As your company grows, so do your accounting needs. Two popular options stand out in the market: NetSuite and Xero.

But which one is the perfect fit for your evolving business?

Let’s dive into a comprehensive comparison to help you make an informed decision.

The Contenders: NetSuite and Xero at a Glance

NetSuite: The All-in-One Powerhouse

NetSuite isn’t just accounting software; it’s a comprehensive Enterprise Resource Planning (ERP) solution. It brings together Customer Relationship Management (CRM), accounting, operations, and more under one digital roo. This unified approach makes NetSuite a powerhouse for businesses with complex needs and ambitious growth plans.

Xero: The Small Business Champion

Xero, on the other hand, zeroes in on what small businesses need most: straightforward, cloud-based accounting and bookkeeping. It’s designed to simplify financial management for entrepreneurs and small business owners who want powerful features without the complexity.

| Category | NetSuite | Xero |

| Target Business Size | Mid-size to large enterprises | Small to medium-sized businesses |

| Core Functionality | Comprehensive ERP (including CRM, HR, and more) | Cloud-based accounting and bookkeeping |

| Scalability | Highly scalable, supports complex multi-entity operations | Scalable for small business growth, may have limitations for very large operations |

| Ease of Use | Steeper learning curve, more complex interface | User-friendly, intuitive interface |

| Pricing Model | Custom quotes, typically annual contracts | Transparent tiered pricing, monthly subscriptions |

| Mobile Capabilities | Basic mobile app, focuses on approvals and reporting | Comprehensive mobile app with full feature parity |

Feature Face-Off: What Can Each Platform Do?

Crunching the Numbers: Accounting and Financial Management

Both NetSuite and Xero offer the essentials: general ledger, accounts payable and receivable, and financial reporting. But that’s where the similarities end.

NetSuite takes financial management to the next level with:

- Multi-entity consolidation for businesses with complex structures

- Advanced revenue recognition

- Comprehensive fixed asset management

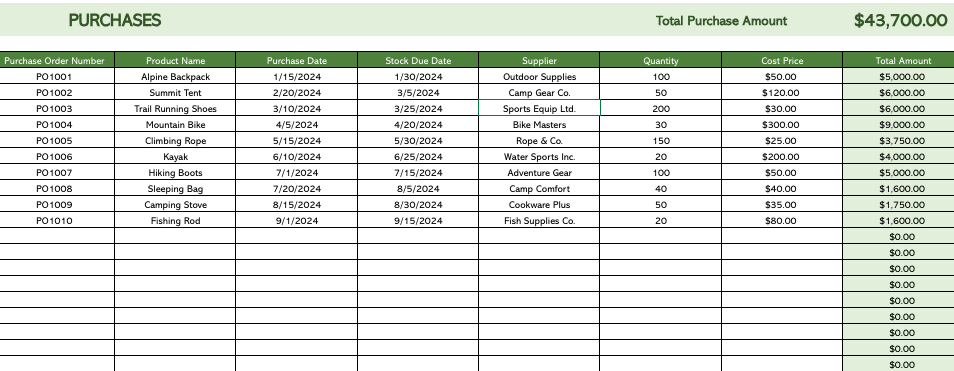

Xero keeps it simpler but still powerful:

- Bank reconciliation

- Inventory tracking

- Basic project costing

For businesses juggling multiple entities or dealing with complex financial scenarios, NetSuite’s advanced capabilities give it a clear edge. But for small businesses focused on core accounting tasks, Xero’s streamlined approach might be just right.

Room to Grow: Scalability and Expansion Support

As your business expands, your software needs to keep pace. Here’s how our contenders stack up:

NetSuite:

- Supports multi-national, multi-currency operations

- Offers industry-specific solutions

- Scales from small business to enterprise-level without changing platforms

Xero:

- Handles basic multi-currency transactions

- Supports growing businesses with additional users and features

- May require migration to more robust systems for very large or complex operations

NetSuite clearly has the advantage for businesses with aggressive growth plans or complex organizational structures. Xero, while capable of supporting growth, may hit limitations for rapidly expanding or highly complex businesses.

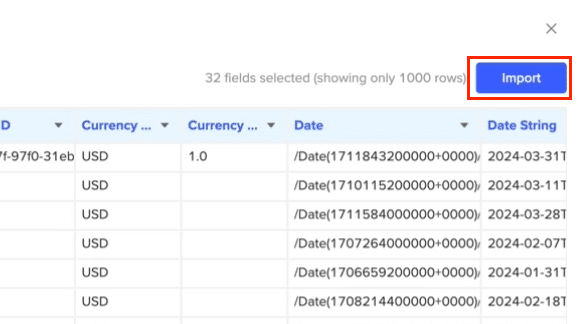

Playing Well with Others: Integration and Ecosystem

In today’s interconnected business world, your accounting software can’t exist in isolation. Let’s see how NetSuite and Xero connect with other tools:

NetSuite:

- Offers a vast array of built-in applications covering most business needs

- Provides APIs for custom integrations

- Has a smaller but more enterprise-focused third-party app marketplace

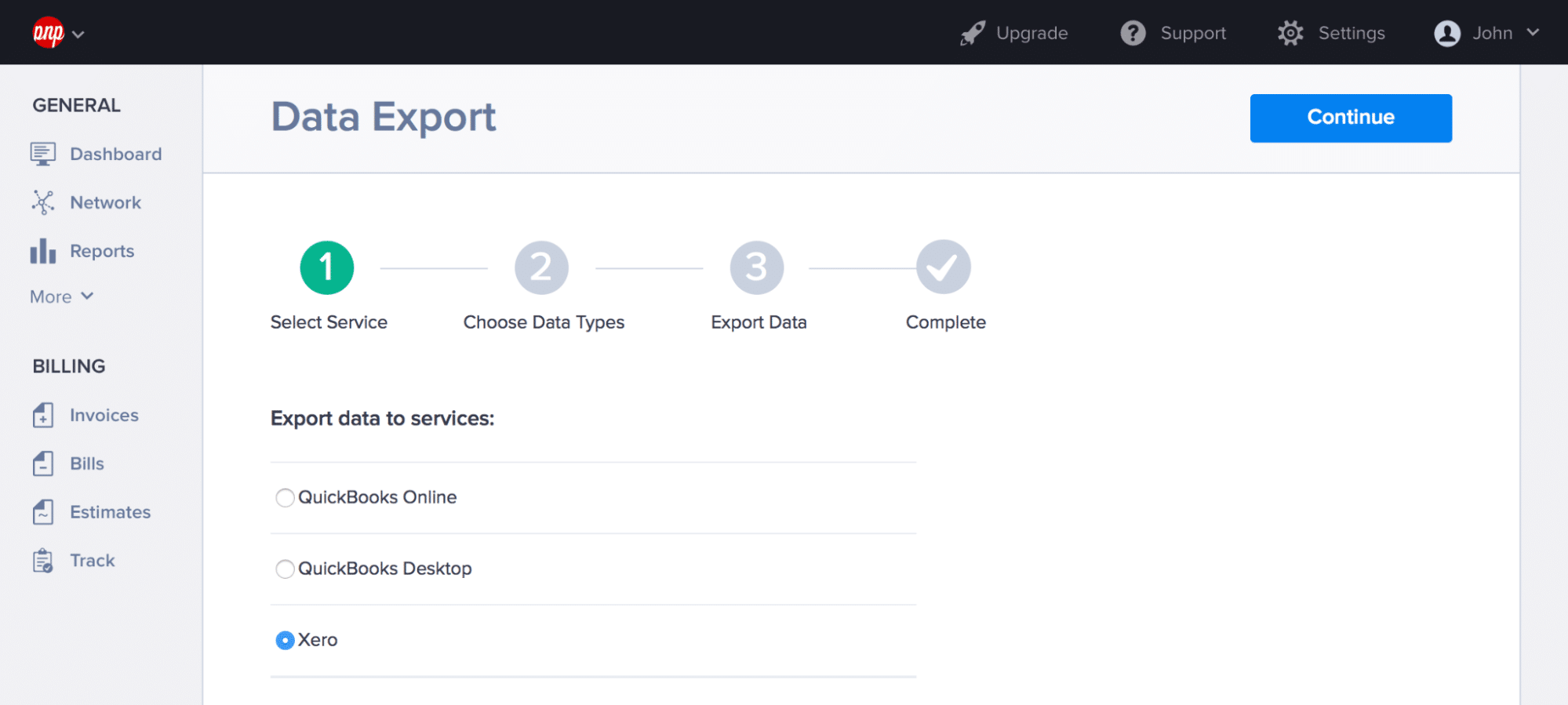

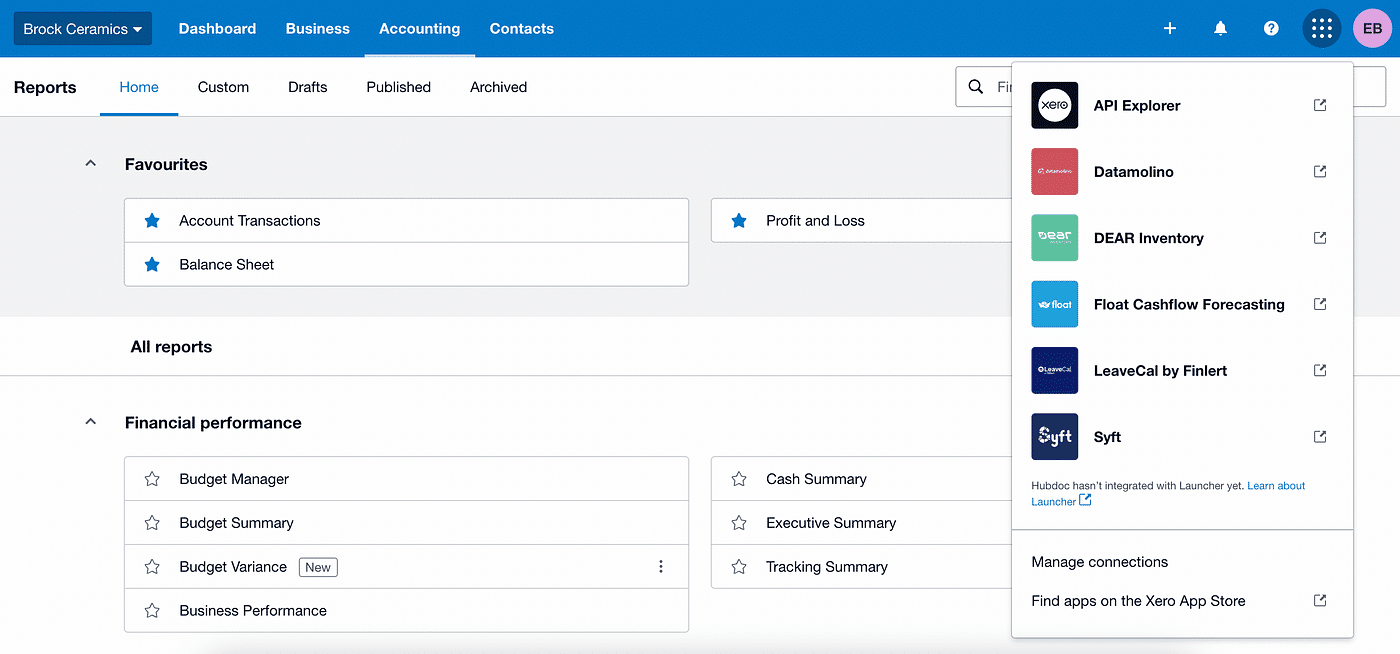

Xero:

- Boasts a large ecosystem of third-party integrations

- Offers open APIs for developers

- Particularly strong in integrations for small business tools

While both platforms offer robust integration options, Xero’s extensive marketplace of small business apps gives it an edge for smaller operations. NetSuite’s built-in applications and enterprise-focused integrations make it more suitable for larger, more complex businesses.

User Experience: Navigating the Software Seas

Finding Your Way: Interface and Navigation

The best features in the world don’t matter if you can’t figure out how to use them. Let’s compare the user experience of NetSuite and Xero:

NetSuite:

- Comprehensive interface with many options and customization possibilities

- Steeper learning curve due to its extensive feature set

- Highly customizable dashboards and reports

Xero:

- Clean, intuitive interface designed for non-accountants

- Shorter learning curve for basic functions

- User-friendly dashboard with key financial metrics at a glance

[Insert Screenshot: Side-by-side comparison of NetSuite and Xero dashboards] This visual should highlight the differences in complexity and layout between the two platforms.

For small business owners who want to dive in quickly, Xero’s intuitive interface is a major plus. However, for businesses that need deep customization and don’t mind investing time in learning the system, NetSuite’s powerful interface can offer significant long-term benefits.

On the Go: Mobile Accessibility

In our increasingly mobile world, the ability to manage finances on the go is crucial. Here’s how NetSuite and Xero perform on mobile devices:

NetSuite:

- Offers a mobile app with access to key features

- Provides a responsive web interface for tablet users

- Mobile functionality focuses on approvals, expense management, and basic reporting

Xero:

- Features a highly rated mobile app for iOS and Android

- Allows for invoice creation, expense tracking, and bank reconciliation on mobile devices

- Offers a consistent experience between mobile and desktop versions

While both platforms offer mobile solutions, Xero’s mobile app is more comprehensive and user-friendly, making it a better choice for business owners who frequently work on the go.

Dollars and Sense: Pricing and Cost Considerations

Now for the million-dollar question (hopefully not literally): How much will these solutions set you back?

Pricing Models: Transparency vs. Customization

NetSuite pricing:

- Customized pricing based on business needs and size

- Requires contacting sales for a quote

- Often involves a significant upfront investment

Xero pricing:

- Transparent, tiered pricing structure

- Plans starting from $12/month for very small businesses

- Higher tiers available for growing businesses with more complex needs

Key Stat: While specific NetSuite pricing isn’t publicly available, industry reports suggest implementation costs can range from $25,000 to $100,000+ for mid-sized businesses.

Xero’s transparent pricing is appealing for small businesses with straightforward needs. NetSuite’s custom pricing reflects its enterprise-grade capabilities but can be a significant investment.

The Long Game: Total Cost of Ownership

When considering costs, it’s crucial to look beyond the sticker price:

NetSuite additional costs:

- Implementation and customization fees

- Staff training and change management

- Potential need for dedicated IT support

Xero additional considerations:

- Costs of add-ons for advanced features

- Potential need for third-party integrations

- Less extensive training requirements

While Xero may seem more economical upfront, businesses with complex needs might find NetSuite’s comprehensive solution more cost-effective in the long run, despite the higher initial investment.

Support When You Need It: Customer Service and Resources

Even the most user-friendly software can leave you scratching your head sometimes. Let’s compare the support offered by both platforms.

Help is on the Way: Support Options

NetSuite support:

- 24/7 phone and email support

- Dedicated account managers for enterprise clients

- Comprehensive knowledge base and community forums

Xero support:

- Email support with 24/48 hour response times

- Live chat during business hours

- Extensive online help center and community

NetSuite’s support is more comprehensive, reflecting its enterprise focus. Xero’s support, while more limited, is generally sufficient for its target market of small businesses.

Learning the Ropes: Training and Educational Resources

Both platforms recognize the importance of user education:

NetSuite offers:

- In-depth training programs and certification courses

- Regular webinars and virtual events

- A vast library of educational content

Xero provides:

- Free online courses through Xero Central

- Regular webinars and video tutorials

- A network of certified advisors for personalized guidance

While both platforms invest heavily in user education, NetSuite’s resources are more extensive, reflecting the complexity of its system.

Making the Right Choice: Your Business, Your Decision

Now that we’ve compared NetSuite and Xero across key areas, let’s look at which businesses might benefit most from each platform.

When NetSuite Shines

NetSuite is ideal for:

- Mid to large-sized businesses with complex operations

- Companies experiencing rapid growth or planning significant expansion

- Businesses requiring advanced financial management and reporting

- Organizations needing a unified system for multiple business functions

Xero’s Sweet Spot

Xero is perfect for:

- Small businesses and startups

- Solopreneurs and freelancers

- Companies with straightforward accounting needs

- Businesses prioritizing user-friendliness and cost-effectiveness

Your Decision Checklist

Consider these factors when making your choice:

- Current business size and complexity

- Projected growth and future needs

- Budget for software and implementation

- Required features and integrations

- In-house IT capabilities

- Importance of mobile accessibility

- Need for advanced reporting and analytics

Choosing Between NetSuite and Xero

The choice between NetSuite and Xero ultimately depends on your business size, complexity, and growth trajectory.

Remember, regardless of which platform you choose, the key to maximizing your accounting software’s potential lies in how well you can integrate it with your other business systems and leverage real-time data for decision-making.

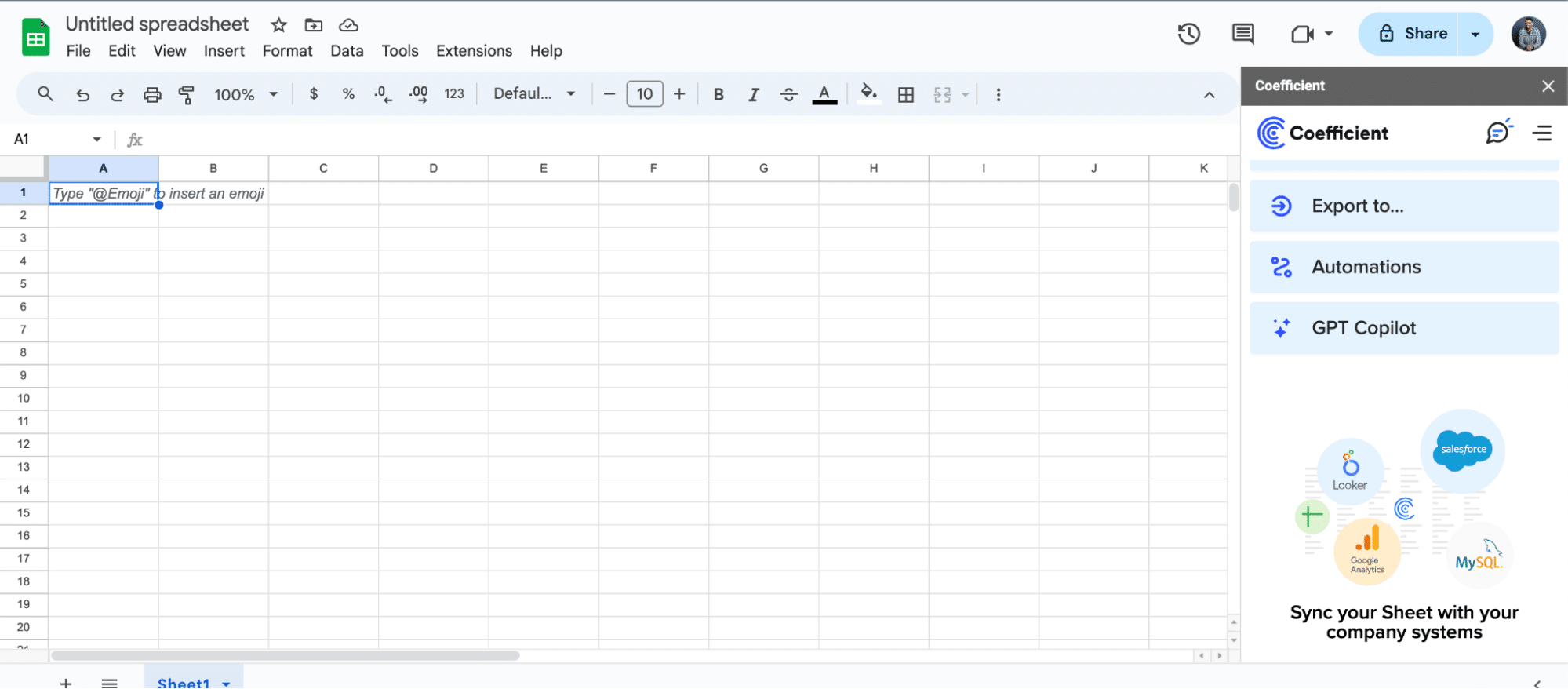

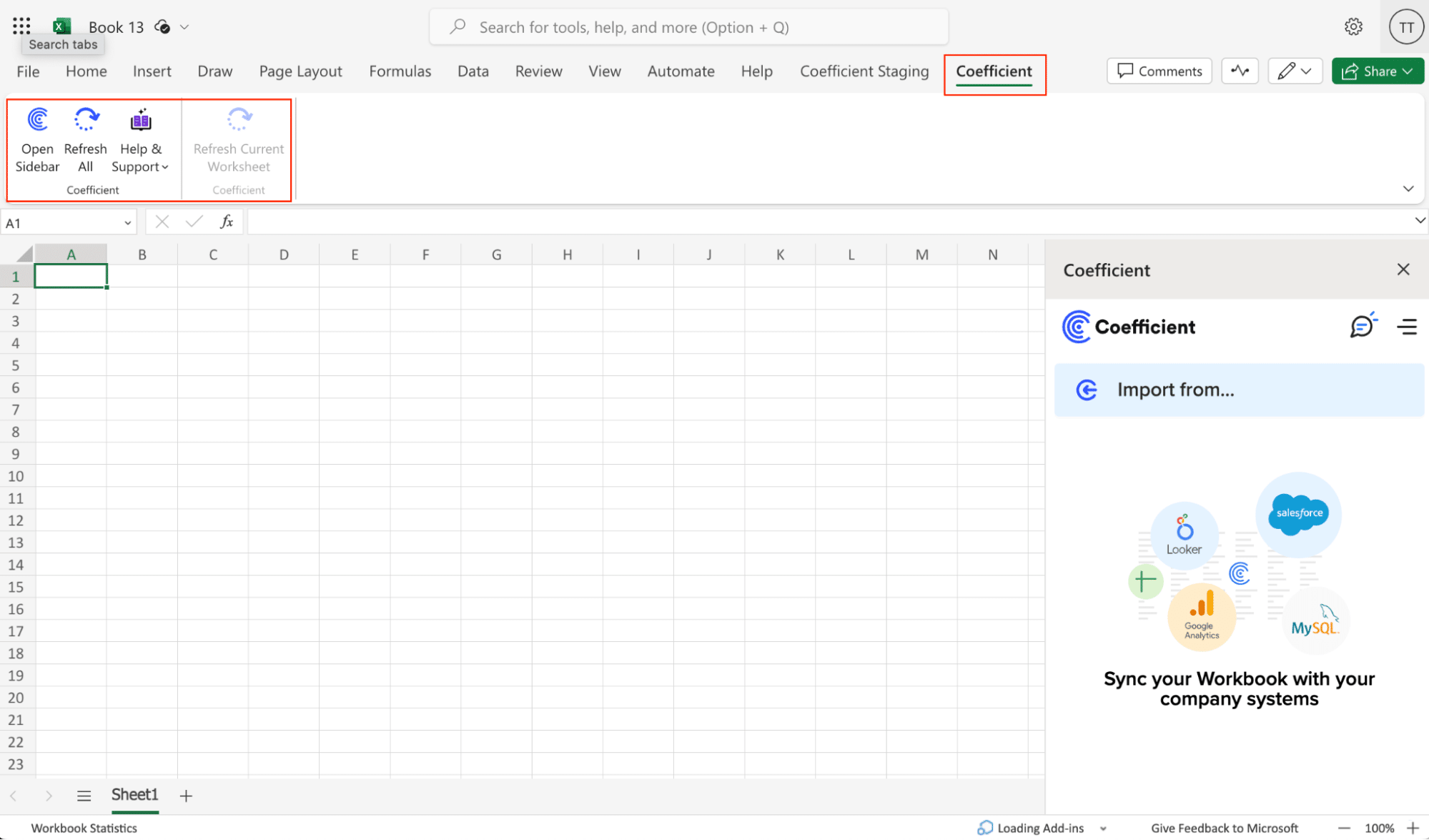

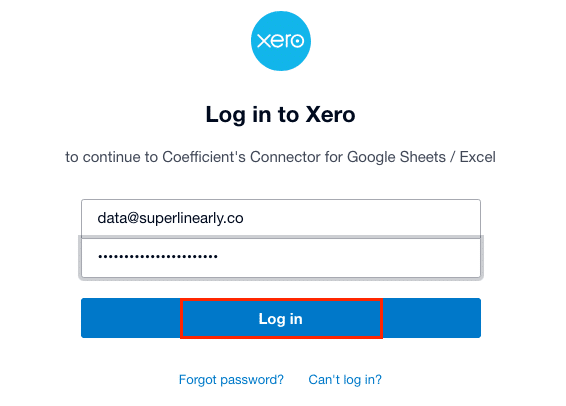

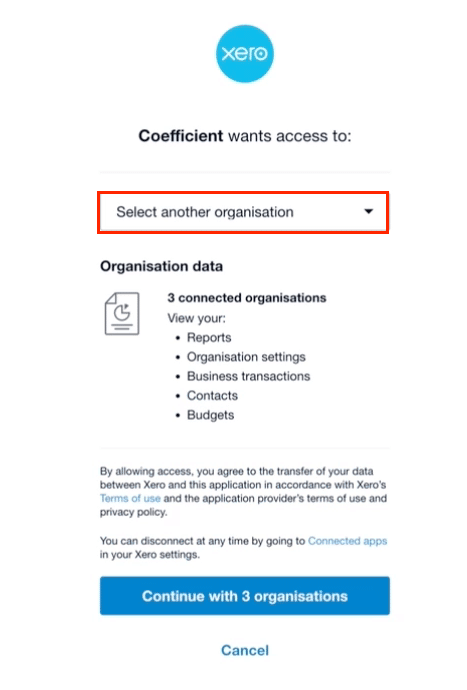

Ready to take your financial reporting and analysis to the next level? Get started with Coefficient to seamlessly integrate your accounting data with spreadsheets, enabling real-time updates and powerful insights that drive business growth.