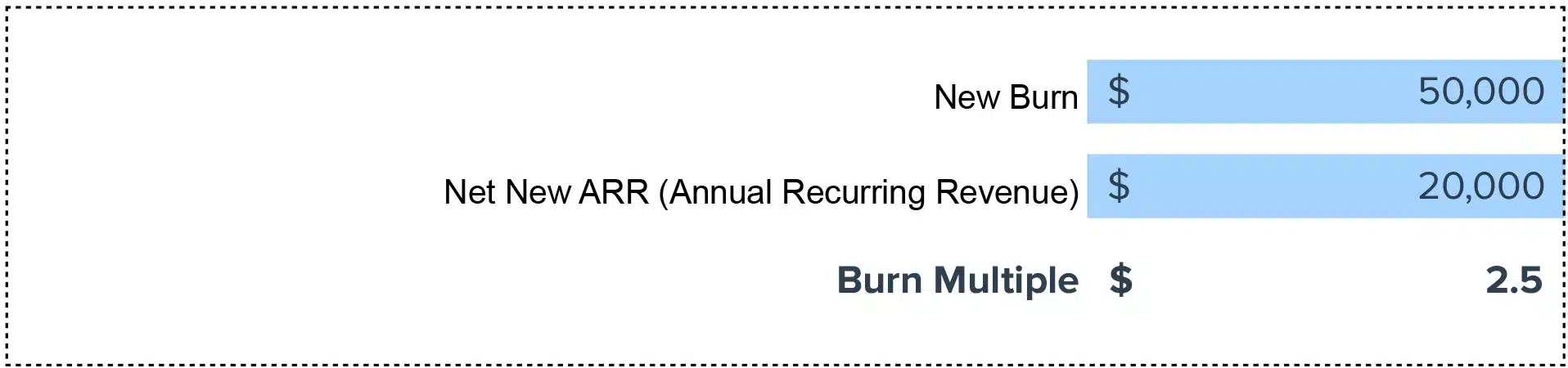

Burn Multiple = Net Burn / Net New ARR (Annual Recurring Revenue)

How to calculate your Burn Multiple?

Key figures required:

– Net Burn: The net cash amount your business expended in a specific period.

– Net New ARR (Annual Recurring Revenue): The net increase in ARR during the same period.

Functions responsible in the process:

– CFOs and Finance Managers to supply accurate financial data.

– Revenue Operations Teams to report on ARR changes.

– Financial Analysts for conducting precise calculations.

Importance: Why Your Burn Multiple Matters

The Burn Multiple measures how a company’s net burn relates to its growth in ARR. It provides insight into whether a startup is burning cash at a rate that is sustainable given its growth rate.

A lower Burn Multiple suggests efficient growth, indicating that the company is utilizing its resources effectively to increase ARR. A higher multiple might signal an unsustainable burn rate, necessitating a strategic review of spending habits and growth strategies.

Example: Applying the Burn Multiple

Consider “NextGen Tech,” which has a Net Burn of $500,000 and a Net New ARR of $250,000. Their Burn Multiple would be 2. This indicates that for every dollar of new ARR, NextGen Tech burns two dollars, prompting a need to investigate and optimize spending and growth strategies.

How to Optimize Your Burn Multiple

1. Streamline Operations: Identify and eliminate inefficiencies in your operational processes.

2. Focus on High-Retention Revenue Streams: Concentrate efforts on products or services with high customer retention and ARR potential.

3. Enhance Revenue Forecasting: Use data-driven insights to improve the accuracy of your revenue forecasts.

4. Cultivate Customer Success: Invest in initiatives that boost customer satisfaction and retention.

5. Control Spending: Regularly review and manage your expenditure to ensure it aligns with your growth objectives.

Calculating Burn Multiple in Excel

1. Label columns A (Net Burn) and B (Net New ARR).

2. Enter your financial figures in the respective columns.

3. In a new cell, apply the formula: `=A2/B2`

4. Press Enter to reveal your Burn Multiple.

Drawbacks: Recognizing the Limits of Burn Multiple

The Burn Multiple is most relevant for startups in their growth phase and might not fully encapsulate the financial health of more mature companies. Additionally, it focuses on short-term cash and ARR movements without considering the broader financial picture.

When to Leverage Burn Multiple

– During financial planning sessions to evaluate and adjust spending strategies.

– Before fundraising efforts to understand and communicate your startup’s efficiency to potential investors.

– At quarterly board meetings for a snapshot of financial health and sustainability.