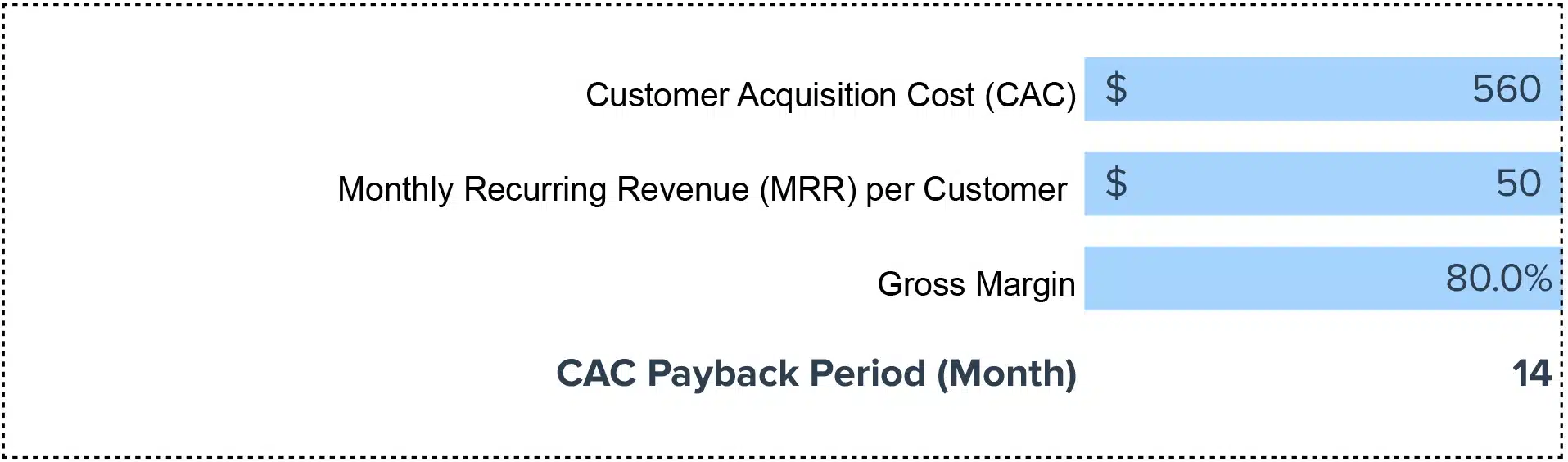

CAC Payback = Customer Acquisition Cost (CAC) / (MRR per Customer * Gross Margin)

How to Calculate CAC Payback Period?

To accurately determine your CAC Payback, you’ll need:

– Your average Customer Acquisition Cost (CAC).

– The Monthly Recurring Revenue (MRR) per customer.

– The Gross Margin as a percentage.

Functions Involved:

– Marketing Analysts to provide CAC figures.

– Sales Managers to report on MRR per customer.

– Finance Officers for gross margin percentages.

The Vital Role of CAC Payback

CAC Payback measures the time required to recoup the costs of acquiring a new customer, illustrating the efficiency of your customer acquisition efforts. It’s a critical metric for startups and growing businesses to ensure sustainable scaling.

Importance: Why CAC Payback Matters

Understanding your CAC Payback is crucial for evaluating the sustainability of your growth. A shorter payback period indicates healthy cash flow and efficient marketing spend, allowing for more aggressive reinvestment in growth initiatives.

Example: CAC Payback in Practice

If “Innovative App Inc.” has a CAC of $120, an MRR per customer of $20, and a gross margin of 50%, the CAC Payback period calculates as 12 months. This insight prompts a review of acquisition strategies to improve efficiency and profitability.

Improvement Strategies: Accelerating CAC Payback Time

1. Optimize Marketing Channels: Focus your marketing spend on high-converting channels.

2. Increase Customer Value: Enhance product offerings to raise MRR per customer.

3. Improve Gross Margins: Streamline operations and costs to improve overall margins.

4. Enhance Customer Retention: Invest in customer success to increase lifetime value.

5. Leverage Referrals: Encourage existing customers to refer new ones, reducing direct CAC.

Calculating CAC Payback in Excel

1. Create columns for CAC, MRR per Customer, and Gross Margin.

2. Enter your specific data into the first two columns.

3. In a new column, input the formula: `=A2/(B2*C2)`

4. Calculate to find your CAC Payback period in terms of months.

Drawbacks: Recognizing CAC Payback Limitations

While informative, the CAC Payback metric does not account for customer churn or varying revenue streams. It should be considered alongside other financial and customer metrics for a comprehensive view.

Where is CAC Payback applicable?

– Budgeting Cycles: To allocate marketing budgets effectively based on payback periods.

– Marketing Strategy Meetings: For strategizing around acquisition channels with better returns.

– Quarterly Financial Reviews: To assess the impact of customer acquisition on cash flow.