QuickBooks Online (QBO) is a cloud accounting software used by many small and midsized businesses. Bank reconciliation is done on a routine basis to ensure that all bank accounts are appropriately accounted for and match the bank statement balance. Having proper bookkeeping practices helps maintain accurate records in your QuickBooks account.

There may be discrepancies in QBO when trying to reconcile your bank account. This guide will walk you through how to fix reconciliation discrepancies and maintain an accurate account balance.

Let’s get started!

Step-by-Step Guide: Fix Bank Reconciliation Discrepancies in QBO

Before diving into the fix process, it’s important to understand what causes bank reconciliation discrepancies in your QBO account. Here are common issues that may affect your account balance:

- Wrong Transaction Amount – Incorrect recording of credit card payments or other transactions

- Timing Differences – Transactions on your bank statement haven’t been recorded in your QBO bank account yet

- Missing transactions – Deleted transactions or unreconciled items not appearing in your reconciliation report

- Duplicate transactions – Multiple entries of the same transaction affecting your beginning balance

- Reconciliation adjustments – Previous reconciliation issues carrying forward

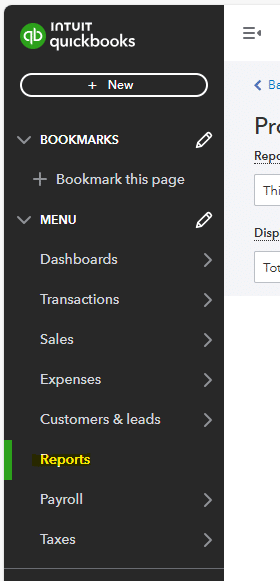

Step 1: Navigate to the Reports Section in QBO

Within QBO, navigate to the reports menu in the menu section. Use the drop-down menu to access your reports.

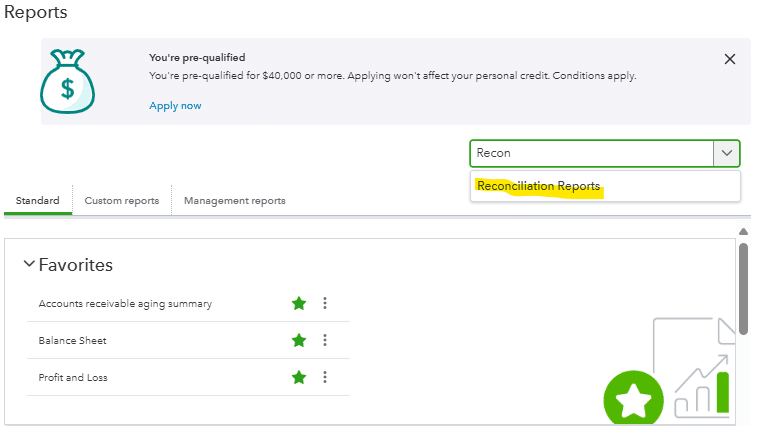

Step 2: Run Reconciliation Report

Once you’ve navigated to the reports section of QBO, search “reconciliation discrepancy report” in the account field to find report options. The system will save your recent searches for quick access.

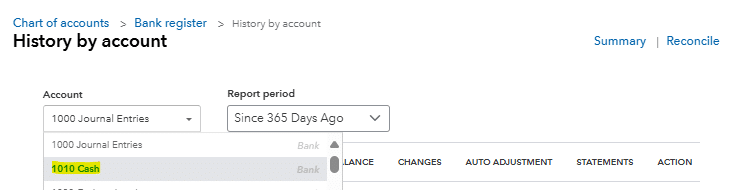

After selecting the reconciliation reports, you will be prompted to choose the account you want to reconcile from the chart of accounts. In this case, we are reconciling the bank account, so you’ll want to select your cash account.

This report can also be used to reconcile other accounts such as accounts receivable, accounts payable, etc.

Step 3: Select Reconciliation Date Range

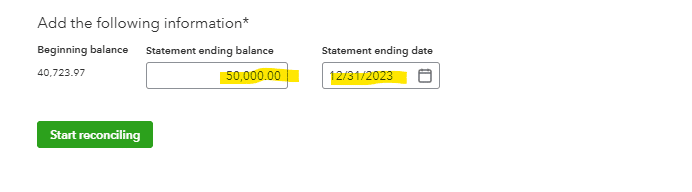

Once you’ve selected the cash account, you will be prompted to select the statement date and ending date. To fill out these fields, you will want to select the date you want to reconcile to.

Your beginning balance should match your last reconciliation, and your ending balance should match your current bank statement.

Once you’ve selected the date, in this example 12/31/2023, you will want to pull in the bank account balance from your bank statement at that particular point in time.

Step 4: Run Bank Reconciliation

After you’ve run your bank reconciliation, you will be able to view register entries and see the statement balance, cleared balance, opening balance, payments, and deposits. This will allow you to see what your reconciling difference is that you need to fix.

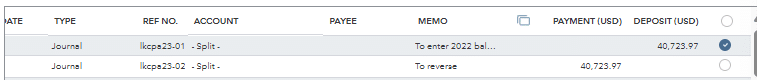

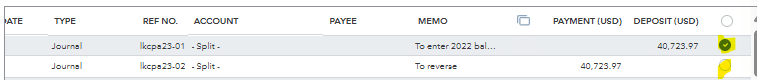

Appearing below the summary will be a listing of detailed transactions with a checkmark option to the right of each transaction detail report.

Step 5: Reconcile to Bank Statement

After running the QuickBooks reconciliation, you will want to review your corresponding bank statement for the timeframe you are reconciling. Compare each entry in your bank register to ensure accuracy.

Any discrepancy between your bank statement and your QuickBooks reconciliation would be considered a reconciling item that is causing a difference between your QBO balance and statement balance.

For any transactions that appear in your bank statement and not in your QuickBooks reconciliation, you will want to navigate back to your dashboards and bank accounts to see if it was deleted or why it isn’t pulling in from the bank. It may also be a timing issue where the transaction is showing on your bank statement on the last day of a given month and didn’t flow into QBO until the first day of the following month.

For any transactions that don’t appear on your bank statement but are showing up in your QuickBooks reconciliation, you will want to uncheck the radial box in QuickBooks. This will remove that transaction from your reconciliation.

As you work through these steps you will fix and reduce your reconciling difference to zero. Once you’ve fully reconciled your bank/cash account you can click finish now in the top right corner of your reconciliation to complete it.

Use Cases for Fixing Bank Reconciliation Discrepancies in QBO

Fixing and running a bank reconciliation in QBO can be useful for businesses in order to:

- Distribute accurate information to shareholders.

- Ensure you aren’t missing any transactions when reporting and running financial statements.

- Be able to appropriately analyze financial information to make informed decisions about your business.

Fix Your Bank Reconciliation Discrepancies in QBO

Bank reconciliation along with other account reconciliations are useful tools for maintaining accurate financial records. By following this guide, you’ll be able to fix your bank reconciliation discrepancies in QBO and help your business make crucial decisions.

Ready to take your data analysis to the next level? Try Coefficient to seamlessly integrate your Excel with live data from various business systems, enabling real-time analysis and more advanced financial modeling.