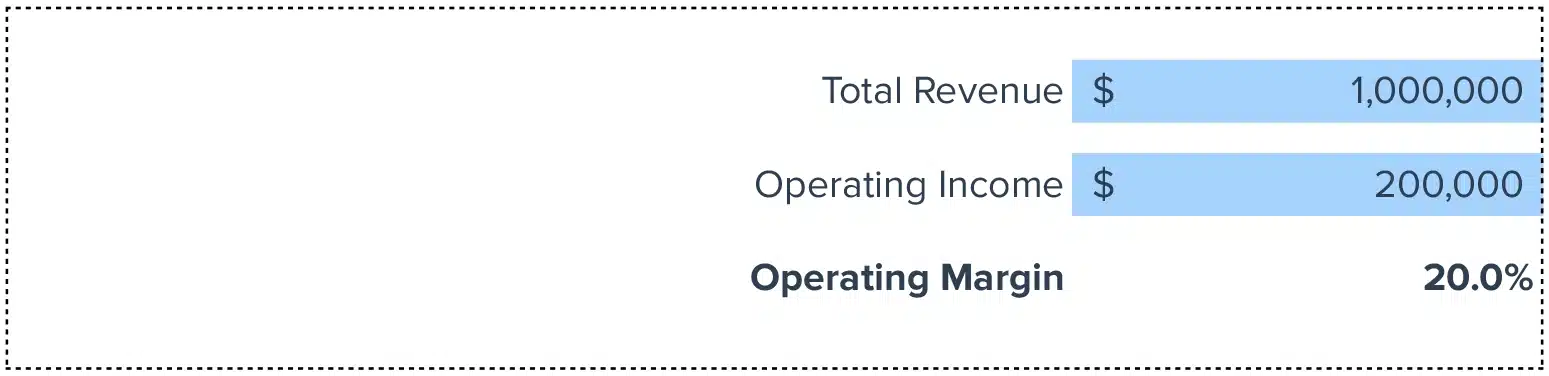

Operating Margin (%) = (Operating Income / Total Revenue) * 100

In today’s competitive business landscape, understanding your company’s financial health is more crucial than ever. With our Operating Margin Calculator, you can gain deep insights into your business’s profitability and operational efficiency in just a few clicks.

How to Calculate Operating Margin: A Step-by-Step Guide

- Determine Revenue: Aggregate all income from your business activities.

- Identify Operating Expenses: Compile all costs directly related to your core business operations.

- Calculate Operating Income: Subtract your Operating Expenses from your Revenue.

- Compute Operating Margin: Divide your Operating Income by Revenue and multiply by 100 to obtain the percentage.

Understanding Operating Margin: A Key Performance Indicator

Operating Margin is a pivotal KPI that illustrates what percentage of revenue remains after deducting the costs associated with producing goods and services.

It’s a direct reflection of the efficiency and profitability of your company’s core business activities, excluding non-operational income and expenses.

The Importance of Operating Margin

Operating Margin is not just a number—it’s a lens through which the operational health and efficiency of a business are viewed.

It serves as a critical benchmark for performance within industries and guides strategic decisions aimed at enhancing profitability.

Real-world Application: A Scenario of Improvement

Imagine a tech company streamlining its software development process, reducing redundancies, and optimizing resource allocation.

This strategic move decreases operating expenses, thereby boosting the Operating Margin, illustrating a direct improvement in profitability and operational efficiency.

Strategies for Enhancing Your Operating Margin

- Embrace Lean Operations: Streamline processes and eliminate waste to reduce costs.

- Optimize Pricing: Adjust your pricing strategies to maximize revenue without deterring customers.

- Enhance Operational Efficiency: Leverage technology and innovation to improve productivity and reduce costs.

- Diversify Revenue Streams: Introduce new products or services to expand your market reach and increase income.

- Negotiate with Suppliers: Work on better terms with your suppliers to reduce the cost of goods sold and improve your bottom line.

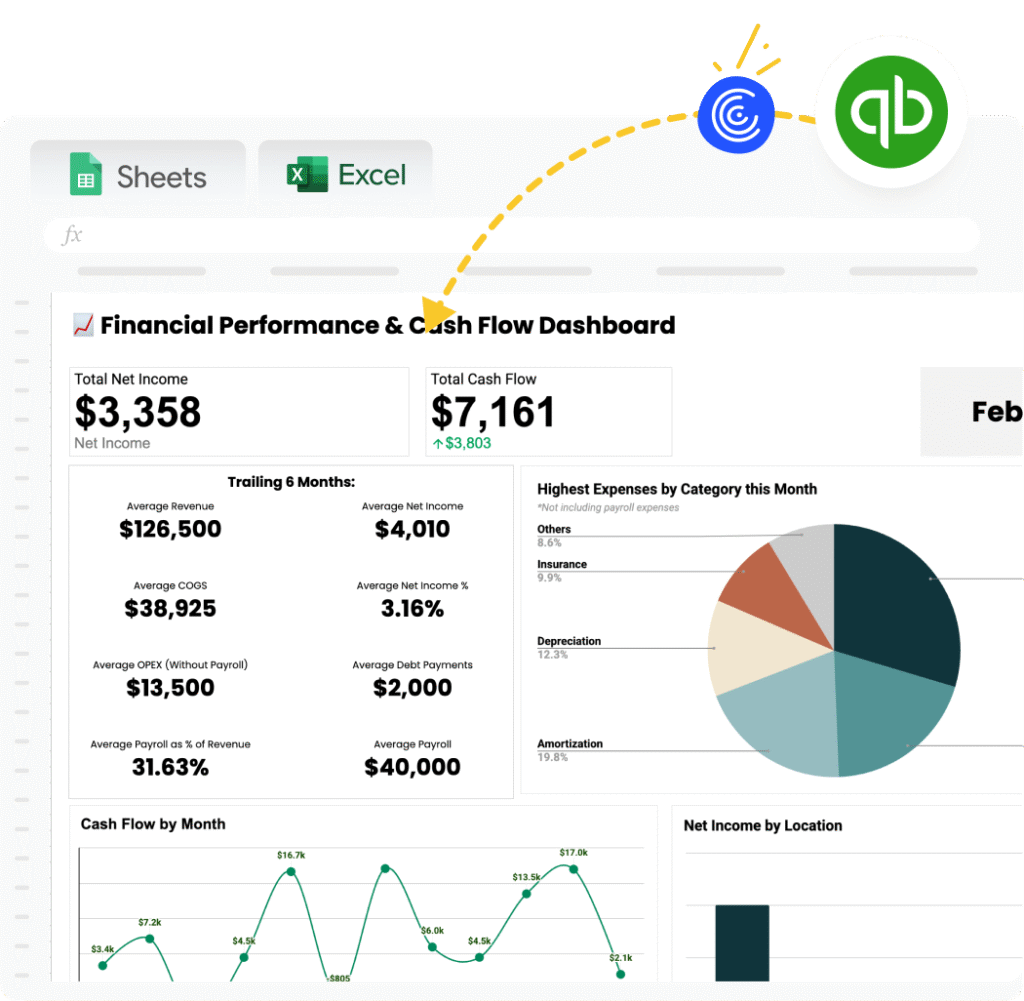

Calculating Operating Margin in Google Sheets

- Input your total Revenue in cell A1.

- Enter your total Operating Expenses in cell B1.

- Use the formula =(A1-B1)/A1*100 in cell C1 to get your Operating Margin percentage.

Considerations and Limitations

While Operating Margin is a key indicator of financial health, it’s important to note its limitations. It does not account for non-operational income/expenses and may be influenced by accounting practices, offering a focused yet partial perspective on financial well-being.

When to Utilize Operating Margin

- Annual financial reviews to evaluate and improve operational efficiency.

- Industry benchmarking to understand competitive standing.

- Strategic planning to make informed decisions about operational and financial strategies.