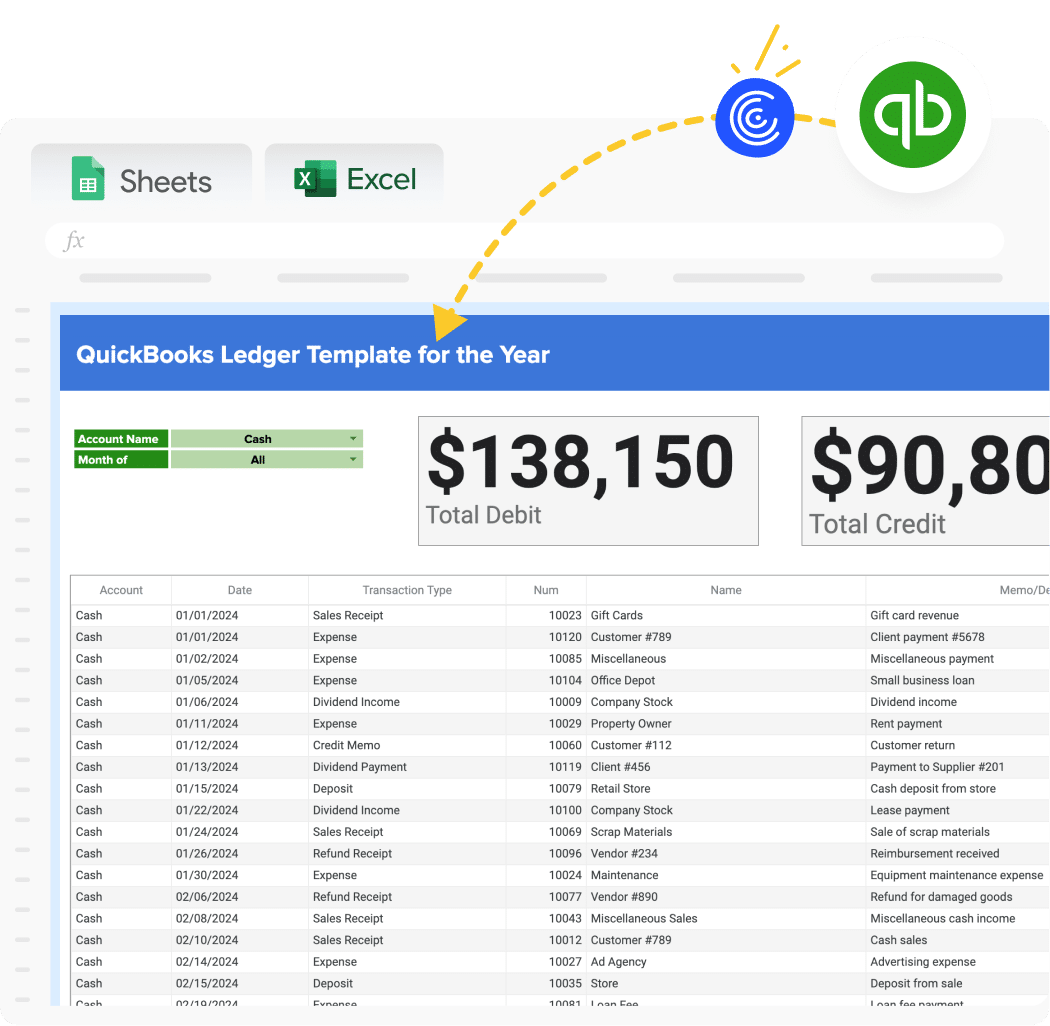

Managing your company’s financial records can be challenging without the right tools. Coefficient’s free QuickBooks ledger template simplifies this process, allowing you to track and analyze your financial data with ease.

What is a QuickBooks Ledger Template?

A QuickBooks ledger report is a comprehensive financial document that provides a detailed record of all transactions within your business. It serves as the backbone of your accounting system, offering a chronological list of debits and credits for each account. This report is essential for maintaining accurate financial records, reconciling accounts, and preparing financial statements.

The QuickBooks ledger report typically includes information such as transaction dates, account names, transaction types, and monetary amounts. It allows business owners and accountants to track the flow of money in and out of the company, ensuring financial transparency and accuracy.

Who is QuickBooks Ledger Template Built For?

The QuickBooks ledger template is designed for:

- Small to medium-sized business owners

- Accountants and bookkeepers

- Financial managers

- Entrepreneurs and startups

- Anyone responsible for managing company finances

This template is particularly useful for those who need to maintain detailed financial records, prepare for tax season, or generate accurate financial reports for stakeholders.

What is the Primary Use Case for QuickBooks Ledger Template?

The primary use case for the QuickBooks ledger template is to provide a clear, organized view of a company’s financial transactions. It allows users to:

- Track all financial activities in one place

- Reconcile accounts and identify discrepancies

- Prepare accurate financial statements

- Analyze spending patterns and cash flow

- Simplify tax preparation and audits

By using this template, businesses can maintain better control over their finances and make more informed decisions based on up-to-date financial data.

Benefits of Using QuickBooks Ledger Template

- Real-time Data Updates: The template syncs directly with QuickBooks, ensuring your ledger always reflects the most current financial information.

- Customizable Reporting: Tailor the ledger to your specific needs by adding or removing columns, filtering data, or creating custom views.

- Time-saving Automation: Eliminate manual data entry and reduce errors by automatically pulling data from QuickBooks into your spreadsheet.

- Enhanced Collaboration: Share the ledger with team members or stakeholders, allowing for better financial transparency and decision-making.

- Improved Financial Analysis: Utilize built-in formulas and charts to gain deeper insights into your company’s financial health.

Metrics Tracked in the Report

The QuickBooks ledger template tracks the following key metrics:

- Date

- Transaction ID

- Account Name

- Account Number

- Debit Amount

- Credit Amount

- Balance

- Transaction Type (Invoice, Payment, Expense, etc.)

- Description/Memo

- Customer/Supplier Name

- Class/Department (if applicable)

More Metrics to Track and Analyze on Google Sheets

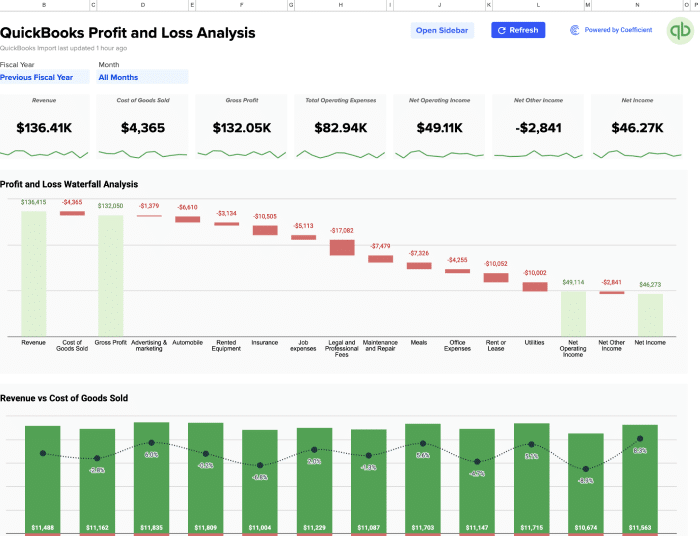

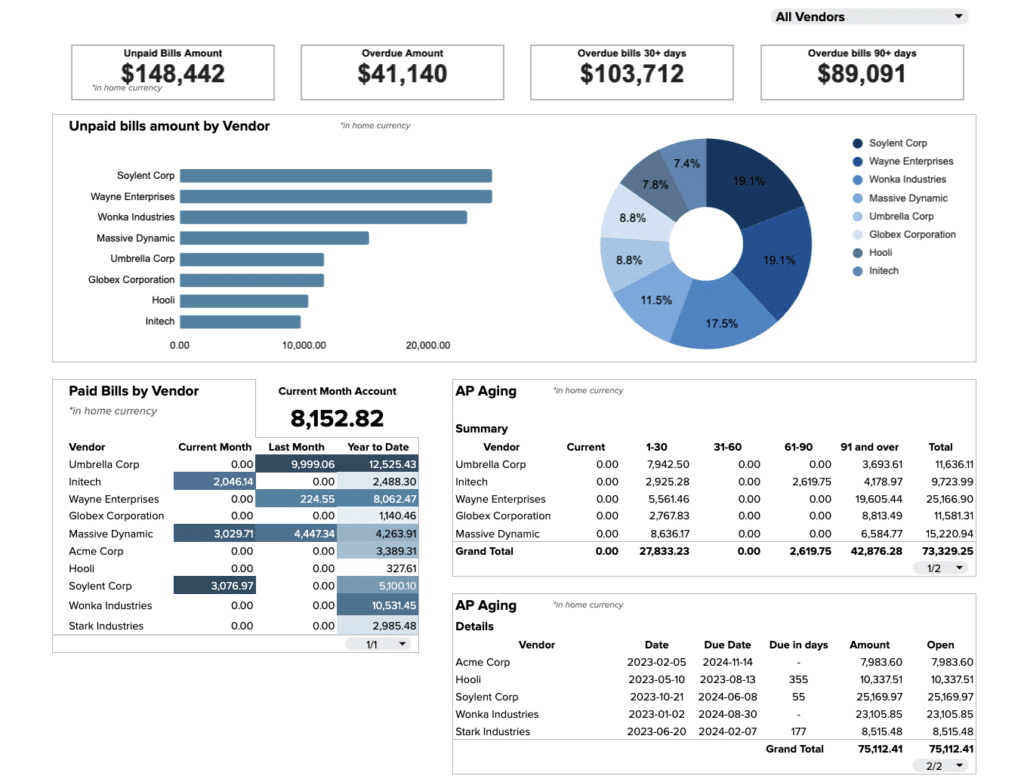

With Coefficient’s QuickBooks integration, you can expand your financial analysis by pulling additional data into Google Sheets:

- Multiple company data connections

- Various report types available in QuickBooks

- Departmental and location-based sorting

- Consolidated reports from multiple sources

- Budget vs. Actuals comparisons

- Profit & Loss statements by month and class

- Accounts Payable and Accounts Receivable dashboards

- Expense breakdowns by vendor

- Month-over-Month growth analysis