QuickBooks Online (QBO) from Intuit is a leading accounting software used by many small business owners and medium-sized businesses. While many entrepreneurs choose between QuickBooks Online and QuickBooks Desktop, both platforms offer user-friendly solutions to handle numerous bookkeeping, credit card processing, and payment processing needs. QBO integrates with a plethora of other platforms that your business account may be using, including tools for managing accounts receivable and accounts payable.

While QuickBooks Online is user-friendly, accounting mistakes can occur due to manual error or integration issues with your company file. When these issues arise, there are several ways to tackle and fix the mistake, often with help from a CPA or ProAdvisor.

This guide will walk through how to fix common QuickBooks mistakes in QuickBooks Online, helping you maintain accurate records for your tax liability and sales tax reporting.

Let’s get started!

Common Quickbooks Accounting Mistakes

There are a lot of varying ways that accounting mistakes can occur in QuickBooks Online. Depending on the type of mistake, the fix or solution may be easier for one mistake compared to another. Some of the most common errors are:

- Data Entry Error – The most common accounting mistake is a manual journal entry or data entry that was entered incorrectly. This could either be to the incorrect account(s) or for the incorrect amount. Typically, this type of error is easily identified when performing your bank reconciliation.

- Duplication Error – This could be a duplication error caused by two employees in your accounting department making the same entry without realizing someone else is duplicating it. It could also be due to an integration error with your bank account that pulled in duplicate bank transactions for something that was either deposited or withdrawn from your bank account.

- Omission Error – An omission error is when either a transaction doesn’t get booked by someone in the accounting department, that should have been posted or if there is an error when pulling in bank feeds that a particular transaction is omitted from that pull. Typically, this is mainly an issue in accrual basis accounting, where there should be a journal entry posted for an asset or liability, that the cash flow hasn’t occurred yet. This can be a big issue when the company needs to report out financial statements to external investors or debtors. If the omission is big enough it can cause material discrepancies in the financial reports you are presenting.

- Principle Errors – A principle error is when a particular journal entry or entries are not in compliance with the governing accounting principles that your business is required to follow. This often isn’t done intentionally but may be due to a new accounting standard that came out, or someone classifying a transaction to the account that they thought it needed to go to but was incorrect. To help combat this error, it is important to keep your accounting team up-to-date on rules and regulations that apply to your business as it relates to accounting and financial reporting.

How to Fix Accounting Mistakes in Quickbooks Online

Option 1: Fix the Mistake Manually

Depending on how recent and the magnitude/volume of the accounting mistakes you can fix the mistake manually. To find what is causing the mistake, you will want to ensure you are reconciling your accounts in QuickBooks Online to easily identify the mistake in your account.

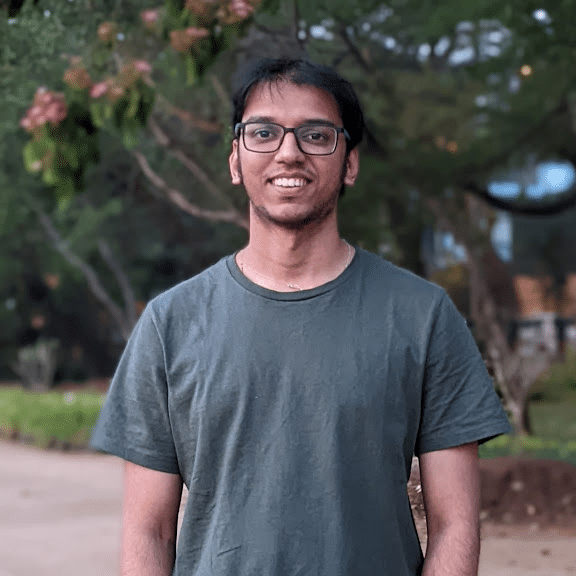

To reconcile your accounts you first need to navigate to the reports section of the main menu.

Once you’ve selected the reports section, you will need to search for the reconciliation reports in the search bar at the top right of the screen.

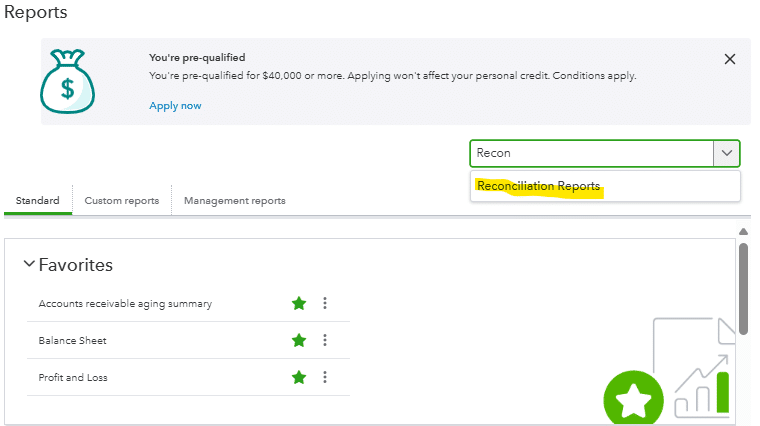

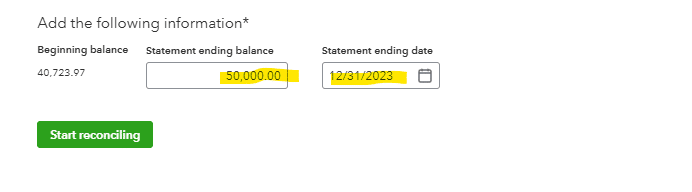

Once you’ve selected the reconciliation reports, you can select the account that you would like to reconcile. In this particular example, we are selecting the cash flow account that we would like to run the reconciliation report for.

Now that you have selected the account that you would like to reconcile, you can then select the date range that you would like to run the reconciliation for.

Depending on the frequency your business / accounting team reconciles accounts this may be weekly, monthly, quarterly, etc. One way to limit accounting mistakes, in particular in the cash account, is to link your business account directly in QuickBooks and classify transactions as they come in.

Once you’ve selected the date range and account you are ready to run the bank reconciliation by selecting the start reconciling button.

As you go through the reconciliation you will be able to identify what bank transactions are incorrect or not matching with your bank statement to know what and how to fix the accounting transactions that are incorrect.

Once you’ve identified the mistake, one option is to book a manual entry to fix the mistake. To do this you first need to navigate to the main menu and select the + New button at the top of the menu.

Once you select the + New button you will select the journal entry option in the other column.

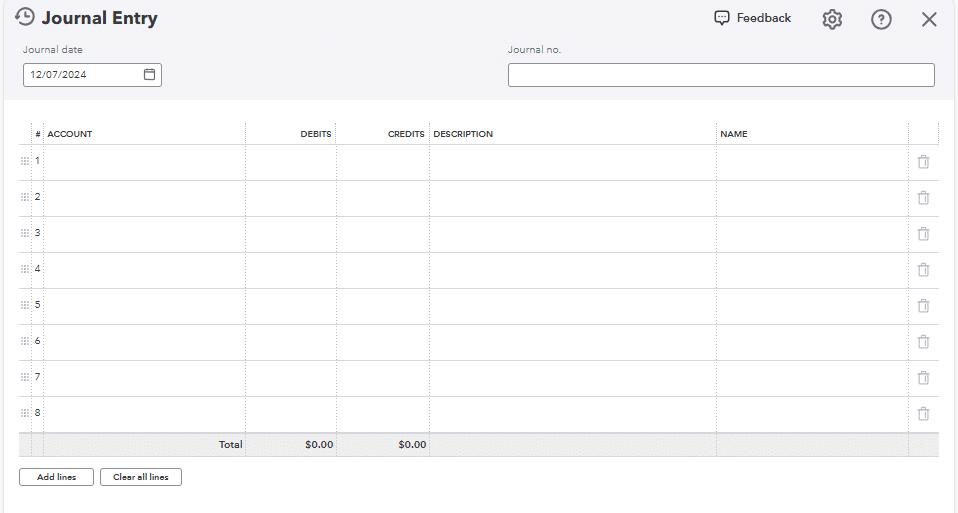

This will take you to a journal entry landing page where you will be able to post a manual journal entry to fix whatever accounting mistakes may have occurred. There are several fields within the journal entry that you need to have information ready for when you go to post the entry.

- What chart of accounts do you need to post to in order to fix the mistake?

- What date does the entry need to be posted to? This may vary depending on what timeframe the accounting mistake was made in and if the accounting period the mistake was made in is still open.

- What amount do you need to debit and credit for each account to fix the accounting mistake? This should be evident as you go through your reconciliations.

- What description do you need to add to the entry? Typically, you will want to add a description that outlines what the entry is for so you and others in the accounting department will know what the entry is for if a question comes up in the future.

Once you’ve posted your manual journal entry to fix the accounting mistake, you should be able to review your reconciliations and financial statements to ensure that the journal entry resolved the accounting mistake, and the balances in the affected accounts are what you were expecting.

Option 2: Reverse the Journal Entry

If you just posted a journal entry or classified a transaction that is causing the accounting mistake you are able to reverse that journal entry and fix your accounting mistakes in QuickBooks Online.

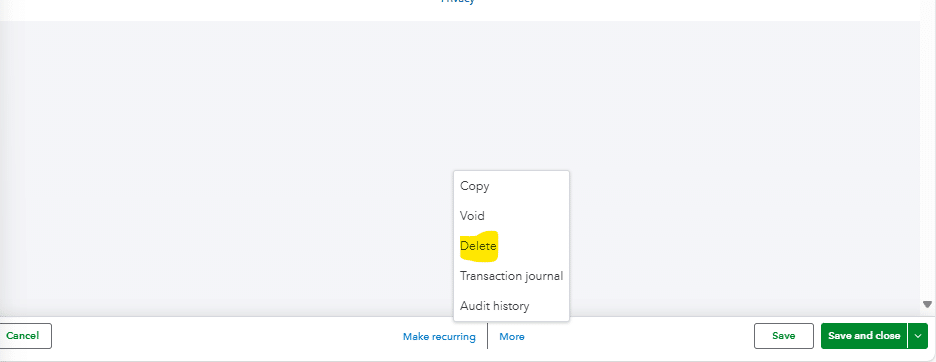

In order to reverse out the journal entry you will first want to navigate to that particular transaction. Depending on what type of transaction is causing the issue it may be in a different section of QuickBooks Online. In this particular example we are going to navigate to the expense section of the main menu and find the journal entry that is causing the issue.

Once the journal entry has been found and selected you will pull a journal entry screen that shows the debit and credit that make up that particular entry. At this point you should review the journal entry and ensure that it is causing the accounting mistake within QuickBooks Online and deleting/reversing out that transaction will fix the mistake.

At the bottom of your selected journal entry there is a delete option for that particular journal entry. This will remove this journal entry from your general ledger and corresponding accounts that role into your balance sheet or income statement.

This is one of the easier solutions for fixing an accounting mistake in QuickBooks Online. Depending on the breadth of the mistakes in QuickBooks and how many months, journal entries, accounts, etc. the mistake involves this may not be an option.

Option 3: Automate error detection with Coefficient

Manual fixes work when you catch errors quickly. But what if you could prevent mistakes before they happen? Coefficient connects QuickBooks directly to Google Sheets or Excel, giving you real-time visibility into your accounting data and automated error detection.

Instead of waiting to discover mistakes during monthly reconciliations, Coefficient lets you:

- Pull live QuickBooks data into spreadsheets automatically

- Set up automated refresh schedules so your data stays current

- Create custom validation rules to flag discrepancies instantly

- Build real-time dashboards that surface errors as they occur

Watch how to connect QuickBooks to your spreadsheet in under 3 minutes:

How Coefficient prevents common accounting mistakes

Eliminating data entry errors: When you import data directly from QuickBooks using Coefficient, you eliminate manual copy-paste operations. Your journal entries, account balances, and transaction data flow automatically into your spreadsheets with zero manual intervention.

Catching duplications early: Set up automated imports that refresh hourly or daily. Review new transactions as they come in rather than discovering duplicate entries weeks later during reconciliation.

Preventing omissions: Create comprehensive reports that pull all transactions within specific date ranges. Cross-reference against bank feeds to ensure nothing falls through the cracks.

Setting up automated QuickBooks imports

Getting started with Coefficient takes less than 5 minutes:

- Install Coefficient from the Google Workspace Marketplace or Microsoft AppSource

- Connect your QuickBooks account through the secure OAuth connection

- Choose your import method:

- Import from existing QuickBooks reports

- Build custom imports from any QuickBooks object (Invoices, Bills, Payments, etc.)

- Write custom queries for complex data needs

- Set your refresh schedule:

- Hourly (every 1, 2, 4, or 8 hours)

- Daily at a specific time

- Weekly on selected days

- Add validation formulas in adjacent columns to flag potential errors

Real results from real companies

“Before Coefficient, I was doing multiple data pulls a day. If you just add up those hours, week over week, month over month, it’s a huge time sink. It also disrupts your flow while analyzing data.”

— Christian Budnik, FP&A Analyst at Solv

Solv’s Success Story:

Solv’s FP&A team struggled with manual QuickBooks data exports that consumed hours every day. After implementing Coefficient, they:

- Saved 364 hours per year across their 7-person team

- Eliminated manual CSV exports and copy-paste operations

- Gained real-time visibility into financial data

- Enabled faster, data-driven decision-making across the organization

Christian Budnik was even promoted after introducing Coefficient to his team’s workflow. Read the full case study →

Benefits over manual methods

When you automate your QuickBooks data workflows with Coefficient, you get:

Time savings: No more manual exports, no more broken formulas when columns change, no more rebuilding dashboards before sharing them.

Real-time accuracy: Your spreadsheets always reflect current QuickBooks data. Schedule automatic refreshes and trust that your numbers are up-to-date.

Error prevention: Catch mistakes as they happen instead of discovering them during monthly closes. Set up alerts to notify you via Slack or email when specific conditions are met.

Two-way sync: Not only can you pull data from QuickBooks, but you can also push updates back. Update records, insert new transactions, or delete entries directly from your spreadsheet.

Audit trails: Every import includes timestamps and tracking columns so you know exactly when data was pulled and what changed.

Fixing Accounting Mistakes in Quickbooks

Having to investigate and fix accounting mistakes in any accounting software, including QuickBooks, can be time consuming and frustrating. Depending on the severity of the mistake and how long it has been occurring, it may take minutes or days to fully clean up.

There are several connectors that integrate with QuickBooks Online that make it possible to better report on and pull transactions out of QuickBooks Online in a digestible way. One such software is Coefficient.

By using Coefficient you may be able to identify and correct accounting mistakes sooner by slicing the data out of QuickBooks into easy to use financial reports. The speed of reporting out of Coefficient will also assist in identifying these mistakes sooner than if you are manually pulling and manipulating reports out of QuickBooks Online.

Get started with Coefficient to enhance your reporting capabilities and transform your accounting processes and reporting. Pull your transactional data into actionable business insights.

Ready to take your data analysis to the next level?

Try Coefficient to seamlessly integrate your Excel with live data from various business systems, enabling real-time analysis and more advanced financial modeling.