Are you looking to harness the full power of Xero’s reporting capabilities?

Whether you’re an accountant, financial controller, or business owner, understanding how to build effective reports and dashboards in Xero is crucial for making informed decisions.

This guide will walk you through everything you need to know about Xero reporting in 2025, from basic report types to advanced dashboard creation and automation.

Common Xero Report Types

Xero offers a variety of report types to help you analyze your financial data. Let’s explore the most commonly used reports and their applications:

Accounting Reports

Xero provides several essential accounting reports that give you a clear picture of your financial health:

- Executive Summary: This report offers a high-level overview of your business’s financial performance, including key metrics like income, expenses, and cash flow.

- Cash Summary: Track your cash inflows and outflows over a specific period, helping you manage your liquidity effectively.

- Income Statement (Profit and Loss): Analyze your revenue, expenses, and profitability over a given timeframe.

- Balance Sheet: Get a snapshot of your company’s financial position, including assets, liabilities, and equity.

- Accounts Receivable Aging Summary: Monitor outstanding customer payments and identify potential collection issues.

- Accounts Payable Aging Summary: Keep track of your unpaid bills and manage your cash flow more effectively.

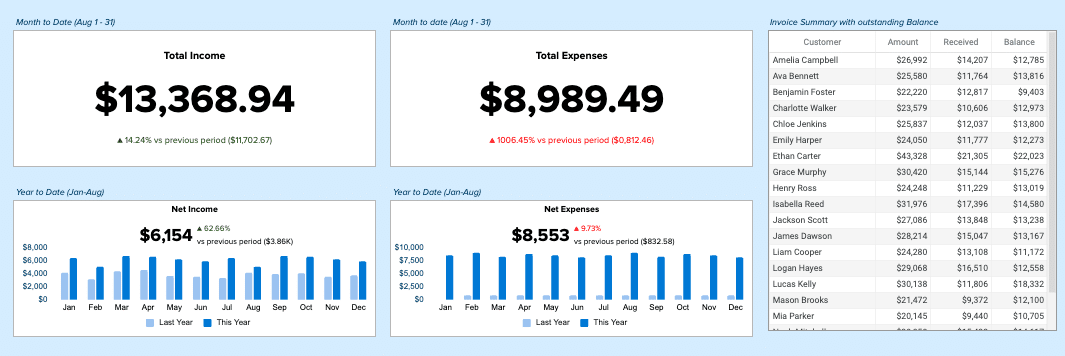

These reports, along with the Financial Reports & Sales Overview Dashboard, offer a snapshot of your company’s performance. For example, the Executive Summary provides a high-level overview of your financial position, while the Accounts Receivable Aging Summary helps you track outstanding invoices and manage cash flow.

Exporting Reports from Xero

Xero allows you to export reports in various formats for further analysis or sharing with stakeholders. Here’s how to export a report:

Step 1: Generate the desired report in Xero. Navigate to the Reports section and select the report you want to export.

Step 2: Click on the “Export” button. This is typically located at the top of the report page.

Step 3: Choose your preferred export format. Xero usually offers CSV and XLSX (Excel) formats for most reports.

Step 4: Configure any additional export options. Depending on the report, you may be able to customize the data included in the export.

Step 5: Click “Export” to download the file. The report will be saved to your device in the chosen format.

While Xero’s native export functionality is useful, tools like Coefficient can streamline this process for spreadsheet users. Coefficient allows you to pull Xero data directly into Google Sheets or Excel, enabling real-time updates and more flexible reporting options.

How to Build a Custom Report in Xero

Creating custom reports in Xero allows you to tailor the information to your specific needs. Here’s a step-by-step guide to building a custom report:

Step 1: Navigate to the Reports section in Xero. Click on “Reports” in the main menu.

Step 2: Select “New Report” or “Custom Reports.” Look for an option to create a new custom report.

Step 3: Choose a report type. Xero offers various report types as starting points for customization.

Step 4: Set your report parameters. Define the date range, accounts, and other relevant filters for your report.

Step 5: Select the columns and data you want to include. Customize the layout by adding or removing columns and choosing specific data points.

Step 6: Apply any necessary formulas or calculations. Use Xero’s built-in functions to perform calculations within your report.

Step 7: Format and style your report. Adjust fonts, colors, and other visual elements to improve readability.

Step 8: Save and name your custom report. Give your report a descriptive name for easy future access.

Step 9: Run the report and review the results. Make any final adjustments to ensure the report meets your needs.

Remember that the exact steps may vary slightly depending on your Xero plan and any updates to the platform.

Building Advanced Reports & Dashboards in Xero

While Xero’s native reporting capabilities are robust, creating truly advanced reports and dashboards often requires additional tools or expertise. Here’s how you can take your Xero reporting to the next level:

Step 1: Identify your reporting goals. Determine the key metrics and insights you need to track.

Step 2: Gather data from multiple sources. Combine Xero data with information from other systems for a more comprehensive view.

Step 3: Use Xero Analytics Plus (if available). This add-on provides more advanced reporting features, including cash flow projections and business snapshots.

Step 4: Leverage third-party reporting tools. Consider using specialized tools like Coefficient to create more flexible and dynamic reports.

Step 5: Design your dashboard layout. Organize your key metrics and visualizations in a logical, easy-to-read format.

Step 6: Create custom visualizations. Use charts, graphs, and other visual elements to make your data more digestible.

Step 7: Implement interactivity. Add filters and drill-down capabilities to allow users to explore the data.

Step 8: Set up automated data refreshes. Ensure your dashboard always displays the most up-to-date information.

Step 9: Test and refine your dashboard. Gather feedback from users and make improvements as needed.

While Xero offers some advanced reporting features, tools like Coefficient provide greater flexibility and familiarity, especially for users comfortable with spreadsheet environments. Coefficient allows you to pull Xero data directly into Google Sheets or Excel, enabling you to create highly customized reports and dashboards with real-time data updates.

Automating Xero Reporting

Automation is key to efficient reporting. Here’s how you can automate your Xero reporting process:

- Schedule regular reports: Set up Xero to automatically generate and email reports on a recurring basis.

- Use Xero’s API: For more advanced automation, leverage Xero’s API to pull data into other systems or custom applications.

- Implement third-party automation tools: Platforms like Zapier or Coefficient can help automate data transfers and report generation.

- Set up alerts: Configure notifications for key financial events or when certain thresholds are met.

- Create report templates: Save time by creating reusable report templates for common reporting needs.

By automating your reporting processes, you can save time, reduce errors, and ensure you always have access to the latest financial insights.

Limitations of Xero Reporting

While Xero offers robust reporting capabilities, it’s important to be aware of its limitations:

- Cash flow projections: Detailed cash flow projections for 60 or 90 days are only available in higher-tier pricing plans.

- Advanced reporting features: Some advanced reporting tools, like Xero Analytics Plus, require an additional subscription.

- Limited customization: While Xero offers some customization options, creating highly specialized reports can be challenging within the native platform.

- Lack of smart notifications: Xero doesn’t offer advanced alert systems, such as Slack notifications for specific financial events.

- Consolidated reporting challenges: Creating consolidated reports for multiple entities can be time-consuming and complex in Xero.

To overcome these limitations, many businesses turn to specialized reporting platforms like Coefficient. These tools can provide greater flexibility, more advanced features, and easier integration with other business systems.

Free Xero Reporting Dashboards for Accountants and Finance Controllers

To help you get started with advanced Xero reporting, Coefficient offers several pre-built dashboard templates:

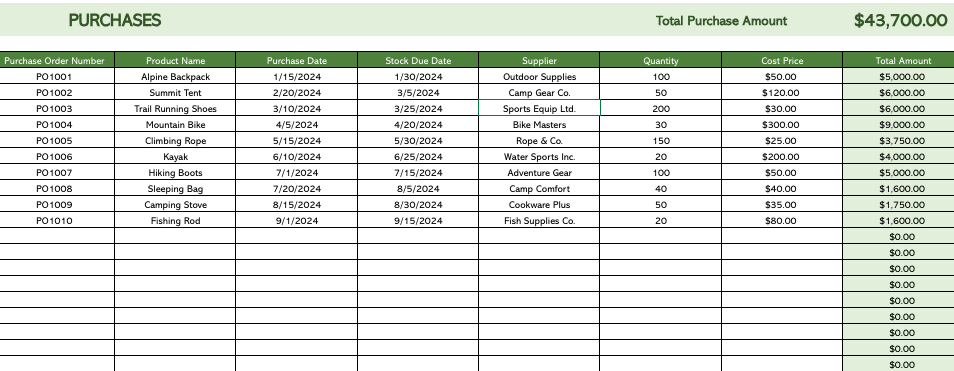

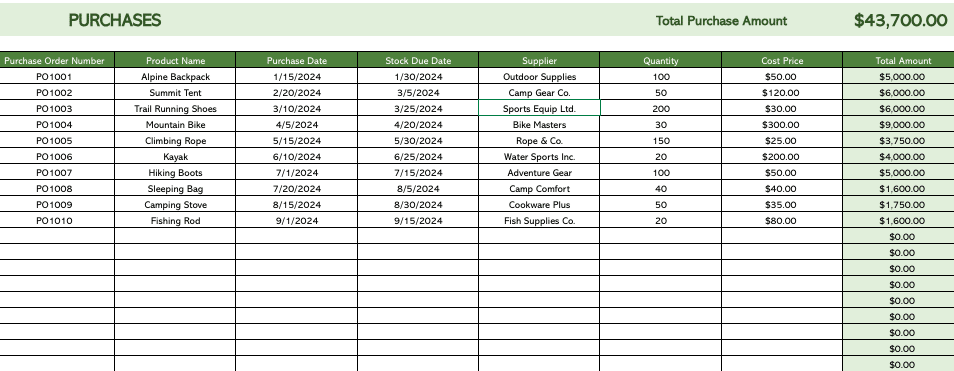

#1 Xero Inventory Excel Template

The Xero Inventory Excel Template streamlines your inventory management process. By integrating directly with your Xero account, this template provides real-time visibility into your stock levels, product performance, and inventory trends, all within Excel.

Use Case: Inventory Management and Optimization

This template helps businesses:

- Monitor current inventory across all products

- Identify top-selling items and slow-moving stock

- Set up alerts for when stock reaches reorder levels

- Manage and track purchase orders efficiently

Metrics Tracked

- SKU, Size, Colour

- Original Stock Level

- Reorder Point

- Cost Price and Markup

- Retail Price

- Total Orders

- Orders Waiting to be Fulfilled

- Stock Waiting to be Received

- Stock on Hand

Get the Xero Inventory Excel Template

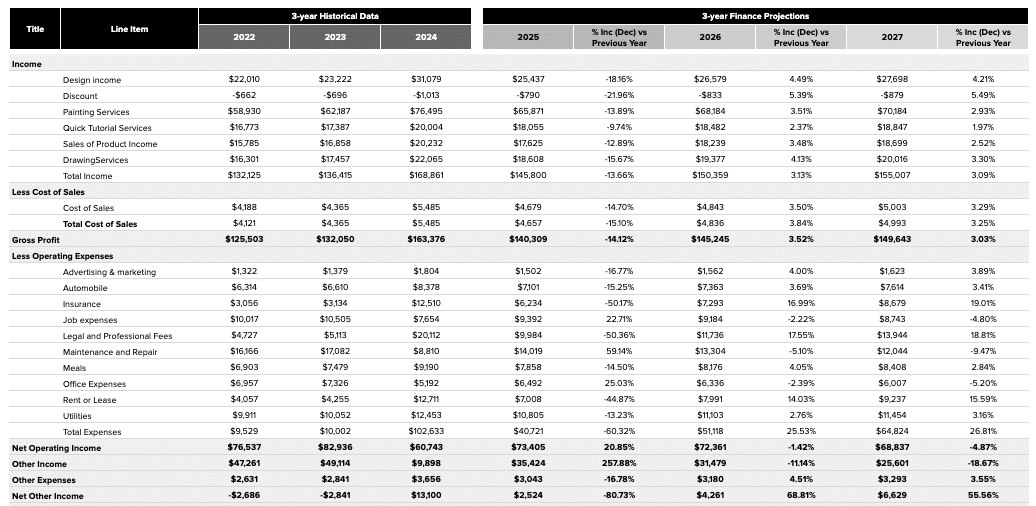

#2 Xero3-Year Finance Projections Template

The Xero Finance Projections Template is crucial for businesses aiming to forecast their financial future. This template connects directly to your Xero account, pulling in real-time financial data to create accurate and dynamic financial projections.

Use Case: Financial Forecasting and Planning

This template enables businesses to:

- Generate detailed financial projections based on historical data

- Develop multiple financial scenarios to prepare for different outcomes

- Use projections to inform budget decisions and resource allocation

- Create professional financial forecasts for stakeholders and potential investors

Metrics Tracked

- Net Income

- Changes in Working Capital

- Depreciation and Amortization

- Accounts Receivable

- Accounts Payable

- Deferred Taxes

- Cash From Sale Of Capital Assets

- Cash Paid for Purchase Of Capital Assets

- Increases in All Other Long-Term Assets

Access the Xero Finance Projections Template

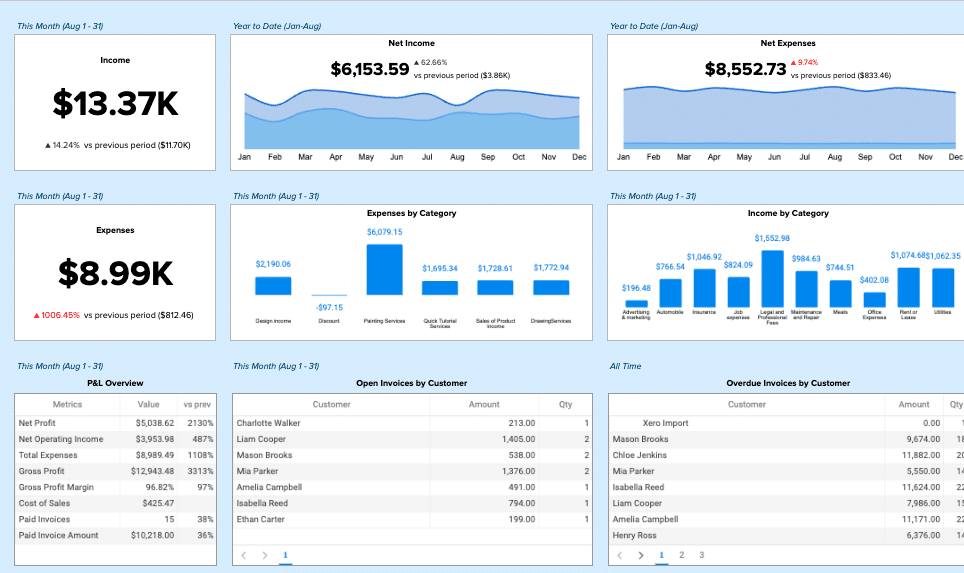

#3 Xero Consolidated Reporting Dashboard

The Xero Consolidated Reporting Dashboard is essential for businesses managing multiple entities or subsidiaries. This dashboard automates the process of consolidating financial data from various Xero organizations, providing a comprehensive view of your overall business performance.

Use Case: Multi-entity Financial Consolidation

This template helps businesses:

- Automate the process of combining financial data from multiple Xero entities

- Gain a holistic view of your organization’s financial performance across all entities

- Reduce errors associated with manual consolidation processes

- Easily prepare consolidated financial statements for regulatory requirements

Metrics Tracked

- Gross profit (cash)

- Open invoices by customer

- Open invoices amount by customer

- Overdue invoices by customer

- Overdue invoices amount by customer

- Total expenses (cash) by category

- Paid invoices amount

- Paid invoices

- Income (cash) by category

Get Started with the Xero Consolidated Reporting Template

#4 Xero Finance Dashboard

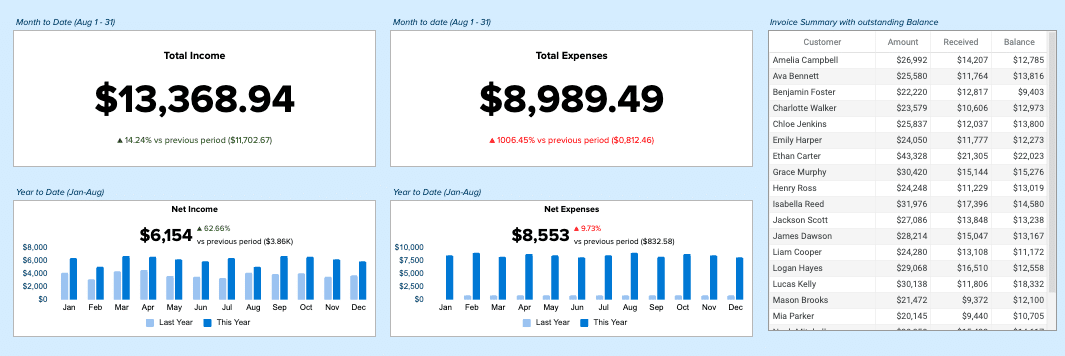

The Xero Finance Dashboard offers a comprehensive visual representation of your business’s financial health. By pulling real-time data directly from Xero, this dashboard provides an at-a-glance overview of key financial metrics, enabling quick and informed decision-making.

Use Case: Financial Performance Monitoring

This dashboard allows businesses to:

- Track critical financial KPIs in real-time

- Identify financial trends and patterns through intuitive charts and graphs

- Easily share financial insights with stakeholders and team members

- Make data-driven decisions based on up-to-date financial information

Metrics Tracked

- Income Overview (Total Income, Income by period)

- Expense Overview (Total Expenses, Expenses by period)

- Bank Summary (Account balances and received amounts)

- Profitability (Income, Gross Profit, Net Profit, Other Income, Profit/Loss)

- Cash Summary (Cash Received, Cash Spent, Cash Surplus/Deficit, Closing Bank Balance)

- Performance (Gross Profit Margin, Net Profit Margin, Return on Investment)

- Balance Sheet (Debtors, Creditors, Net Assets)

Explore the Xero Finance Dashboard

Optimize Your Xero Reporting with Live Data

Effective reporting and dashboarding are crucial for making informed business decisions. By leveraging Xero’s built-in features and enhancing them with Coefficient’s advanced capabilities, you can gain deep insights into your financial performance and drive growth.

Ready to take your Xero reporting to the next level? Get started with Coefficient today and discover how easy it can be to create powerful, data-driven reports and dashboards that integrate seamlessly with your Xero data.

Related Reading

- How to Connect Xero to Excel

- How to Connect Xero to Google Sheets

- How to Export Data from Xero? A Detailed Step-by-Step Walkthrough

- How to Export Xero Data from Multiple Accounts: A Comprehensive Guide

- How to Export Xero Repeating Invoices to Excel: Step-by-Step Guide

- Best 5 Xero Reporting Tools in 2024: Supercharge Your Financial Insights