Profit Margin = (Net Income / Sales)

How to Calculate Profit Margin?

Net Income: This represents the company’s total earnings, accounting for all expenses, taxes, and additional income.

Sales: This is the total revenue generated from goods sold or services provided by the company.

What is Profit Margin?

Profit Margin is a financial metric used to determine the percentage of profit a company makes for each dollar of sales. It shows how effectively a business is translating sales into profits.

Why is Profit Margin Important?

Understanding Profit Margin is crucial for businesses as it reflects the overall financial health, efficiency in cost management, and pricing strategy effectiveness. It’s an essential indicator for investors and management to make informed decisions.

Calculating Profit Margin – Example

Consider a company with a net income of $120,000 and sales of $600,000. The profit margin would be calculated as:

Profit Margin = ($120,000 / $600,000) = 0.20 or 20%

This indicates that for every dollar earned from sales, the company retains $0.20 as profit after covering all expenses.

How to Improve Profit Margin

Optimize Pricing Strategies

Adjust your product pricing to balance competitiveness with profitability. An increase in prices, if accepted by your market, can directly boost your profit margin.

Reduce Costs

Identify and cut unnecessary costs. Review supplier contracts, streamline operations, and improve efficiency to reduce expenditure without compromising quality.

Enhance Customer Experience

Invest in customer service and support. Satisfied customers are likely to return and recommend your business, increasing revenue and reducing marketing and acquisition costs.

Focus on High-Margin Products

Analyze which products or services yield higher margins and focus your resources and marketing efforts on these areas to maximize overall profitability.

Implement Financial Controls

Regular financial reviews and tighter control over expenses can prevent cost creep and help maintain a healthier profit margin.

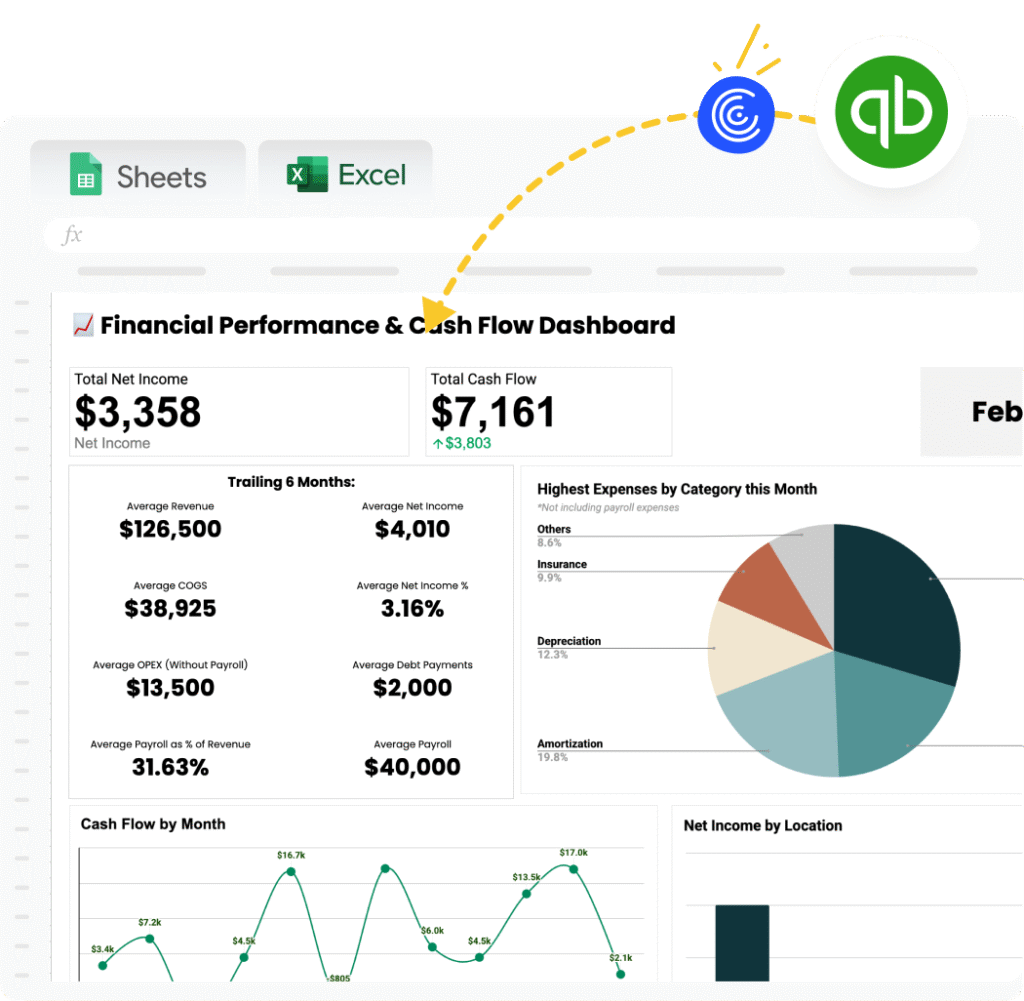

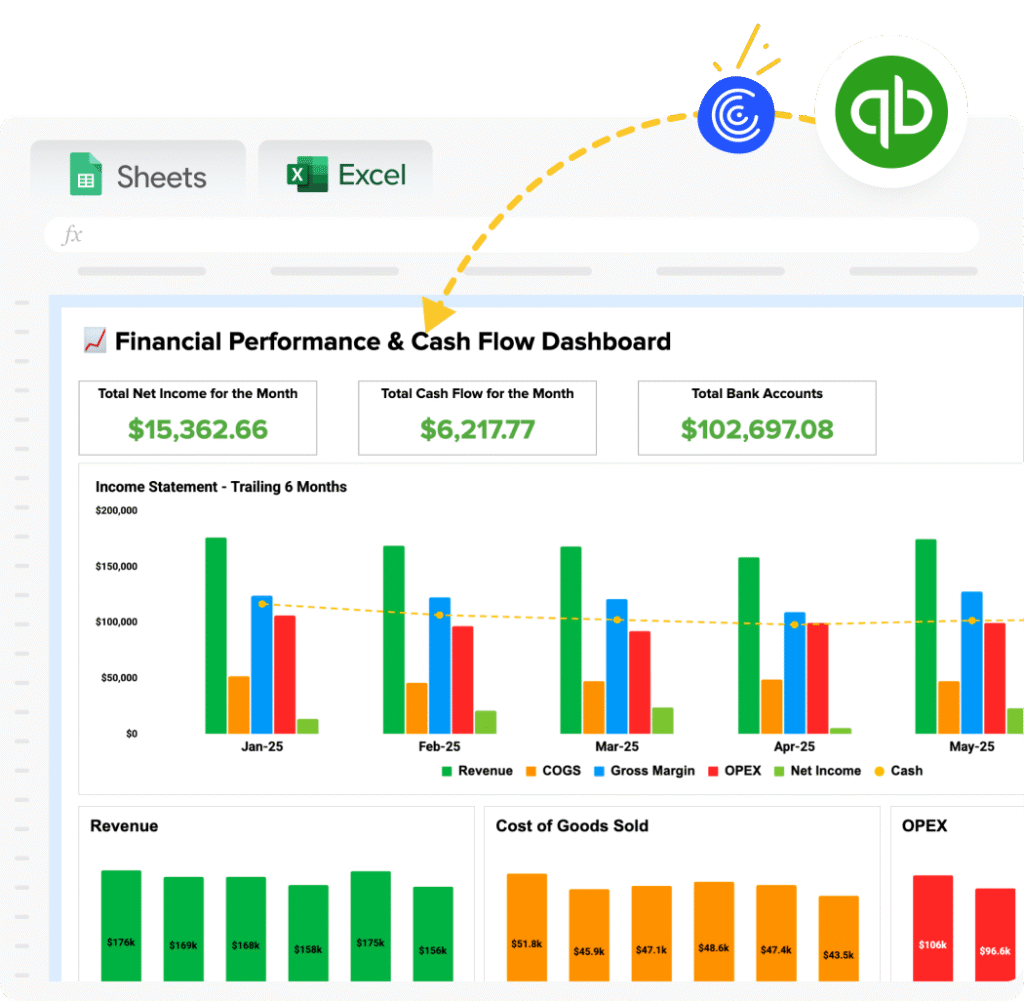

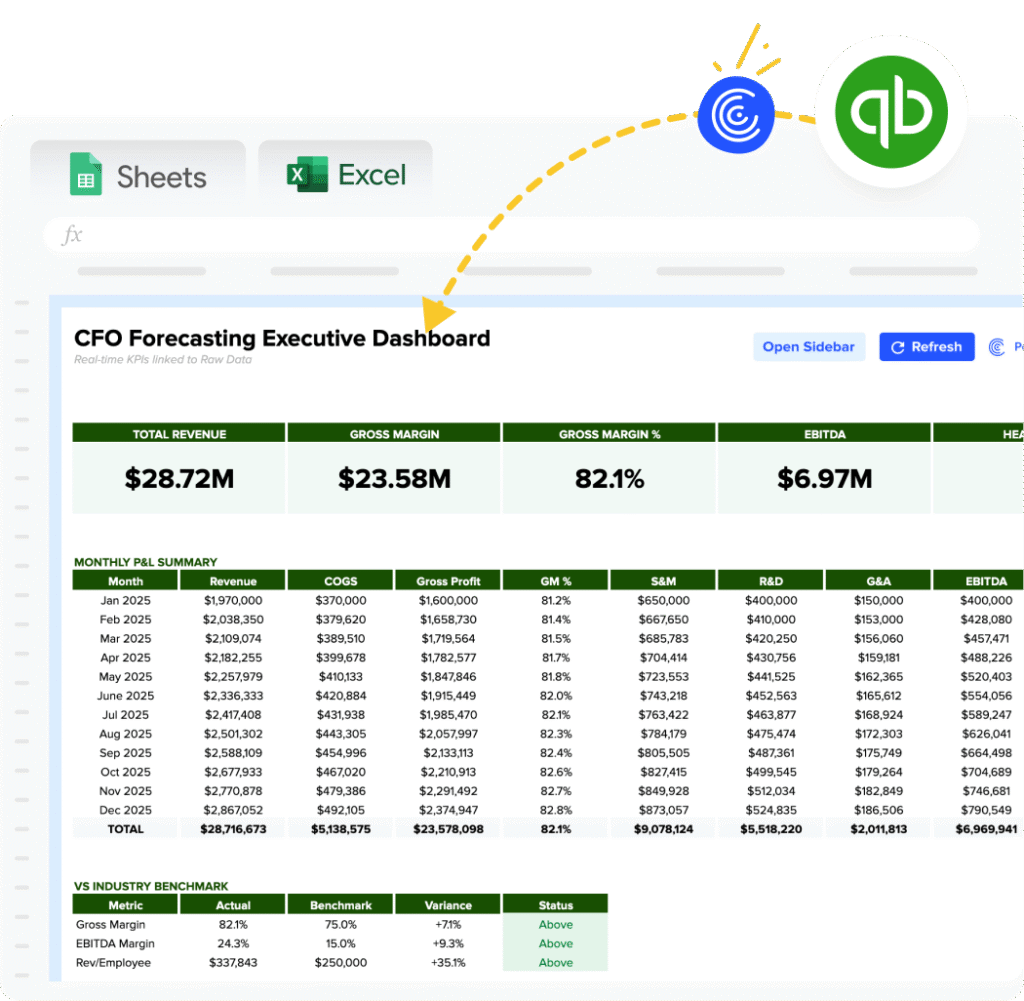

How to Calculate Profit Margin in Google Sheets and Excel?

Step 1: Enter the Net Income in cell A1.

Step 2: Input the total Sales in cell A2.

Step 3: Type the formula =(A1/A2) in cell A3 to obtain the Profit Margin.

Drawbacks of Profit Margin

– Market Dependency: Profit margins can be significantly influenced by market changes and economic conditions.

– Non-Inclusive of Growth Investments: High profit margins might result from under-investing in future growth opportunities.

– Product-Based Variability: Different products have different margins, which might skew overall profitability analysis.

When to Use the Profit Margin Calculator

Utilize the Profit Margin Calculator during quarterly financial reviews, when adjusting pricing strategies, or while preparing for investor presentations to quickly assess financial health.

Profit Margin Calculator: Tips and Tricks

– Predict Trends: Use historical margin data to forecast future trends and set financial targets.

– Monitor Regularly: Frequently update your calculations to reflect the most current financial data.

– Simplify Reporting: Automate your calculations with tools like Coefficient.io to save time and reduce errors in repetitive tasks.