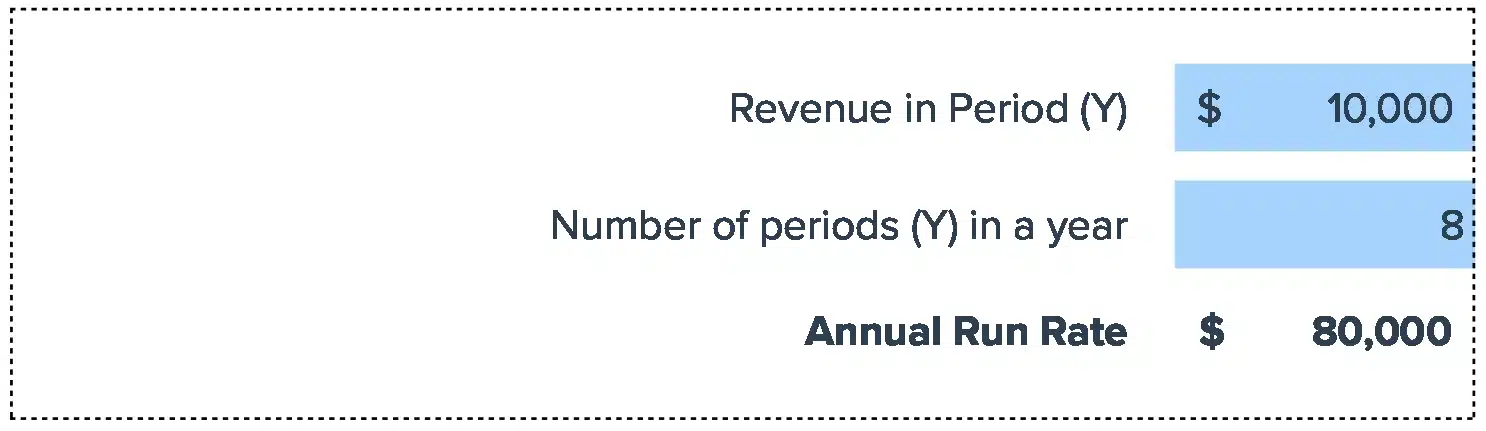

Formula for Revenue Run Rate:

Revenue Run Rate = Revenue in Period * # of Periods in a Year

How to calculate Annual Run Rate / Revenue Run Rate?

- Determine the revenue generated in a certain period (a week, month, quarter, etc.).

- Multiply the result by the number of periods (of the same cadence) in a year.

What is Revenue Run Rate?

Revenue Run Rate is a metric used to forecast the annual revenue that will be generated based on the current revenue levels, growth rate, market demand, and other relevant factors, assuming that the present revenue is free from any seasonality or outlier effect and the present market conditions will prevail throughout the year.

Why is Revenue Run Rate Important?

Revenue Run Rate is an indicator of financial performance that takes a company’s current revenue in a certain period (a week, month, quarter, etc.) and converts it to an annual figure to get the full-year equivalent. This metric is often used by rapidly growing companies, as data that’s even a few months old can understate the current size of the company.

Revenue Run Rate can be a very helpful indicator of financial performance for a young company that has only been in business for a short period of time. Revenue Run Rate can be an especially powerful tool if the company is relatively sure that the financial environment won’t change drastically. Nascent firms can also quote Revenue Run Rate or Profit Run Rate figures when trying to raise funds for business activity. A company that doesn’t have a long, established credit record might secure funds on the basis of its Revenue Run Rate. The Revenue Run Rate can also be helpful when a firm makes major changes to its operational structure and management. The Revenue Run Rate can be used as a benchmark to see whether the changes have improved the financial performance of the company or not.

How to improve Revenue Run Rate?

Here are some ways to improve Revenue Run Rate:

- Increase the number of customers: Acquiring new customers is one of the most effective ways to increase revenue. Consider investing in marketing campaigns, social media advertising, and other promotional activities to attract new customers.

- Increase the average order value: Encourage customers to purchase more by offering discounts on bulk purchases or bundling products together.

- Reduce customer churn: Retaining existing customers is just as important as acquiring new ones. Consider offering loyalty programs, personalized discounts, and other incentives to keep customers coming back.

- Expand your product line: Offering new products or services can help attract new customers and increase revenue from existing ones.

- Improve operational efficiency: Streamlining your operations can help reduce costs and increase revenue. Consider automating repetitive tasks, outsourcing non-core functions, and optimizing your supply chain.

How to calculate Revenue Run Rate in Google Sheets?

Here’s how to calculate Revenue Run Rate in Google Sheets:

- Enter the revenue generated in a certain period in cell A1.

- Enter the number of periods in a year in cell A2.

- Enter the formula

=A1*A2 in cell A3. - The result in cell A3 will be the annual revenue run rate.

Drawbacks of Revenue Run Rate

Here are some drawbacks of Revenue Run Rate:

- Changes in the environment: The Revenue Run Rate, like all Run Rate figures, makes the critical and often unrealistic assumption that the financial environment will remain relatively unchanged in the future.

- Seasonality: Revenue Run Rate does not account for seasonality, which can lead to inaccurate projections.

- Outliers: Revenue Run Rate can be skewed by outliers, such as unusually high or low revenue in a certain period.

When should you use Revenue Run Rate?

Revenue Run Rate is a useful metric for companies that are rapidly growing and want to forecast their annual revenue based on current revenue levels. It can also be used as a benchmark to measure the effectiveness of changes made to a company’s operational structure and management. However, it’s important to keep in mind that Revenue Run Rate makes the assumption that the present financial environment will remain relatively unchanged in the future, which may not always be the case.

What is the difference between MRR and Annual Run Rate?

MRR (Monthly Recurring Revenue) is a metric used to measure the predictable revenue generated by a company’s subscription-based business model. It is calculated by multiplying the total number of subscribers by the average monthly subscription fee. Annual Run Rate, on the other hand, is a metric used to forecast the annual revenue that will be generated based on the current revenue levels, growth rate, market demand, and other relevant factors, assuming that the present revenue is free from any seasonality or outlier effect and the present market conditions will prevail throughout the year.

In other words, MRR is a measure of current revenue, while Annual Run Rate is a measure of future revenue.

What is the difference between Annual Run Rate and Burn Rate?

Annual Run Rate is a metric used to forecast the annual revenue that will be generated based on the current revenue levels, growth rate, market demand, and other relevant factors, assuming that the present revenue is free from any seasonality or outlier effect and the present market conditions will prevail throughout the year. Burn Rate, on the other hand, is a metric used to measure the rate at which a company is spending its cash reserves. It is calculated by subtracting the total cash outflow from the total cash inflow over a certain period of time. In other words, Annual Run Rate is a measure of future revenue, while Burn Rate is a measure of current cash flow.

What is the difference between Annual Recurring Revenue and Annual Run Rate?

Annual Recurring Revenue (ARR) is a metric used to measure the predictable revenue generated by a company’s subscription-based business model. It is calculated by multiplying the total number of subscribers by the annual subscription fee. Annual Run Rate, on the other hand, is a metric used to forecast the annual revenue that will be generated based on the current revenue levels, growth rate, market demand, and other relevant factors, assuming that the present revenue is free from any seasonality or outlier effect and the present market conditions will prevail throughout the year. In other words, ARR is a measure of current revenue, while Annual Run Rate is a measure of future revenue.