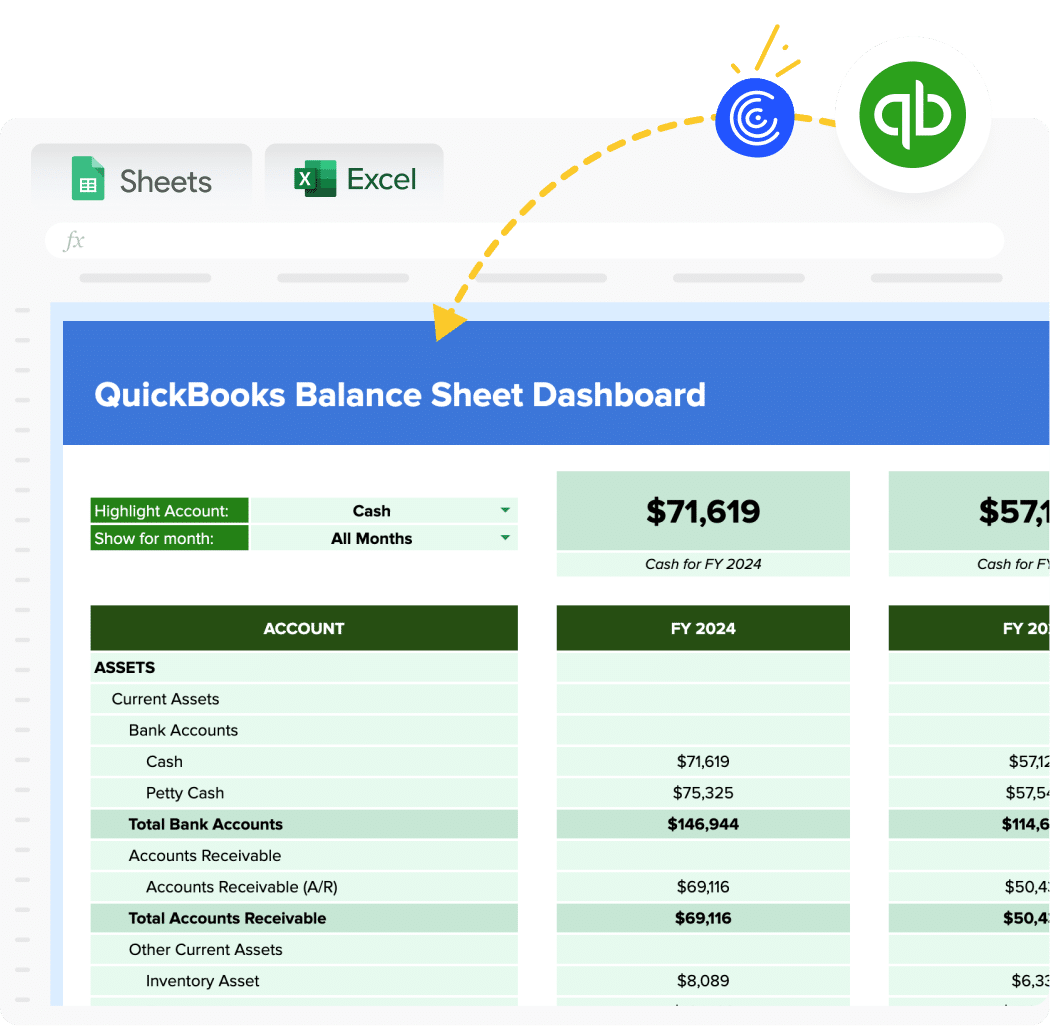

Tracking your company’s financial health can be challenging. Coefficient’s free QuickBooks Balance Sheet template provides real-time financial snapshots, helping you make informed decisions with up-to-date data.

What is a Balance Sheet template?

A balance sheet report is a financial statement that provides a snapshot of a company’s financial position at a specific point in time. It outlines the company’s assets, liabilities, and equity, offering a clear picture of what the business owns and owes. This crucial document helps stakeholders understand the company’s financial health, solvency, and overall worth.

The balance sheet is one of the three primary financial statements, alongside the income statement and cash flow statement. It adheres to the fundamental accounting equation: Assets = Liabilities + Equity. This equation ensures that the balance sheet always “balances,” with total assets equaling the sum of liabilities and equity.

Who is the Balance Sheet template built for?

The QuickBooks Balance Sheet template is designed for:

- Small business owners seeking a clear view of their company’s financial position

- Accountants and bookkeepers managing multiple client accounts

- Financial analysts needing real-time data for accurate reporting

- Entrepreneurs looking to track their startup’s growth and financial health

- Investors requiring up-to-date financial information for decision-making

What is the primary use case for the Balance Sheet template?

The primary use case for the QuickBooks Balance Sheet template is to provide a real-time, comprehensive overview of a company’s financial status. This template allows users to:

- Monitor assets, liabilities, and equity in real-time

- Track financial growth and changes over time

- Identify potential financial issues before they become critical

- Make informed decisions based on current financial data

- Prepare accurate financial reports for stakeholders and investors

Benefits of using QuickBooks Balance Sheet Template

- Real-time data synchronization: Get the most up-to-date financial information directly from QuickBooks

- Customizable reporting: Tailor the balance sheet to your specific needs and preferences

- Time-saving automation: Eliminate manual data entry and reduce the risk of errors

- Historical comparisons: Easily compare current financial positions with previous periods

- Enhanced decision-making: Access accurate, timely data to guide strategic business choices

Metrics Tracked in the Report

The QuickBooks Balance Sheet template tracks the following key metrics:

- Assets

- Current Assets (Cash, Accounts Receivable, Inventory, etc.)

- Fixed Assets (Property, Equipment, etc.)

- Total Assets

- Liabilities

- Current Liabilities (Accounts Payable, Short-term Debt, etc.)

- Long-term Liabilities (Long-term Debt, etc.)

- Total Liabilities

- Equity

- Owner’s Equity

- Retained Earnings

- Total Equity

- Total Liabilities and Equity

- Comparative Figures (Previous Periods)

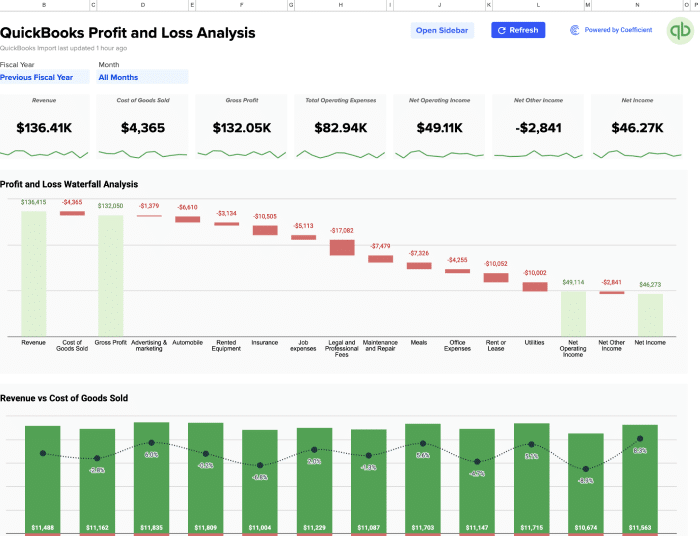

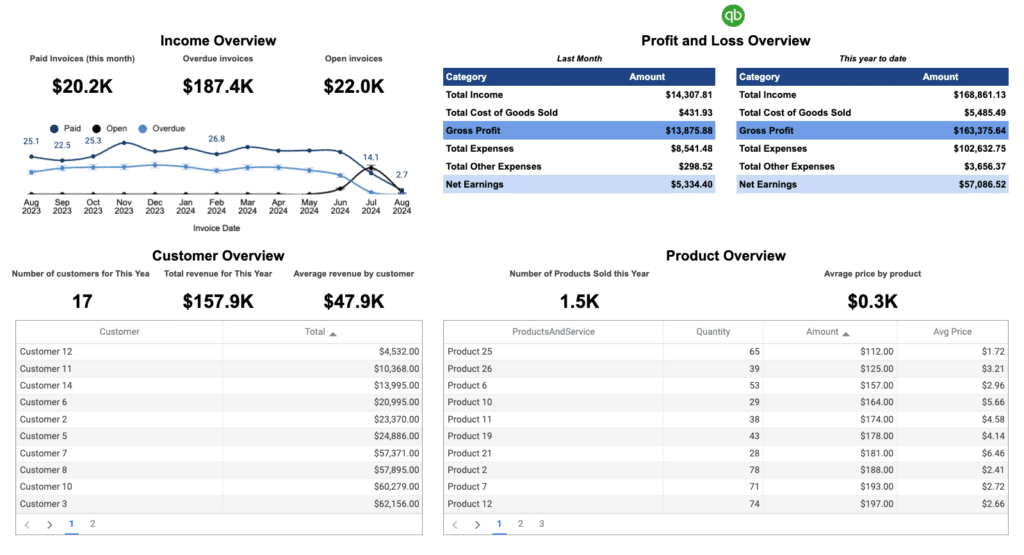

More Metrics to track and analyze on Google Sheets

With Coefficient’s QuickBooks integration, you can pull additional metrics and create custom reports:

- Connect to multiple QuickBooks companies

- Choose from various report types available in QuickBooks

- Maintain cell references when refreshing data

- Drill down into specific data points

- Automatically consolidate multiple reports

- Sort data by Department or Location

- Access free financial templates, including:

- P&L Budget vs. Actuals

- P&L by Class

- Expenses by Vendor

- Profit & Loss by Month & Class

- Consolidated P&L

- Profit & Loss – MoM Growth

- Live A/P Dashboard

- Live A/R Dashboard