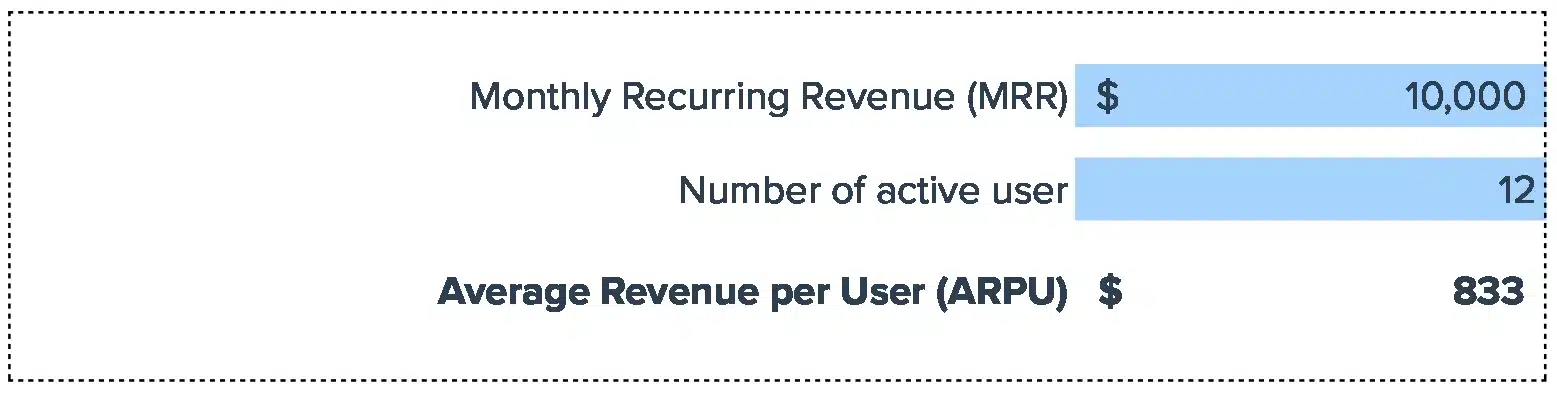

Formula for ARPU

ARPU = Total Monthly Recurring Revenue ÷ Number of Active Monthly Users

How to Calculate ARPU?

To calculate ARPU, follow these steps:

- Identify Total Monthly Revenue: Aggregate the revenue earned within a specific period.

- Determine Average Number of Monthly Users: Calculate the mean number of users during the same period.

- Divide MRR by Average Number of Monthly Users.

Metrics Needed:

- Total Monthly Revenue: Generally provided by the Finance team.

- Number of Monthly Users: Typically sourced by the IT or Data Analytics team.

What is ARPU?

Average Revenue Per User (ARPU) is a crucial metric that measures the average revenue generated per user or customer. It’s widely used in sectors like telecommunications, subscription-based services, and various B2C industries to assess the profitability and efficiency of their customer base.

Why is ARPU Important?

ARPU is a vital metric for several reasons, particularly in the SaaS and subscription-based business models:

- Customer Value Assessment: ARPU quantifies the average revenue a user contributes, helping businesses understand how much each customer is worth. This aids in evaluating the overall health and sustainability of the revenue model.

- Business Growth Tracking: By monitoring ARPU over a time period, companies can gauge the effectiveness of their growth strategies. An increasing ARPU indicates successful upselling or improved customer acquisition strategies.

- Resource Allocation: Understanding ARPU helps in making informed decisions about where to invest in marketing, product development, or customer service to maximize revenue per user.

- Pricing Strategy Validation: ARPU can serve as a benchmark to assess the effectiveness of current pricing strategies. It can highlight if a pricing model needs adjustment to align better with market demand and customer willingness to pay.

- Benchmarking and Comparison: It allows for performance comparison with competitors and industry standards, providing a clear picture of where the company stands in the market.

How to Improve ARPU?

- Enhance Customer Experience: Improved services lead to higher customer satisfaction and spending. Example: Netflix’s personalized recommendations increase viewer engagement.

- Upselling: Offering premium features can entice users to spend more through upgrades or add-ons.

- Cross-Selling: Introducing complementary products to existing customers.

- Loyalty Programs: Rewarding most active customers to encourage higher spending with exclusive collaborations with marketing and other customer success efforts.

- Pricing Optimization: Adjusting prices based on market research and customer feedback. Example: SaaS companies like Salesforce regularly update pricing for maximum revenue.

Drawbacks of ARPU

- While ARPU is a useful metric, it has its limitations:

- Overgeneralization: ARPU treats all customers as equal, potentially masking the diversity within the user base. It can overlook variations in customer behavior, preferences, and spending patterns.

- Short-Term Focus: ARPU primarily focuses on short-term revenue and might not accurately reflect long-term customer value or loyalty.

- Ignores Profitability: ARPU does not consider the cost of acquiring or servicing customers. High ARPU does not always mean high profitability, especially if customer acquisition costs are high.

- Market Misinterpretation: In markets with diverse customer segments, ARPU might give a skewed view of the company’s performance, leading to misguided strategic decisions.

- Evaluating Business Models: Particularly useful for SaaS and subscription-based companies to assess their business models and forecast revenue.

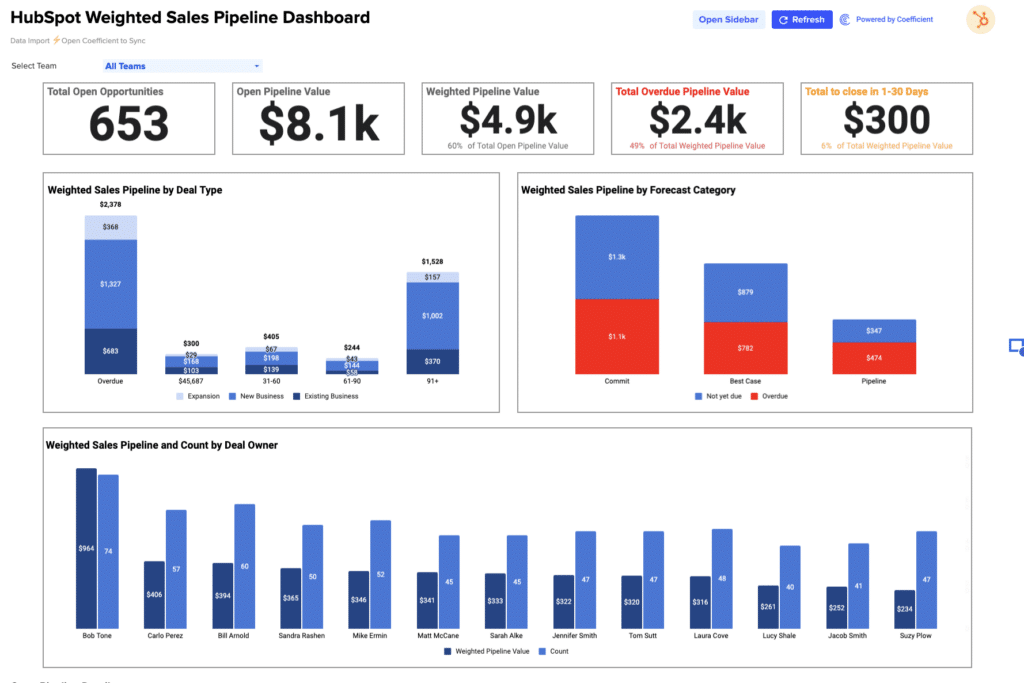

- Measuring Impact of Marketing Efforts: It helps in understanding the effectiveness of marketing campaigns aimed at increasing revenue per user.

- New Market Entry or Product Launch: When entering new markets or launching new products, ARPU can provide quick insights into initial performance and customer value.

Calculating ARPU – Example

Scenario: Consider a SaaS company, CloudTech Solutions, that offers cloud storage and collaboration tools. CloudTech has a mix of free and premium subscription plans. For simplicity, we’ll focus on their premium subscriptions or paying customers.

- Total Monthly Revenue or Monthly Recurring Revenue (MRR): In a given month, CloudTech Solutions reports a total revenue of $500,000 from its premium subscriptions.

- Average Number of Premium Subscribers: Throughout the same month, the average number of premium subscribers is calculated to be 10,000.

Calculation: To find the ARPU for CloudTech Solutions,

ARPU = Total Revenue / Average Number of Users = $500,000/10,000 = $50

This means, on average, each premium subscriber contributes $50 to CloudTech Solutions’ revenue per month. For a SaaS analyst, this figure is crucial. It helps in understanding how much revenue is generated per paying user, offering insights into the company’s revenue generation efficiency from its premium user base. This ARPU figure can then be compared against operational costs, customer acquisition costs, and other financial metrics to gauge the overall profitability and sustainability of the current monetization structure.

What factors need to be considered to leverage ARPU?

- When analyzing ARPU, consider the following factors:

- Market Segmentation: Different segments may have varying ARPUs. Understanding this can lead to more targeted strategies.

- Customer Lifecycle: The stage of the customer in their lifecycle (new vs. existing) can significantly impact ARPU.

- Service or Product Updates: Changes in offerings or service improvements can affect ARPU, as they might alter user engagement or spending patterns.

- Seasonality: ARPU can fluctuate based on seasonal trends or market conditions, which should be considered in analysis.

Difference between ARPU and LTV (Lifetime Value)

ARPU measures the average revenue generated per user in a specific time frame. LTV (Customer Lifetime Value) estimates the total revenue a business can expect from a single customer throughout their entire relationship with the company.

While ARPU provides a snapshot of current revenue performance, LTV offers a long-term perspective, considering factors like customer retention, churn rate, and long-term profitability.

Difference between ARPU and ARPPU (Average Revenue Per Paying User)

ARPU includes all users, whether they are paying or not.ARPPU specifically measures the revenue generated from paying users only.ARPU gives an overall revenue efficiency metric, while ARPPU focuses on the subset of users who contribute directly to the revenue, often leading to higher values than ARPU in freemium or free-to-use services with premium options.