Formula for LTV

LTV = Average Monthly Recurring Revenue (MRR) per Customer × Average Customer Lifespan (in months)

Customer Lifetime Value (LTV) is a pivotal metric that quantifies the total revenue a company can expect from a single customer throughout their subscription lifecycle. LTV is especially crucial in SaaS due to the recurring revenue model and the emphasis on customer retention and long-term value.

Calculating LTV in SaaS

- Determine Average MRR per Customer: Calculate this by dividing the total monthly recurring revenue by the total number of customers.

- Estimate Average Customer Lifespan: This is the average period a customer continues to subscribe to the service, typically measured in months or years.

Importance of LTV

LTV is crucial for SaaS businesses for several reasons:

- Forecasting Revenue: It predicts long-term revenue and helps in financial planning and forecasting.

- Customer Retention Focus: Due to the subscription model, increasing customer lifespan directly impacts LTV and overall profitability.

- Pricing Strategy: Understanding LTV assists in making informed decisions about subscription pricing and package structures.

- Investor Attraction: High LTV is a strong indicator of business health and scalability, crucial for attracting investors.

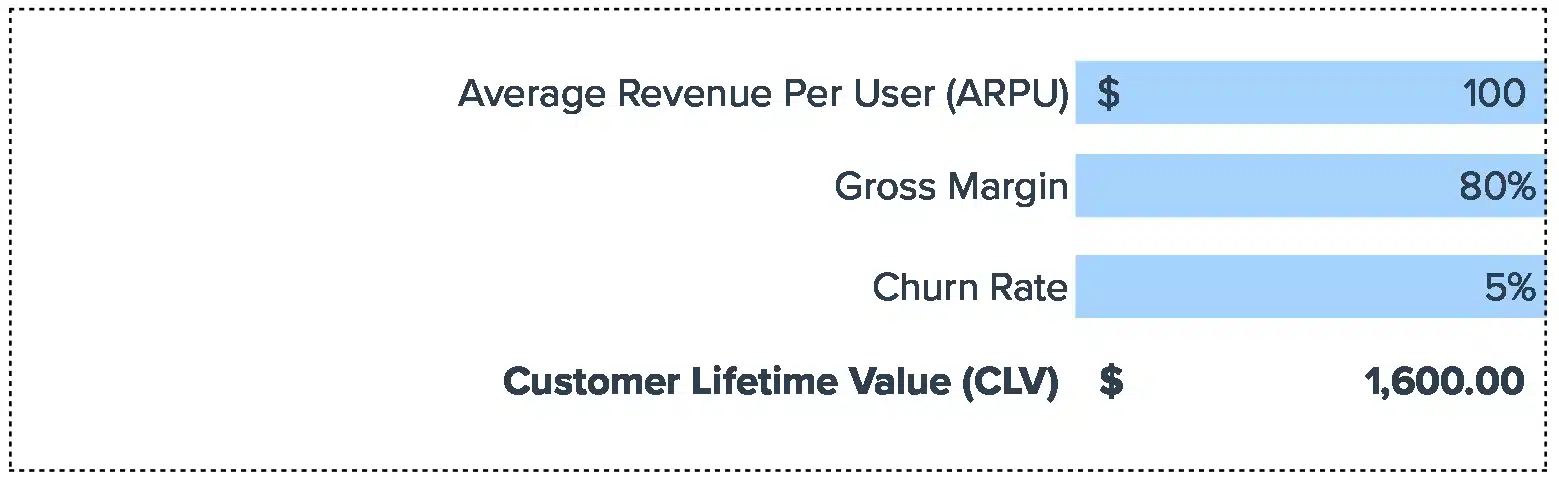

Example: LTV Calculation for a SaaS Company

Imagine a SaaS company offering project management tools with an average MRR of $50 per customer. If the average customer subscribes for 2 years (24 months), the LTV would be:

LTV=$50×24=$1,200LTV=$50×24=$1,200

This means each customer, on average, contributes $1,200 in revenue over their lifecycle with the company.

Strategies to Increase LTV in SaaS

- Enhance Customer Experience: Improving product features and customer support to increase customer satisfaction and retention.

- Implement Upselling and Cross-Selling: Encouraging customers to upgrade to higher-tier plans or purchase additional services.

- Optimize Pricing Models: Developing pricing strategies that align with customer value perception and usage patterns.

Limitations and Considerations of LTV in SaaS

- Predictive Challenges: Estimating average customer lifespan can be speculative, especially for new SaaS companies without extensive historical data.

- Market and Competition Dynamics: SaaS markets are often volatile, with rapid changes in technology and competition affecting customer preferences and LTV.

- Balancing CAC and LTV: It’s crucial to consider the cost of acquiring customers (CAC) alongside LTV to ensure sustainable growth.