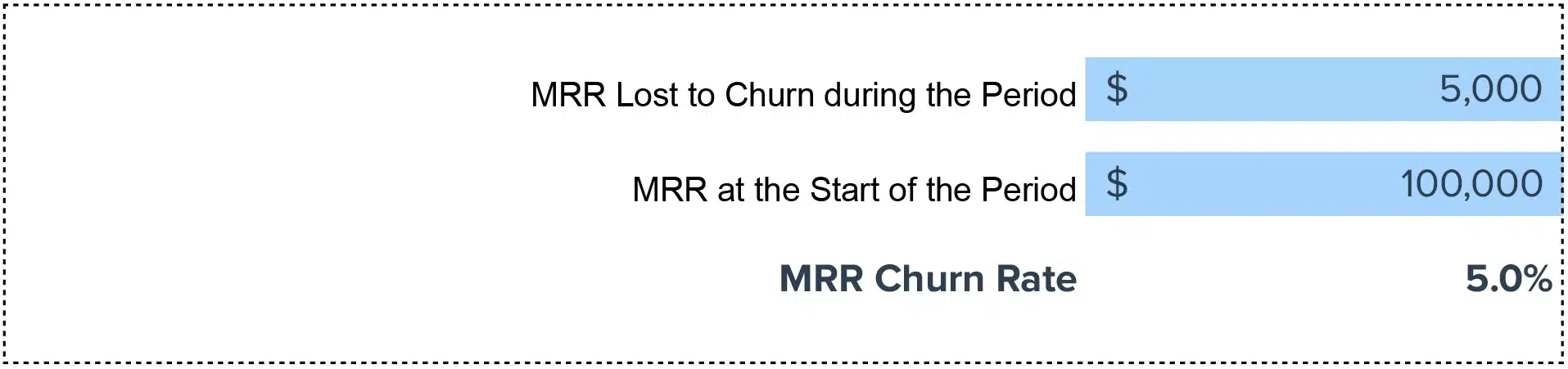

MRR Churn Rate = (MRR Lost to Churn during the Period / MRR at the Start of the Period) x 100

How to Measure Your MRR Churn Rate

Essential metrics to have:

– MRR at the start of the period.

– MRR lost to churn during the same period.

Roles involved in the process:

– **Finance and Subscription Managers** provide MRR figures.

– **Customer Success Teams** contribute churn data.

– **Data Analysts** perform calculations and extrapolate insights.

The Significance of MRR Churn Rate

MRR Churn Rate measures the percentage of monthly recurring revenue that’s lost due to customer churn. It’s an invaluable metric for SaaS companies to gauge revenue retention and predict long-term viability.

Importance: The Criticality of Monitoring MRR Churn Rate

Understanding your MRR Churn Rate can shed light on customer satisfaction and product fit. A lower churn rate signifies a healthy, growing business, whereas a higher rate prompts immediate attention to customer retention strategies.

Example: Utilizing the MRR Churn Rate

Let’s consider “StreamlineHR,” which started the month with an MRR of $50,000 but experienced a $5,000 reduction in MRR due to churn. Applying the formula, StreamlineHR’s MRR Churn Rate is 10%. This critical insight leads to focused retention strategies to mitigate further losses.

Improvement Strategies: Reducing Your MRR Churn Rate

1. Improve Customer Onboarding: Ensure customers fully understand how to use your product to its fullest.

2. Enhance Product Value: Continuously update and improve your offerings based on customer feedback.

3. Implement Feedback Loops: Act on customer input to drive product and service improvements.

4. Offer Outstanding Customer Support: Be proactive and responsive in addressing customer issues.

5. Analyze Churn Patterns: Dig deep into why customers leave and address the underlying causes.

Calculating MRR Churn Rate in Google Sheets

1. Title columns A (Start of Period MRR), B (MRR Lost to Churn), and C (MRR Churn Rate).

2. Enter your MRR figures in columns A and B.

3. In cell C2, input the formula: `=(B2/A2)*100`

4. Execute the formula to calculate the MRR Churn Rate.

Drawbacks: The Limitations of MRR Churn Rate

While vital, the MRR Churn Rate doesn’t account for new revenue acquired during the period. It’s important to balance this metric with others for a full financial health assessment.

When is MRR Churn Rate calculated?

– Monthly financial reviews to track revenue retention trends.

– Following pricing or product changes to assess impact on customer retention.

– Annual strategic planning to set benchmarks and goals for improvement.