You’re staring at spreadsheets you manually rebuilt for the fourth time this month. Every financial report requires exporting data from QuickBooks, then from Salesforce, then from your data warehouse. You’re reconciling it all in Excel while hoping you didn’t miss something critical.

Your CFO just asked for a revenue forecast that combines accounting actuals with pipeline data and marketing spend—due tomorrow morning. Your current process means another late night of CSV exports and VLOOKUP gymnastics.

Both Coefficient and DataRails promise to end this data wrangling nightmare. They both connect to financial systems, automate reporting, and work within spreadsheets you already use.

But here’s the fundamental difference that changes everything: DataRails is an FP&A platform built exclusively for finance teams working in Excel. Coefficient is a comprehensive data connector that matches DataRails’ financial capabilities while extending to 70+ systems across your entire business.

This guide will help you understand which platform fits your actual workflow: a finance-only FP&A specialist or a comprehensive data automation platform that starts with finance excellence but doesn’t stop there.

- Coefficient vs DataRails: Core differences

- Coefficient vs DataRails: Integration ecosystem

- Coefficient vs DataRails: Features and functionality

- Coefficient vs DataRails: Pricing comparison

- Coefficient vs DataRails: User experience

- Coefficient vs DataRails: Customer support

- Coefficient vs DataRails: Which should you choose?

- Coefficient vs DataRails: Real-world decision scenarios

- Transform your finance workflows today

Coefficient vs DataRails: Core differences

The choice between these platforms isn’t about features. It’s about fundamentally different philosophies on how modern finance teams should operate.

What is DataRails?

DataRails built their entire identity around one mission: “Transform the CFO’s Office” with an Excel-native FP&A platform designed exclusively for finance professionals. They’ve deliberately chosen to focus on financial planning and analysis, ignoring other business functions entirely.

Their FinanceOS platform works as an Excel add-in, preserving 100% of Excel’s native functionality while adding powerful FP&A automation. For finance professionals who’ve spent decades mastering Excel shortcuts, pivot tables, and complex formulas, this continuity matters. You’re not learning a new platform—you’re enhancing the one you already know.

DataRails excels at three specific things:

- Automated financial consolidation with sophisticated version control that prevents the dreaded “Final_Final_v3” nightmare

- Driver-based scenario modeling built specifically for FP&A workflows and board presentations

- Genius AI that understands financial planning contexts and can generate variance analyses automatically

Steven Carkey, VP Finance Operations at Butternut Box, captures the tangible impact: “Without Datarails, I would’ve needed to double my current team of three just to produce what we’re delivering today.” This efficiency gain comes from DataRails’ laser focus on automating repetitive financial tasks.

What is Coefficient?

Coefficient starts with a radically different premise: modern finance teams don’t work in isolation anymore. Today’s CFOs need P&L data alongside sales forecasts. They calculate customer acquisition costs using both accounting systems and marketing platforms. They build board presentations that explain not just what happened financially, but why it happened operationally.

The platform works as a sidebar in both Google Sheets and Excel, connecting 70+ business systems with live, auto-refreshing data. This includes the same robust financial integrations that DataRails offers—QuickBooks, NetSuite, Xero—but extends far beyond into sales, marketing, operations, and customer success systems.

Coefficient transforms finance workflows in three powerful ways:

- Deep financial connectivity matching DataRails’ capabilities for QuickBooks, NetSuite, and Xero

- Cross-functional intelligence combining financial data with Salesforce pipelines, Google Ads spend, and operational metrics

- Two-way sync capabilities that let you update source systems directly from your analysis

Christian Budnik at Solv quantifies the transformation: “Before Coefficient, I was doing multiple data pulls a day from various systems. By automating connections between Salesforce, Looker, and QuickBooks, we saved 364 hours per year—that’s over 9 weeks of manual work eliminated.”

Coefficient vs DataRails: Integration ecosystem

This is where the philosophical divide becomes a practical constraint. The systems you can connect determine the analyses you can perform.

Integration capabilities at a glance

| Integration Category | DataRails | Coefficient |

| Financial Systems | ✅ Deep integration (QuickBooks, NetSuite, Xero, Sage, 200+ variants) | ✅ Deep integration (QuickBooks, NetSuite, Xero, Sage Intacct, Stripe) |

| CRM Platforms | ⚠️ Limited (Salesforce/HubSpot – reporting only) | ✅ Full Sync from all major CRMs. (Salesforce, HubSpot, Pipedrive, Zoho CRM, Bigin) |

| Marketing Tools | ❌ None | ✅ Comprehensive (Google Ads, Facebook Ads, LinkedIn, Mailchimp) |

| Data Warehouses | ⚠️ Basic (Snowflake, SQL Server) | ✅ Complete (Snowflake, BigQuery, Databricks, Redshift) |

| Operations | ❌ None | ✅ Extensive (Jira, Asana, ClickUp, Zendesk) |

| Payment Systems | ❌ None | ✅ Stripe, Square, Chargebee |

| Total Unique Systems | ~30 actual platforms (200+ variants) | 70+ distinct platforms |

DataRails integrations: Deep but narrow

DataRails advertises 200+ integrations, but this number is misleading. They count every variant and version as separate—QuickBooks Online, QuickBooks Desktop, QuickBooks Enterprise all count individually. In reality, you’re getting about 30 unique platforms, almost entirely financial.

Their financial integrations are admittedly comprehensive. They handle multi-entity consolidation beautifully, manage complex eliminations, and preserve all your custom fields and reports. For pure accounting data, DataRails matches anyone in the market.

But here’s where it falls apart. When your board asks why revenue is down 15%, DataRails shows you the numbers perfectly. It can’t tell you that Google Ads CAC increased 40%, that Salesforce shows deals slipping to next quarter, or that Zendesk tickets reveal a product quality issue. You’ll export those manually—defeating the entire purpose of automation.

The CRM connections they do offer (Salesforce and HubSpot) are read-only and limited. You can pull basic data for reporting but can’t push updates back. No enrichment. No two-way workflows. Just one-directional data extraction.

Coefficient integrations: Financial depth plus everything else

Coefficient takes a fundamentally different approach. Instead of 200 variants of 30 systems, you get 70+ distinct platforms covering every business function. The financial depth matches DataRails, but the breadth transforms what’s possible.

Consider a real scenario: building your quarterly board report. With Coefficient, your consolidated P&L from multiple QuickBooks entities sits next to pipeline velocity from Salesforce, marketing efficiency from Google Ads, and customer satisfaction from Zendesk. One platform. One refresh. Complete context.

The two-way sync capabilities change everything. Update forecast assumptions in your spreadsheet and push them back to Salesforce. Modify budget allocations and sync to your database. Enrich CRM records with calculated metrics. DataRails can’t do any of this—it’s strictly read-only.

Payment system integrations like Stripe and Chargebee matter enormously for SaaS and subscription businesses. You need MRR, churn rates, and cohort analyses alongside traditional financials. Coefficient connects natively. DataRails forces manual exports.

Coefficient vs DataRails: Features and functionality

Both platforms offer robust features, but their scope and implementation philosophy differ dramatically.

Feature comparison breakdown

| Feature Category | DataRails | Coefficient |

| Financial Consolidation | ✅ Advanced multi-entity with eliminations | ✅ Multi-entity support with spreadsheet flexibility |

| Scenario Modeling | ✅ Built-in FP&A scenario tools | ✅ Spreadsheet-based with live data |

| Data Refresh | ⚠️ Scheduled syncs only | ✅ Real-time + hourly auto-refresh |

| Two-way Sync | ❌ Read-only | ✅ 6+ major systems |

| AI Capabilities | ✅ Genius AI (FP&A specialized) | ✅ AI Sheets Assistant (comprehensive) |

| Platform Support | ⚠️ Excel only | ✅ Excel AND Google Sheets |

| Automation | ⚠️ Basic report scheduling | ✅ Alerts, snapshots, auto-refresh, Slack/email |

| Data Governance | ✅ Version control, audit trails | ✅ Activity logs, permission controls |

DataRails features: Built for FP&A excellence

DataRails shines when handling complex financial planning scenarios. Their platform includes purpose-built tools that finance teams genuinely appreciate.

Multi-entity consolidation works elegantly. Connect eight QuickBooks companies, define your elimination rules, map your chart of accounts, and DataRails handles the rest. The consolidation happens automatically with proper audit trails. Their version control system prevents the spreadsheet chaos that plagues most finance teams—no more “Budget_Final_Final_v3_ACTUAL_FINAL.xlsx” disasters.

Scenario modeling leverages driver-based planning that FP&A professionals expect. Build best case, worst case, and most likely scenarios with assumptions that cascade through your model. Their Genius AI understands financial contexts deeply—ask it to “create variance analysis for Q3” and it knows exactly what you mean.

The Excel-native experience preserves everything finance teams have built over years. Your existing models, macros, and formulas continue working. You’re not migrating to a new platform; you’re enhancing your current one.

Coefficient features: Financial power plus business intelligence

Coefficient matches most of DataRails’ financial capabilities while adding comprehensive business intelligence that DataRails can’t touch.

Financial consolidation works differently but effectively. Connect multiple QuickBooks or NetSuite instances, use familiar spreadsheet formulas to define consolidation rules, and build your reports. While it may lack some of DataRails’ specialized FP&A workflows, it handles 90% of consolidation needs perfectly well.

The AI Sheets Assistant might not specialize in FP&A, but its versatility is powerful. Ask it to “build a dashboard showing QuickBooks revenue, Salesforce pipeline, and Google Ads spend” and it creates the entire structure. It writes formulas, generates pivot tables, and builds visualizations across all your connected data sources.

Real-time data refresh fundamentally changes how you work. Pro plan users get hourly automatic updates across all connections. Your morning dashboard shows current pipeline, yesterday’s sales, and real-time marketing spend. DataRails’ scheduled syncs can’t match this immediacy.

Two-way sync opens entirely new workflows. Calculate sales quotas in your spreadsheet using historical performance and market data, then push them directly to Salesforce. Update budget allocations and sync to your SQL database. Enrich HubSpot records with calculated lead scores. These capabilities simply don’t exist in DataRails.

Coefficient vs DataRails: Pricing comparison

The value proposition becomes crystal clear when you examine actual costs against delivered capabilities.

Detailed pricing breakdown

| Pricing Element | DataRails | Coefficient |

| Entry Level | ~$2,000/month minimum | $49/month (Starter) |

| Typical Cost | $24,000-36,000/year | $99/user/month (Pro) |

| Pricing Model | Opaque, requires sales demo | Transparent, self-service |

| Free Trial | ❌ Demo only | ✅ Free tier available |

| Contract Terms | Annual commitment required | Month-to-month available |

| Included Integrations | Financial systems only | All 70+ systems included |

| User Limits | Varies by contract | Unlimited on Pro plan |

DataRails pricing: Premium for specialization

DataRails doesn’t publish pricing, requiring demos and sales calls. This opacity itself tells a story. Based on user reports and third-party sources:

The entry point typically starts around $2,000 per month or $24,000 annually. Larger implementations with more entities and users can reach $50,000+ per year. You’re paying enterprise prices for specialized FP&A features that many teams don’t fully utilize.

The value proposition assumes you need every specialized feature—complex multi-currency consolidations, sophisticated elimination rules, specialized regulatory reporting. For companies that do need these features, the price might be justified. But most don’t.

You’re also locked into annual contracts with significant commitment requirements. Want to test it for a month? Not possible. Need to scale down during slow periods? You’re locked in.

Coefficient pricing: Transparent value

Coefficient publishes clear, per-user pricing that scales with your needs. No sales calls, no negotiations, just straightforward value:

Free tier connects three data sources with manual refresh. Perfect for testing financial consolidation or building proof-of-concepts. DataRails won’t even show you the product without a sales demo.

Starter plan ($49/month) includes five data sources with daily auto-refresh. For small teams or simple use cases, this handles basic financial reporting plus sales and marketing data for less than DataRails’ implementation fee.

Pro plan ($99/user/month) delivers everything most teams need. Hourly refresh keeps data current. Unlimited rows handle enterprise scale. The AI Assistant builds complex analyses. Two-way sync enables workflow automation. For a five-person finance team, you’re paying $495/month for capabilities that cost $2,000+ with DataRails.

The math is compelling. Five Coefficient Pro users cost $5,940 annually. That gets you QuickBooks, NetSuite, Salesforce, Google Ads, Stripe, and 65+ other systems with hourly refresh and two-way sync. DataRails charges $24,000+ for financial systems alone with no real-time updates.

Coefficient vs DataRails: User experience

The most powerful features mean nothing if your team won’t adopt the platform. Both tools prioritize user experience but with different philosophies.

DataRails experience: Excel purism

DataRails commits completely to the Excel experience. This isn’t a plugin that occasionally uses Excel—it IS Excel with invisible superpowers.

Users consistently praise the seamless integration. Charlotte Kelly at Butternut Box notes: “We’ve cut our weekly reporting time in half. The learning curve was minimal because we stayed in Excel.” Your keyboard shortcuts work. Your macros run. Your formulas calculate. The only difference is data magically updates itself.

The two-week implementation includes hands-on configuration of your specific workflows. DataRails’ team helps map your consolidation rules, configure eliminations, and set up your reports. It’s high-touch onboarding that ensures everything works perfectly for your specific needs.

But this Excel purity comes with constraints. No Google Sheets option means excluding team members who prefer cloud-native tools. The specialized interface, while powerful, requires training to master. And the finance-only focus means other departments can’t leverage the platform at all.

Coefficient experience: Intuitive flexibility

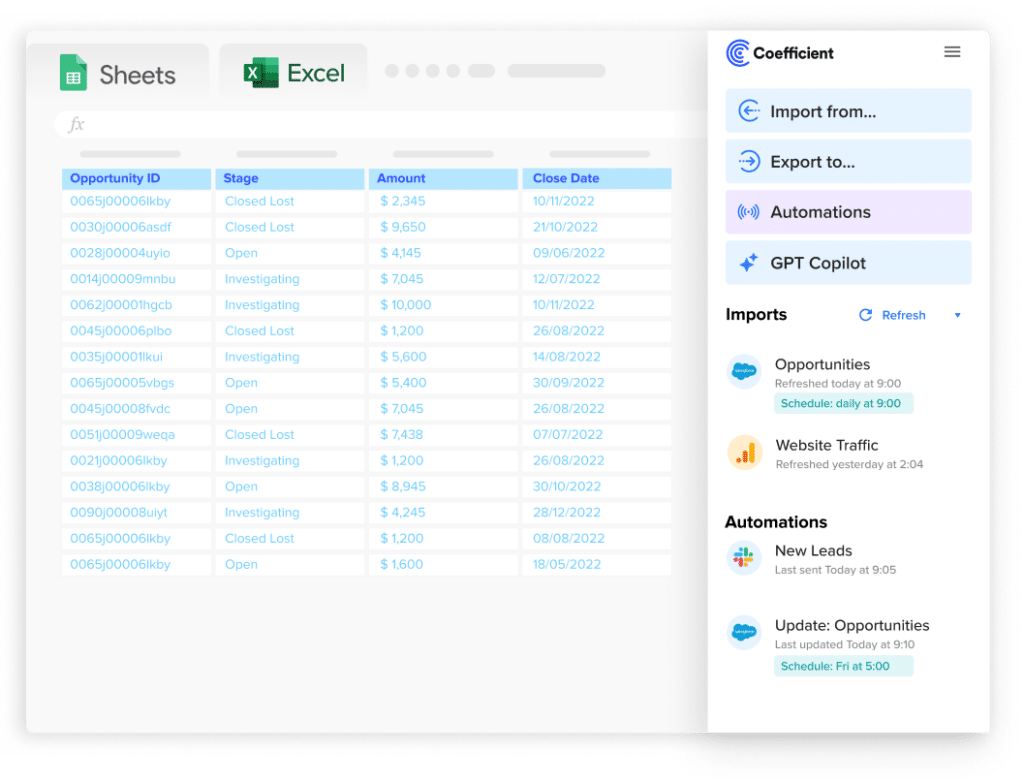

Coefficient prioritizes immediate usability across both Excel and Google Sheets. The sidebar interface is deliberately simple—anyone can import data within minutes.

Live Coefficient QuickBooks Dashboard

Stop exporting data manually. Sync data from your business systems into Google Sheets or Excel with Coefficient and set it on a refresh schedule.

Get Started

The process is refreshingly straightforward. Select your data source from the sidebar. Choose what to import using visual selections or simple queries. Apply filters if needed. Data populates automatically with the structure preserved. No implementation project. No specialized training. Just immediate value.

Supporting both Excel and Google Sheets matters more than it might seem. Finance teams can work in Excel while sales teams collaborate in Google Sheets, all pulling from the same live data sources. This flexibility enables company-wide adoption rather than department isolation.

The self-service model means you’re analyzing data the same day you install Coefficient. While DataRails spends two weeks configuring your consolidation rules, Coefficient users are already building dashboards and automating reports.

Coefficient vs DataRails: Customer support

Enterprise customers need enterprise-grade support. Both platforms deliver, but with different approaches.

Support comparison

| Support Feature | DataRails | Coefficient |

| G2 Support Rating | 4.7-4.9 stars | 4.8 stars, 9.9/10 quality score |

| Onboarding | Dedicated CSM, 2-week implementation | Self-service with documentation |

| Response Time | Business hours | 24-hour response commitment |

| Security Compliance | SOC 2 Type II, GDPR | SOC 2 Type II, GDPR |

| Training Requirements | Mandatory platform training | Optional, intuitive design |

| Community Resources | Limited user community | Active Slack community |

DataRails support: High-touch partnership

DataRails assigns dedicated customer success managers who know your implementation intimately. This isn’t just support—it’s ongoing consulting.

The two-week implementation includes hands-on configuration, training sessions, and workflow optimization. Your CSM understands your consolidation rules, reporting requirements, and specific use cases. When issues arise, you’re talking to someone who knows your setup.

This high-touch model is necessary given the platform’s complexity. Without proper training, users struggle to leverage DataRails’ powerful features. The support team essentially becomes an extension of your finance team.

Coefficient support: Scalable enablement

Coefficient takes a self-service approach backed by responsive support when needed. The 9.9/10 support quality score on G2 reflects users’ satisfaction with this model.

Most users never need support because the platform is intuitive. But when you do need help, the team responds quickly with genuine expertise. The active Slack community provides peer support and best practices. Comprehensive documentation covers every integration and feature.

The support philosophy mirrors the product philosophy—empower users to succeed independently while providing expert help when needed. This scales better than DataRails’ high-touch model and keeps costs down.

Coefficient vs DataRails: Which should you choose?

After examining every angle, the choice comes down to your organization’s specific needs and future direction.

Choose DataRails if:

You must have ALL three of these conditions:

- You work exclusively in Excel with no Google Sheets users anywhere in your organization

- You handle complex multi-entity consolidations with sophisticated elimination requirements that go beyond standard consolidation

- You’re certain you’ll never need non-financial data for context or analysis

DataRails makes sense for large enterprises with complex, Excel-based FP&A workflows that won’t change. If you’re a 500+ person company with 15+ entities across multiple countries and currencies, their specialized features might justify the premium pricing. But be certain you’ll never need marketing data, sales pipelines, or operational metrics.

Choose Coefficient if:

You have ANY of these needs:

- Financial data plus context from sales, marketing, or operations

- Support for both Excel and Google Sheets users

- Two-way sync capabilities for workflow automation

- Real-time data refresh for immediate insights

- Transparent pricing without long sales cycles

Most modern finance teams need broader insights than pure accounting data. Revenue forecasts require pipeline visibility. Customer acquisition costs need marketing spend. Board presentations demand operational context. Coefficient delivers all of this while matching 90% of DataRails’ financial capabilities.

Coefficient vs DataRails: Real-world decision scenarios

Let’s examine specific scenarios to clarify the right choice.

Scenario: Multi-entity financial consolidation

Your situation: Eight QuickBooks entities across three countries needing monthly consolidation with inter-company eliminations.

DataRails approach: Automated consolidation with built-in elimination rules and currency conversion. Beautiful consolidated statements with variance analysis.

Coefficient approach: Connect all eight QuickBooks instances, use spreadsheet formulas for eliminations, build consolidated reports with pivot tables. Slightly more manual but completely feasible.

Winner: DataRails if this is your only need. Coefficient if you also want sales forecasts or marketing ROI alongside financials.

Scenario: Revenue forecasting and planning

Your situation: Build revenue forecasts combining historical financials, current pipeline, and marketing performance.

DataRails approach: Excellent for the historical financial component. Manual export and reconciliation for pipeline and marketing data. Separate analysis in different tools.

Coefficient approach: Pull QuickBooks historicals, Salesforce pipeline, and Google Ads spend into one model. Refresh everything hourly. Build unified forecasts with complete context.

Winner: Coefficient by a landslide. DataRails literally cannot access two-thirds of the required data.

Scenario: Board reporting package

Your situation: Quarterly board deck with P&L, balance sheet, KPIs, pipeline analysis, and customer metrics.

DataRails approach: Perfect for financial statements. Manual process for everything else. Multiple tools and exports required.

Coefficient approach: One platform pulls all data. Financial statements from QuickBooks, pipeline from Salesforce, customer metrics from support system, marketing ROI from ad platforms. Unified dashboard with automatic refresh.

Winner: Coefficient delivers the complete package. DataRails handles only the financial portion.

Transform your finance workflows today

DataRails built an excellent platform for Excel-only teams working exclusively with financial data who need sophisticated FP&A features. But most finance teams need more than isolation—they need integration.

Coefficient delivers robust financial reporting capabilities while connecting your entire business. You get QuickBooks consolidation AND Salesforce pipelines. NetSuite reporting AND Google Ads ROI. Xero automation AND operational KPIs. All for a fraction of DataRails’ cost.

Modern finance teams don’t just report what happened—they explain why and predict what’s next. That requires data from across your business, not just your accounting system.

Stop choosing between financial depth and business breadth. Stop paying enterprise prices for department-level solutions. Stop maintaining data silos in the name of automation.Get started with Coefficient and see why 500,000+ users chose comprehensive connectivity over narrow specialization. Free to try. No sales calls required. Complete business intelligence starting at $49/month.