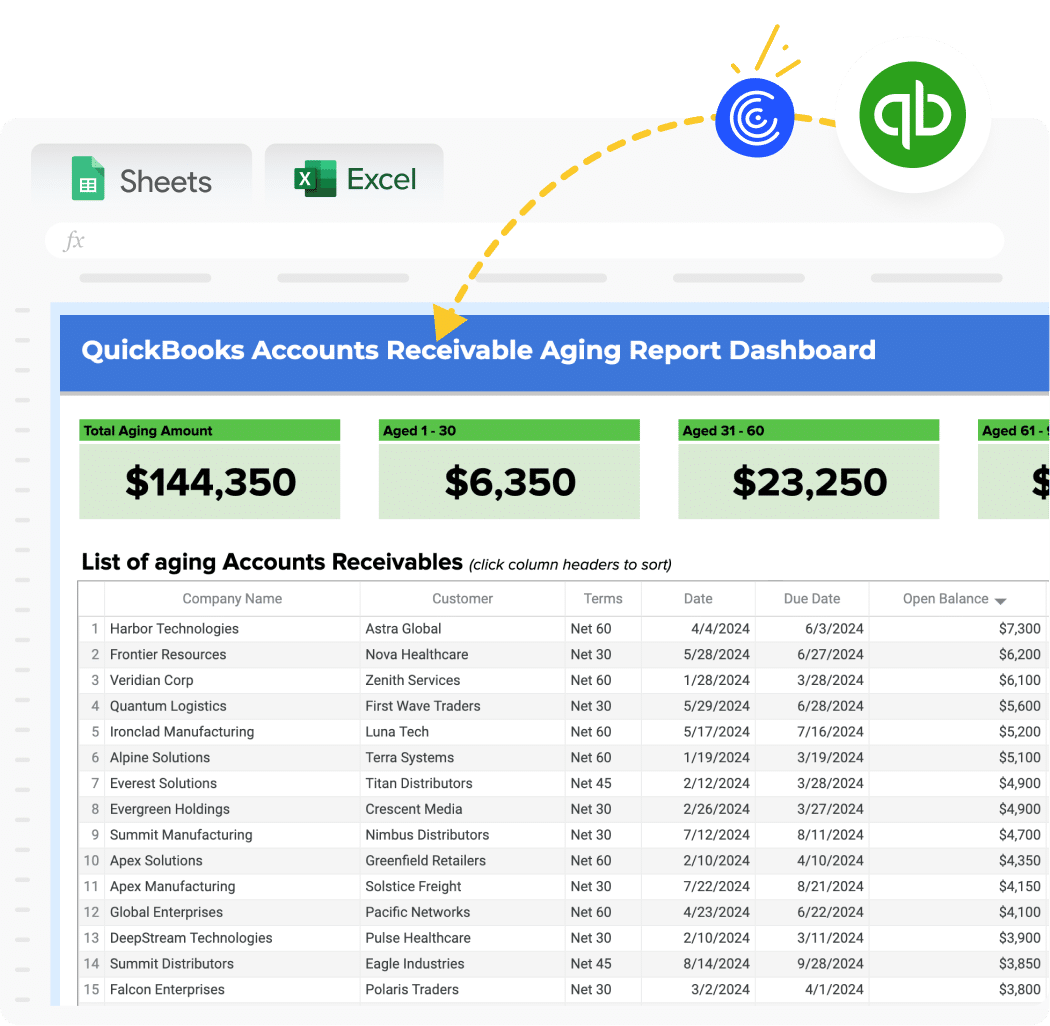

Free QuickBooks Template for Accounts Receivable (AR) Aging Report

Managing outstanding invoices can be challenging. Coefficient’s free QuickBooks template for Accounts Receivable Aging Reports simplifies tracking and analyzing unpaid customer balances, helping you improve cash flow and reduce financial risk.

What is an Accounts Receivable (AR) Aging Report?

An Accounts Receivable (AR) Aging Report is a financial document that categorizes a company’s unpaid customer invoices based on the length of time they’ve been outstanding. This report typically groups receivables into time buckets such as 0-30 days, 31-60 days, 61-90 days, and over 90 days past due.

The AR Aging Report serves as a crucial tool for businesses to monitor their cash flow, assess customer payment behaviors, and identify potential collection issues. By providing a clear overview of outstanding balances, it enables companies to prioritize collection efforts and make informed decisions about credit policies.

Who is the Accounts Receivable (AR) Aging Report template built for?

This template is designed for:

- Finance managers and CFOs seeking to improve cash flow management

- Accounts receivable specialists responsible for tracking and collecting customer payments

- Small to medium-sized business owners who want better visibility into their financial health

- Accountants and bookkeepers managing multiple client accounts

What is the primary use case for the Accounts Receivable (AR) Aging Report template?

The primary use case for this template is to provide a comprehensive view of a company’s outstanding receivables. It allows users to:

- Quickly identify overdue accounts and prioritize collection efforts

- Assess the effectiveness of current credit policies

- Forecast cash flow based on expected payment timelines

- Evaluate customer payment trends and creditworthiness

- Calculate and monitor key financial metrics such as Days Sales Outstanding (DSO)

Benefits of using QuickBooks Accounts Receivable (AR) Aging Report Template

- Real-time data synchronization: The template automatically pulls the latest data from QuickBooks, ensuring your reports are always up-to-date.

- Customizable aging buckets: Tailor the aging categories to match your company’s credit terms and collection policies.

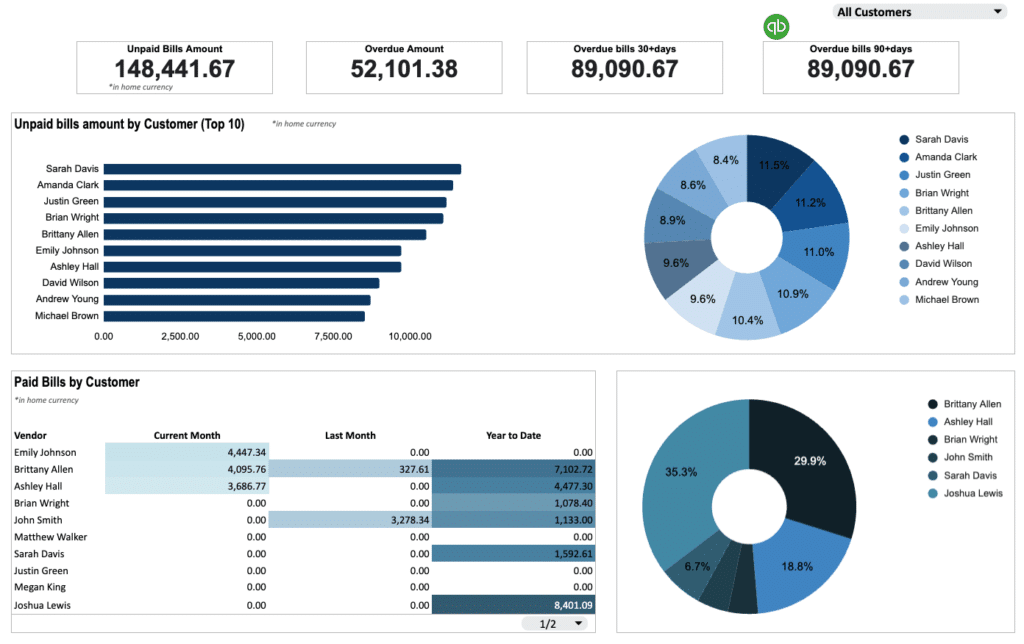

- Enhanced visualization: Transform raw data into easy-to-understand charts and graphs for better insights and decision-making.

- Automated alerts: Set up notifications for high-risk accounts or when certain thresholds are reached, allowing for proactive management.

- Seamless integration: Combine AR aging data with other financial metrics for a more comprehensive view of your business’s financial health.

Metrics Tracked in the Report

- Customer Name

- Invoice Number

- Invoice Date

- Due Date

- Days Outstanding

- Current (0-30 days)

- 31-60 Days

- 61-90 Days

- Over 90 Days

- Total AR per Customer

- Percentage of Total AR per Aging Bucket

- Total AR Outstanding

- Notes/Comments

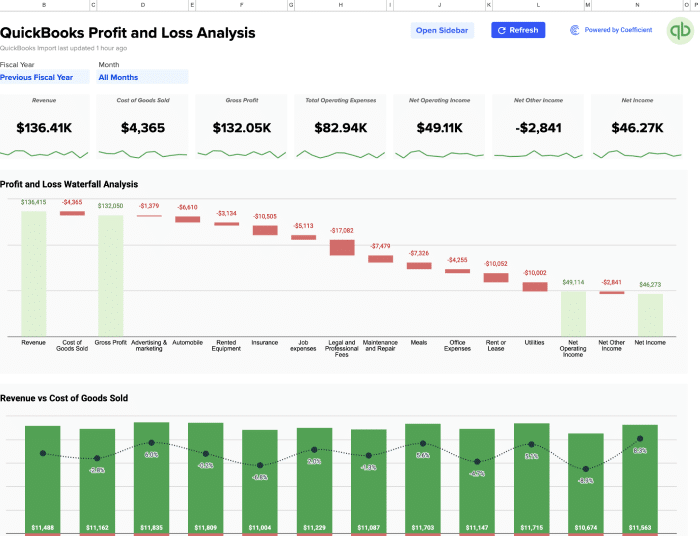

More Metrics to track and analyze on Google Sheets

With Coefficient’s QuickBooks integration, you can expand your financial analysis by pulling additional data:

- Profit & Loss statements

- Budget vs. Actuals comparisons

- Expenses by Vendor

- Profit & Loss by Month & Class

- Consolidated P&L

- Profit & Loss – Month-over-Month Growth

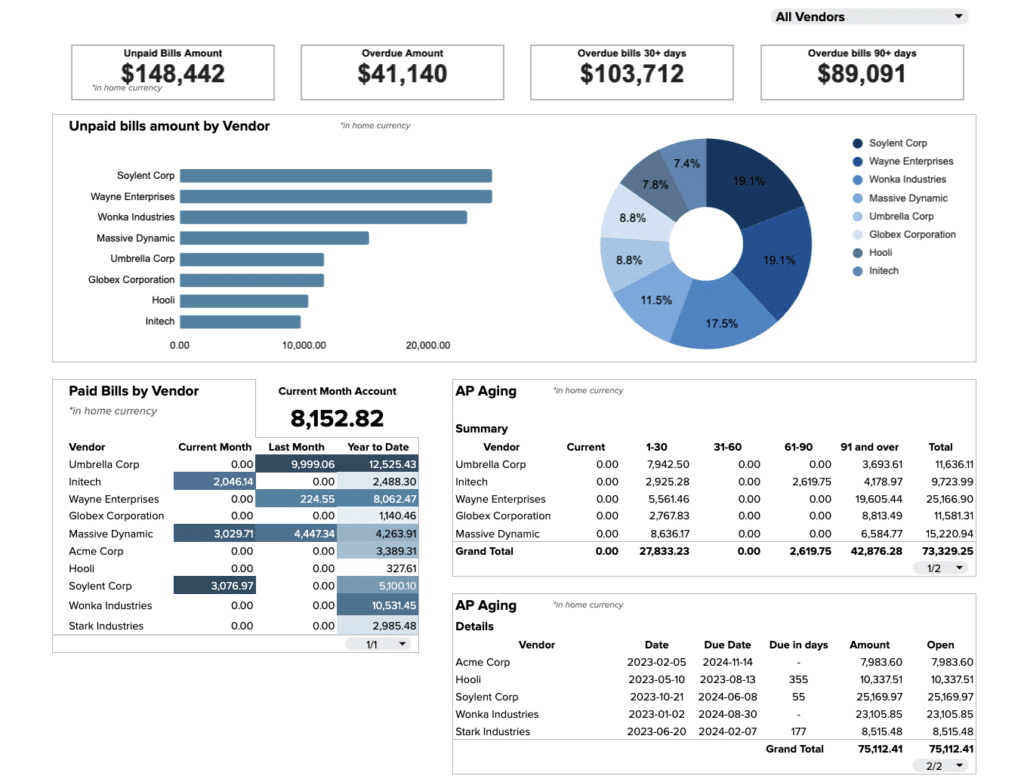

- Live Accounts Payable Dashboard

- Department and Location-specific data

You can also leverage Coefficient’s free financial templates, including:

Outstanding Payments Dashboard

P&L Budget vs. Actuals

Live A/P Dashboard