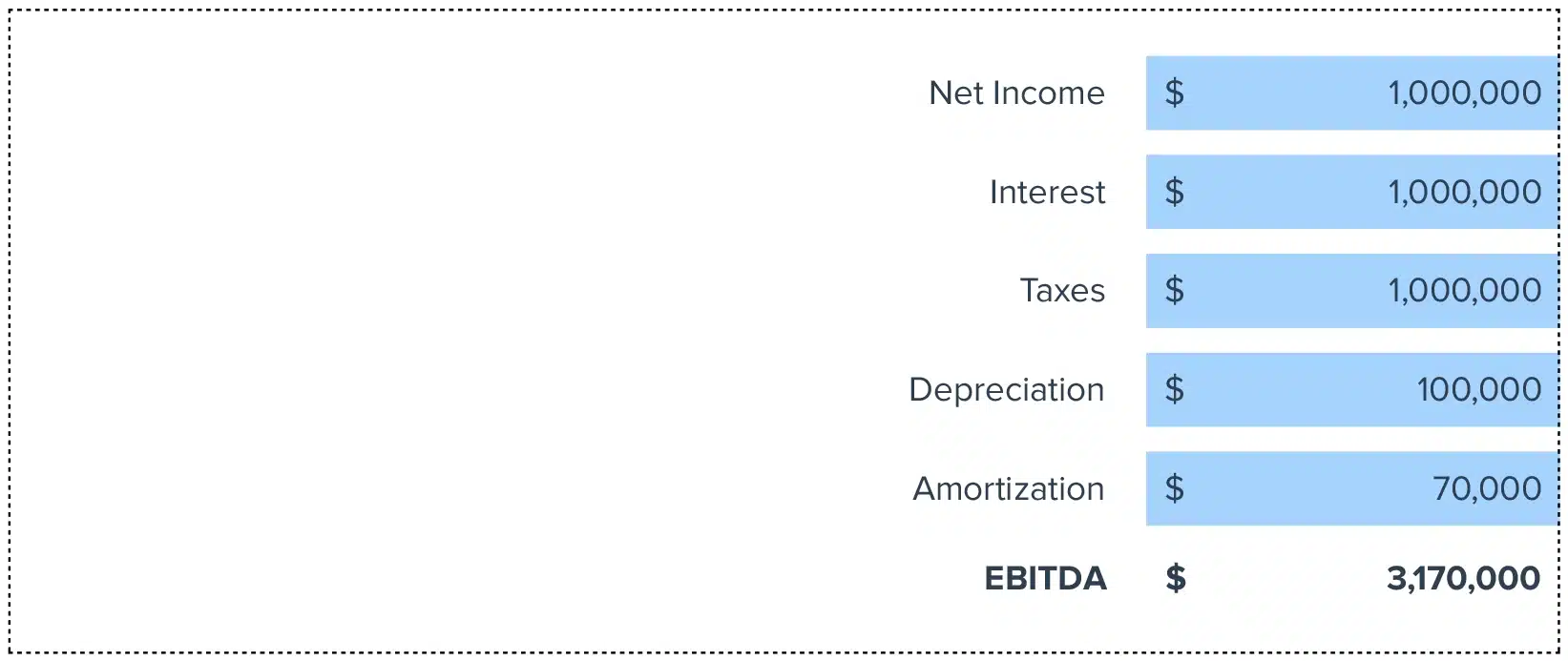

EBITDA = Net Income + Interest + Taxes + Depreciation + Amortization

Unlock the power of accurate EBITDA analysis with our streamlined calculator. Forget the hassle of manual calculations and embrace a tool designed to enhance your financial insights.

Step-by-Step Calculation Guide

- Start with Net Income: Your bottom line profit, the starting point of EBITDA calculation.

- Add Interest Expenses: Include all costs related to debt.

- Include Taxes: Add back the tax expenses to neutralize tax jurisdiction effects.

- Adjust for Depreciation and Amortization: Add these non-cash expenses back to reflect asset usage and intellectual property value over time.

Understanding EBITDA

EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. It’s a critical financial metric that strips away non-operating expenses to provide a clearer view of a company’s operational profitability.

The Importance of EBITDA

EBITDA is pivotal for investors and analysts as it offers a simplified view of a company’s operational efficiency and profitability, serving as a proxy for cash flow.

It’s especially valuable for assessing companies with significant non-cash expenses or for making comparative valuations within the same industry.

Real-World Application: A Business Scenario

Consider a manufacturing firm evaluating its operational efficiency against an industry benchmark.

By calculating EBITDA, the firm can isolate and analyze operational profitability, setting the stage for strategic improvements and investment decisions.

Five Strategies to Enhance EBITDA

- Cost Optimization: Streamline operations to reduce direct costs.

- Revenue Growth: Innovate and expand product lines to boost sales.

- Operational Efficiency: Enhance productivity through technology and process improvements.

- Market Expansion: Enter new markets to increase revenue streams.

- Strategic Investments: Focus on high-margin products or services.

Google Sheets Guide: EBITDA Calculation Simplified

- Input your net income in cell A1.

- Enter interest, taxes, depreciation, and amortization in cells A2 to A5, respectively.

- In cell A6, use the formula =SUM(A1:A5) to calculate EBITDA.

Understanding EBITDA’s Limitations

While EBITDA is a valuable tool, it’s not without its limitations. It does not account for capital expenditures, potentially overstating cash flow.

Moreover, being a non-GAAP measure, EBITDA lacks standardization, leading to varying interpretations and calculations.

When to Use EBITDA

EBITDA is most beneficial when comparing the operational efficiency of companies within the same industry or when assessing a company’s ability to generate operational cash flow.

It’s particularly useful for businesses with significant depreciation and amortization expenses.