Cost of Goods Sold = Beginning Inventory + Purchases During the Period – Ending Inventory

One of the key metrics that can provide valuable insights into the efficiency and cost structure of your SaaS business is the Cost of Goods Sold (COGS). By understanding and optimizing this metric, you can unlock new avenues for sustainable growth and maximize the profitability of your SaaS venture.

What is Cost of Goods Sold (COGS)?

Cost of Goods Sold (COGS) refers to the direct costs associated with the production, delivery, and support of the products or services offered by a SaaS business. It includes expenses such as hosting, infrastructure, customer support, and any other costs directly related to the provision of the SaaS offering.

How to Calculate Cost of Goods Sold

To calculate the Cost of Goods Sold, you’ll need to track the following metrics:

- Beginning Inventory: The value of the inventory at the start of the accounting period.

- Purchases During the Period: The total cost of all purchases made during the accounting period.

- Ending Inventory: The value of the inventory at the end of the accounting period.

These metrics are typically managed by the Finance and Operations teams within a SaaS organization.

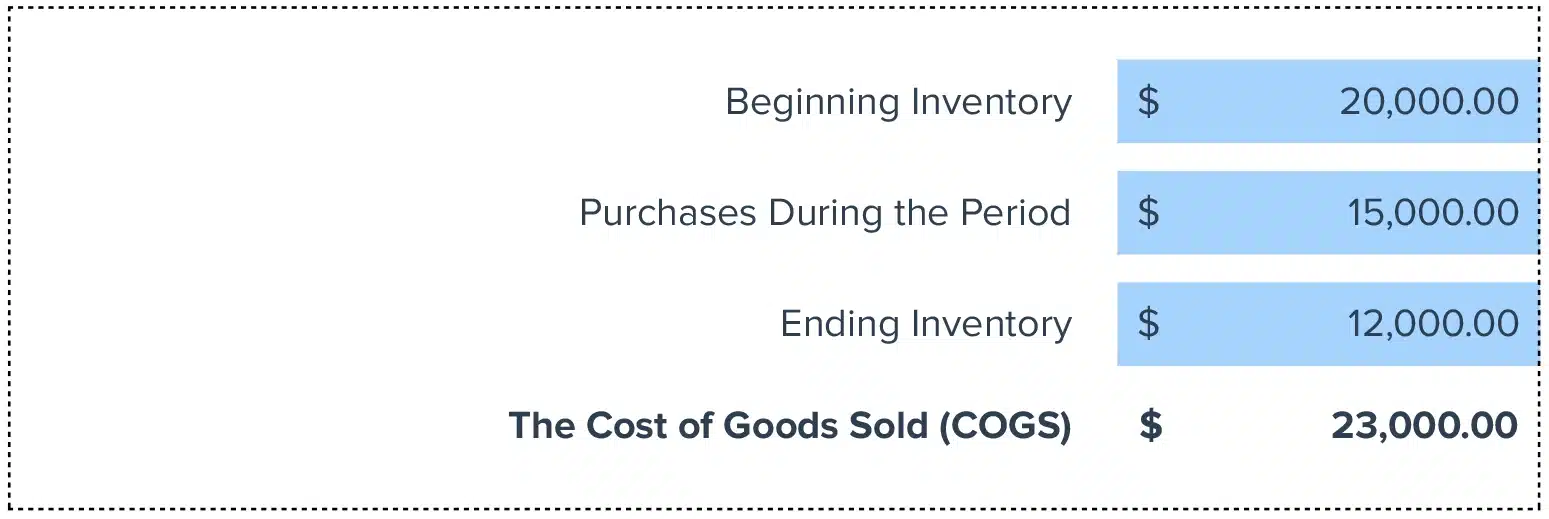

Example Calculation of Cost of Goods Sold

Let’s say your SaaS company had the following inventory and purchase data for the month:

- Beginning Inventory: $20,000

- Purchases During the Period: $30,000

- Ending Inventory: $15,000

To calculate the Cost of Goods Sold, you would use the following formula:

Cost of Goods Sold = $20,000 + $30,000 – $15,000 = $35,000

This means your SaaS business incurred $35,000 in direct costs related to the provision of its products and services during the month.

Importance of Cost of Goods Sold for SaaS Businesses

Cost of Goods Sold is a crucial metric for SaaS businesses for several reasons:

- Profitability Optimization: By understanding and managing COGS, SaaS companies can identify opportunities to optimize their cost structure, ultimately improving their overall profitability.

- Pricing and Competitiveness: Analyzing COGS can help SaaS businesses set appropriate pricing for their offerings, ensuring they remain competitive while maintaining healthy profit margins.

- Financial Planning and Budgeting: COGS data is essential for accurate financial planning and budgeting, allowing SaaS companies to make informed decisions about resource allocation and investment.

- Investor Confidence: SaaS businesses that demonstrate effective cost management, as evidenced by a well-controlled COGS, are often viewed more favorably by investors and potential acquirers.

How Do You Calculate COGS on a Balance Sheet?

On a balance sheet, the Cost of Goods Sold is typically calculated using the following formula:

Cost of Goods Sold = Beginning Inventory + Purchases – Ending Inventory

This calculation reflects the cost of the goods or services that were sold during the accounting period, which is then used to determine the company’s gross profit.

Strategies to Optimize Cost of Goods Sold

To optimize your Cost of Goods Sold and improve the overall profitability of your SaaS business, consider the following strategies:

- Streamline Operations: Identify and eliminate inefficiencies in your business processes, such as reducing hosting costs, automating support tasks, and optimizing resource utilization.

- Leverage Technology: Invest in tools and technologies that can help you automate and optimize your cost-related operations, reducing manual effort and improving overall efficiency.

- Negotiate Vendor Contracts: Review and renegotiate contracts with your suppliers, vendors, and service providers to ensure you’re getting the best possible pricing and terms.

- Enhance Product and Service Offerings: Continuously evaluate and enhance your SaaS product or service offerings to provide more value to your customers, enabling you to command higher prices and maintain a stronger profit margin.

- Regularly Review and Analyze: Closely monitor your COGS on a regular basis, identifying areas for improvement and implementing strategies to optimize your cost structure.

Calculating Cost of Goods Sold in Google Sheets

To make it easy for you to calculate and track your Cost of Goods Sold, we’ve created a Google Sheets template that you can use. Here’s a step-by-step guide on how to use it:

- Access the Template: Click above to access the Cost of Goods Sold Google Sheets template.

- Enter Your Data: In the “Data” sheet, input the following information:

- Beginning Inventory

- Purchases During the Period

- Ending Inventory

- Review the Calculations: The template will automatically calculate your Cost of Goods Sold based on the data you provided.

- Analyze and Interpret the Results: Use the insights gained from your Cost of Goods Sold to inform your operational, pricing, and product strategies, enabling you to drive sustainable profitability and growth for your SaaS business.

By leveraging this Google Sheets template, you can effortlessly track and optimize your Cost of Goods Sold, empowering you to maximize the financial health and long-term success of your SaaS venture.