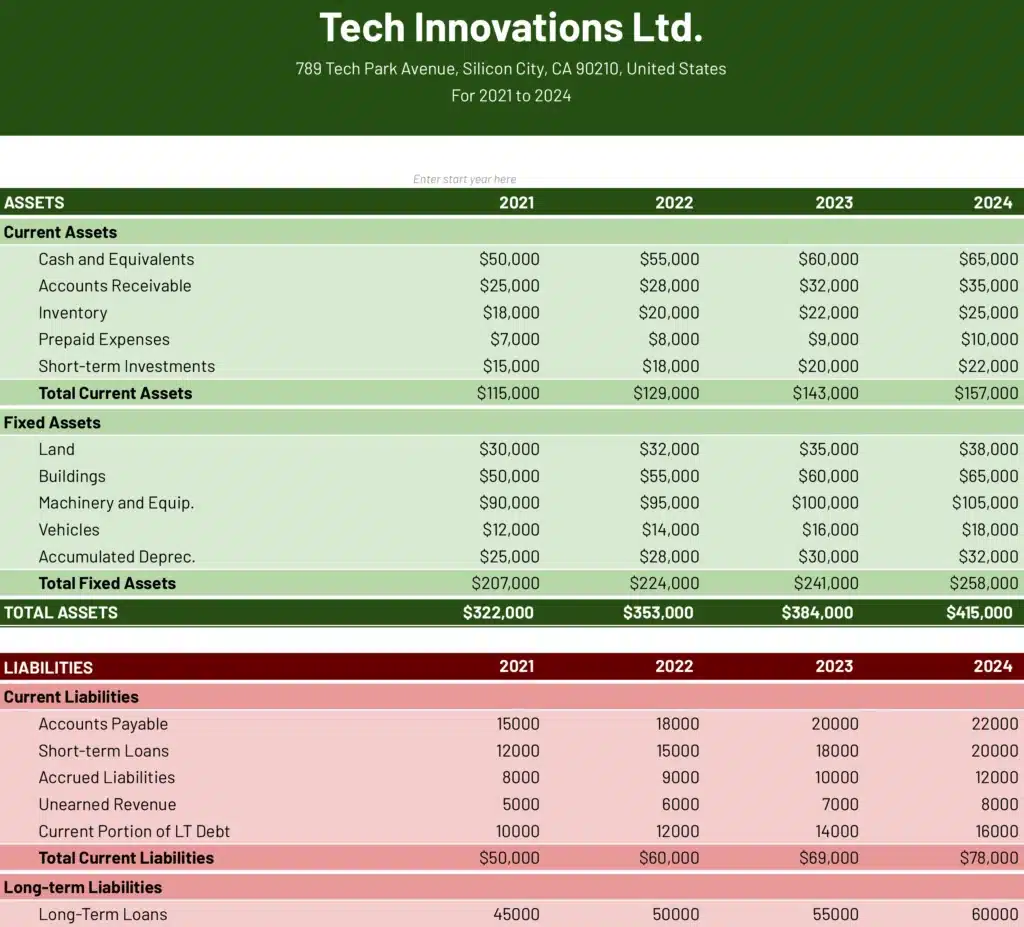

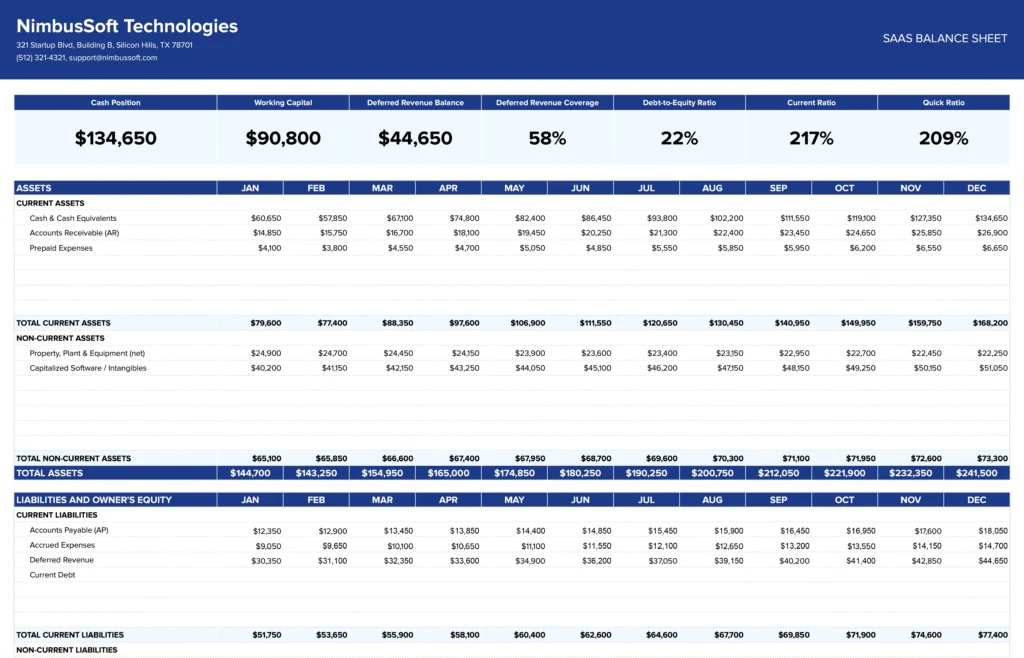

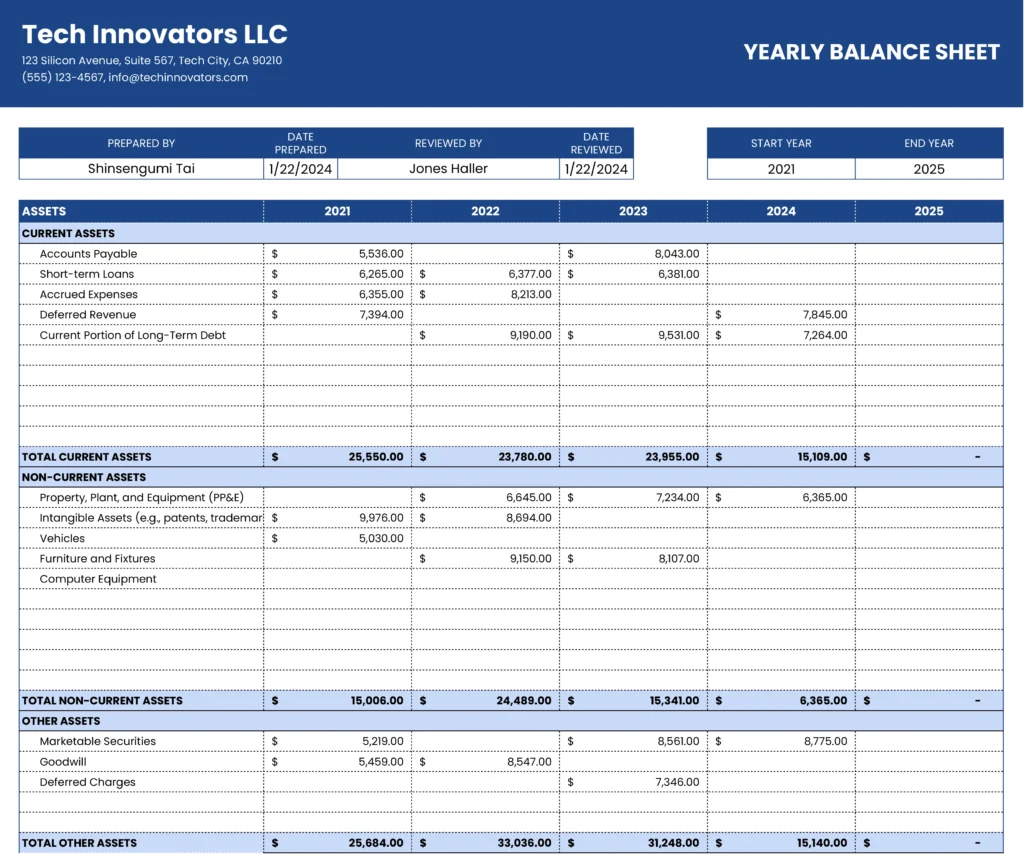

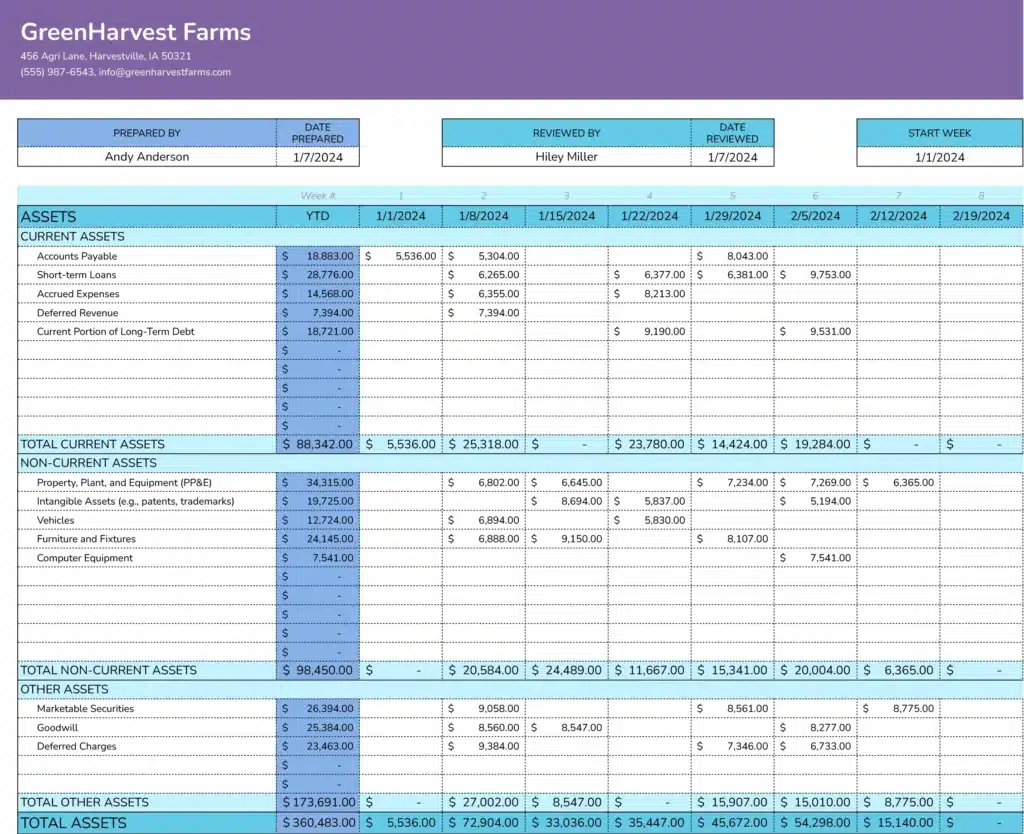

To create a pro forma balance sheet, start by analyzing historical financial statements to establish a base. Then, incorporate projected business activities, market trends, and expected changes in assets, liabilities, and equity. Consider potential investments, revenue growth, and expense variations to accurately forecast the company’s financial position in future periods.

Strategic Business Applications of Pro Forma Balance Sheets

Strategic business applications of pro forma balance sheets are extensive. They are crucial in forecasting future financial health, supporting investment decisions, and aiding in risk assessment. Businesses use them for planning expansions, mergers, or acquisitions, offering a clear vision of potential financial outcomes and facilitating informed strategic decisions.

Conclusion

Pro forma balance sheet templates are indispensable tools in financial management. This guide underscores their importance and encourages businesses to leverage these templates for effective financial forecasting and planning.