Shopify has become a leading ecommerce platform that helps businesses sell both online and in person. As a versatile platform for managing your online store and physical sales channels, Shopify provides crucial financial data that accounting professionals need to track sales, expenses, inventory management, and more.

This comprehensive guide will walk you through essential Shopify accounting practices for managing your business finances, whether you’re handling the books yourself or working with a professional.

Key Ecommerce Accounting Terms to Know

Before diving into the specifics of Shopify accounting, let’s understand some crucial terms for ecommerce bookkeeping:

- Purchase Order: An approved document from a customer indicating their agreement to purchase specific goods or services. This typically precedes the actual purchase and shows approval through appropriate channels.

- Sales Order: A seller-prepared document, usually created in response to a purchase order, providing detailed information about the goods or services being purchased.

- Accounts Payable: Outstanding invoices owed to your vendors.

- Accounts Receivable: Outstanding invoices your customers owe you.

- Cost of Goods Sold (COGS): The total direct costs of producing and distributing your product. This excludes overhead or administrative expenses like office salaries or software.

- Sales Tax: Tax paid to state or local jurisdictions where your purchaser resides, varying significantly between locations.

Shopify Accounting Guide for Small Businesses

Step 1: Choosing Accounting Software

The foundation of efficient business accounting for your Shopify store starts with choosing appropriate accounting solutions. Fortunately, Shopify offers seamless integration with major cloud-based accounting platforms including Quickbooks Online, Xero, and other best accounting software options.

When evaluating accounting tools, consider your specific business needs. For example, a company managing thousands of SKUs may require different functionality than one with limited inventory.

Step 2: Connect to Shopify

After selecting your accounting software, the next step is establishing integration with your Shopify business. Let’s examine how to connect with QuickBooks Online, though similar processes exist for other platforms like Xero or FreshBooks.

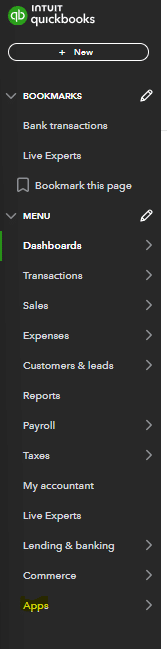

To connect QuickBooks Online with your Shopify store navigate to the apps section of the main menu.

Once you’ve selected the Apps section of the main menu, you can search for several applications integrated with Quickbooks Online, including Shopify.

Now that you’ve selected the Shopify connector, you can link the Shopify app to your accounting software, Quickbooks Online. Note that there are several accounting software options that have as seamless of an integration to Shopify as Quickbooks Online.

Step 3: Choose your Shopify Accounting Method

Within business accounting, there are two primary accounting methodologies that small business owners typically choose from: cash basis accounting or accrual accounting. Understanding these methods is crucial for proper ecommerce bookkeeping and managing your Shopify business.

Cash basis accounting is simpler and is typically how you are taxed (depending on your business structure). Under this method, you account for financial transactions and recognize revenue and expenses when the cash is either received or paid. This can lead to timing differences between when you actually complete a sale in your online store or receive something from a vendor and when you recognize that corresponding transaction.

Accrual accounting is more commonly used as an organization grows, particularly for ecommerce business operations. This method is required if your organization needs an audit performed under United States Generally Accepted Accounting Principles (GAAP). Under accrual accounting, you account for transactions when they are earned or incurred, rather than when you receive or pay out the cash. For example, you would recognize revenue from a customer when you ship their product through your Shopify store, even if they have 60-day payment terms and you won’t receive the cash until that period ends.

Your accounting method can significantly affect your financial reporting and what/how you’re able to report. For instance, tracking your cost of goods sold (COGS) and maintaining accurate accounting may be more challenging under cash basis accounting compared to accrual accounting.

Step 4: Recording Transactions

Once you’ve set up your accounting system, integrated Shopify with it, and selected your accounting method, you’re ready to record transactions from your Shopify sales.

Efficiently and accurately recording transactions is the foundation of ecommerce bookkeeping. Most accounting software discussed in step 1 will automatically sync orders, payments, and other financial data from Shopify, eliminating the need for manual entry into your accounting system. This automation helps streamline your accounting tasks and ensures more accurate accounting.

For example, in QuickBooks Online, when integrating with your Shopify store, you have several options to classify how Shopify transactions feed into your system:

- Record a sale in QuickBooks and recognize revenue when an order is created in Shopify

- Create a deposit when a payout to a vendor is paid by Shopify

- Automatically create new items in QuickBooks when products are created in Shopify

Depending on your business needs, accounting method, and how you want your financial statements to look, you may need to adjust how transactions are mapped to best fit your business finances. Different accounting solutions may offer varying functionality and customizable options.

Step 5: Sales Tax

One tax compliance area that can be particularly challenging for ecommerce business owners, especially those shipping across the country, is sales tax. As previously mentioned, sales tax varies depending on the state, county, or even city where your customers are located. For Shopify sellers operating nationally, this can create an administrative challenge when using their chosen accounting software.

Fortunately, most accounting solutions that integrate with Shopify include built-in features to properly account for and track your sales tax obligations across different jurisdictions.

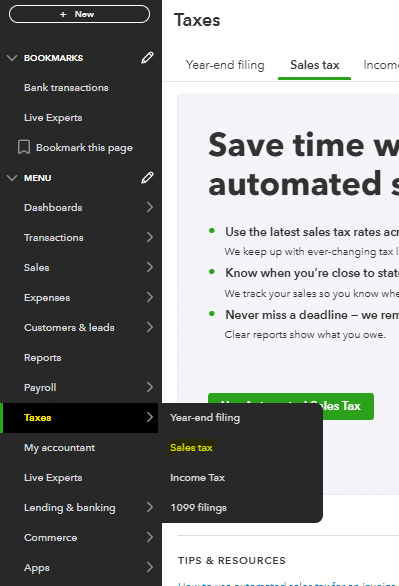

In this example we will walk through how to look at your sales tax liability and reporting in Quickbooks Online.

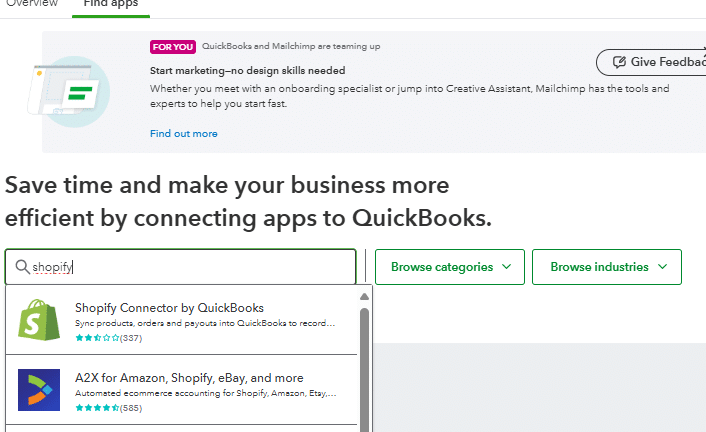

Once you’ve signed into your QuickBooks Online account, navigate to the drop-down menu at the left side of your screen. This works whether you’re using Mac or PC (note that QuickBooks Desktop has a slightly different interface).

Once you’ve accessed the menu, first verify if your sales tax has been enabled. Many businesses have non-taxable sales, or may not need to charge sales tax to their end user. If your business doesn’t need to process sales receipts with tax or pay sales tax, you won’t want this feature enabled.

To enable sales tax in QuickBooks Online, click on the taxes – sales tax section of the menu. This is where you can manage sales tax settings.

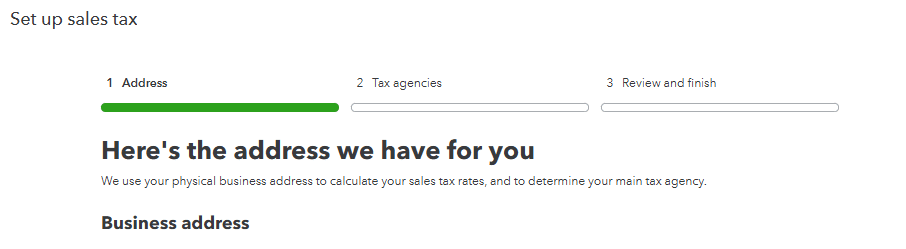

Once in this section, click “use tax” to begin setup. You can save your preferences for future use.

After selecting to use automated sales tax in QuickBooks Online, you’ll need to verify the correct tax category and tax rate for your jurisdiction.

The first prompt requires your business address. This helps determine the applicable sales tax rate based on your location. Click next to proceed.

You’ll reach the tax agency section once you’ve entered your address and selected next. The corresponding tax agency from your business address will appear. You’ll need to select your filing frequency for your sales tax return. Consult with a bookkeeping expert about your report period.

After filling out the appropriate tax agency information, QuickBooks Online will prompt you to review and finalize. This enables tracking of your total sales tax liability and running the corresponding report.

Now that you’ve got your sales tax set-up in Quickbooks Online, the corresponding sales tax information will be available from Shopify and fed through to Quickbooks Online for you to pull into your sales tax liability report.

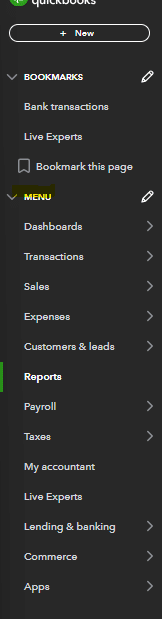

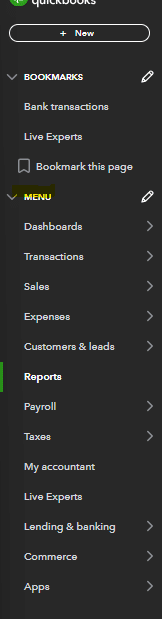

To run the sales tax liability report, you need to navigate back to the reports menu in QuickBooks Online. Select “go to reports” from the menu.

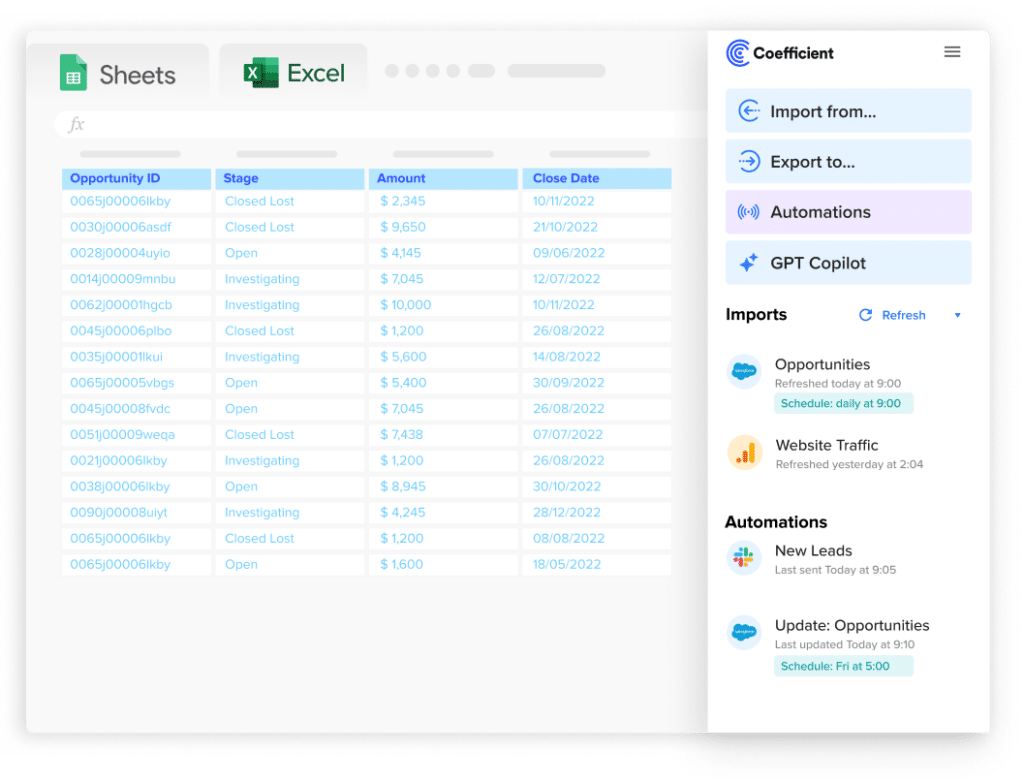

Stop exporting data manually. Sync data from your business systems into Google Sheets or Excel with Coefficient and set it on a refresh schedule.

Get Started

Once in the menu, select the reports.

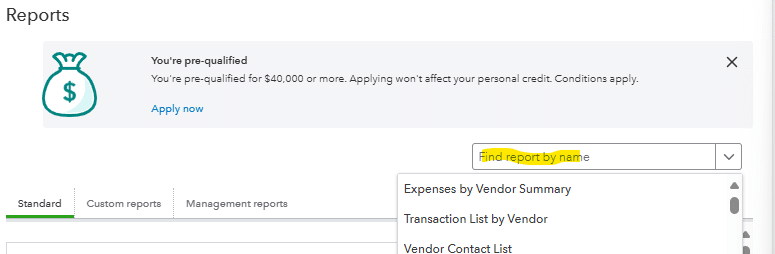

In the report module, search for “sales tax liability report” in the search bar at the top of the reports menu. You can customize reports as needed.

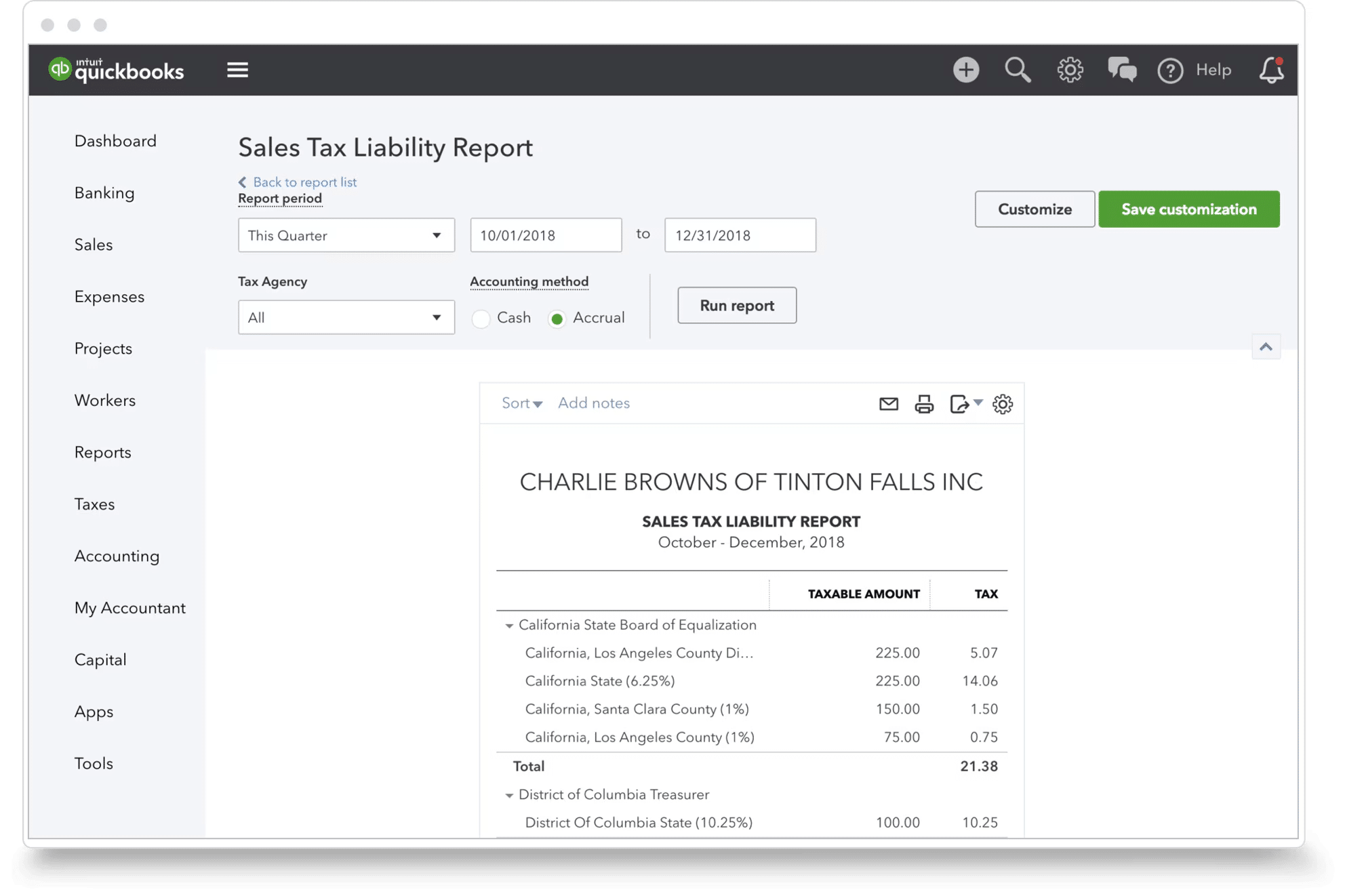

After selecting the sales tax liability report, choose the date range and tax agency. This reporting is typically done on a monthly or quarterly basis for sales tax payments. You can select a particular tax agency if your business operates across multiple jurisdictions.

After selecting the relevant timeframe and jurisdiction, you’ll have the necessary information about your sales tax due. This helps track how your total sales and taxable amount have changed over time.

While this specific example uses QuickBooks Online, all major accounting software options that integrate with Shopify, such as Xero, FreshBooks, or Wave, should offer some form of sales tax liability reporting. This helps you properly track your liability and ensure you don’t have any unknown or unrecorded liabilities that could pose a risk to your business finances.

Step 6: Financial Reporting

Now that you’ve fully integrated your accounting software with Shopify and are automatically syncing financial transactions, you’ll need to establish comprehensive financial reporting for both internal and external stakeholders. Leading accounting solutions offer both standard and customizable reporting options to help track your business finances.

Here are the essential financial reports every Shopify business should maintain:

- Profit and Loss Statement – This measures the profitability of your ecommerce business during a specific time period. The results will vary depending on whether you’re using cash basis or accrual accounting methods.

- Balance Sheet – This crucial report measures your assets, liabilities, and equity at a specific point in time. For Shopify sellers, this is particularly important when evaluating your current inventory tracking, cash position, accounts receivable, and other assets against your current liabilities to assess your financial health.

- Cash Flow Statement – This report tracks your net cash flow from operating, investing, and financing activities during a specific period. It’s especially valuable for bridging the gap between accrual accounting and actual cash position, helping business owners make informed decisions about their business finances.

- Aged Accounts Receivable – This report details all customer outstanding invoices at a specific point in time. The aging buckets (0-30 days, 31-60 days, 61-90 days, etc.) help you monitor customer payment patterns and manage your cash flow effectively.

- Aged Accounts Payable – Similar to the receivables report, this shows all outstanding vendor invoices with aging buckets, helping you prioritize payments and manage your business finances.

In QuickBooks Online, you’ll find these financial reports in the reports section of the main menu. For an ecommerce business using Shopify, it’s particularly important to accurately track your cost of goods sold (COGS) when preparing financial statements. This metric drives your product margins and can significantly influence pricing and cost-cutting decisions across your organization.

Step 7: Sales and Purchase Orders

Sales and purchase orders play a vital role in any business, but they’re especially crucial for ecommerce business operations using Shopify due to the volume of transactions and nature of online business.

Most accounting software platforms allow you to generate purchase orders directly within their system, but Shopify also provides this capability through its Shopify app. Depending on your business needs and preferred workflow, you can choose to manage purchase orders through either your accounting system or Shopify platform.

For sales orders, since they’re generated when a customer makes a purchase through your online store, the most logical place to maintain these records is within your Shopify system, where you track all Shopify sales. This approach helps maintain a clear audit trail and ensures proper inventory management across your sales channels.

This integrated approach to order management helps ensure:

- Accurate tracking of all financial transactions

- Proper inventory tracking across your Shopify store

- Streamlined processing of payment gateway transactions

- Efficient handling of refunds and adjustments

- Real-time synchronization with your accounting system

For small business owners managing multiple sales channels or operating across various currencies, maintaining organized order records is crucial for accurate accounting and proper financial reporting.

Put This Shopify Accounting Guide to Practice

Shopify is one of the most common commerce and ecommerce platforms used in the United States. It allows businesses to have a one-stop shop for both online and in-person purchases and sales tracking, and it is scalable for your business growth. For accounting professionals that work for or with businesses that use Shopify there are several key areas that you need to focus on that were outlined in this guide.

One major advantage of using Shopify is that there is a pre-built integration with most of the major cloud based accounting software solutions. This eliminates a lot of the information technology work that would need to be done if an integration were being built from scratch.

Additionally, there are integrations with Excel connectors, such as Coefficient, that can take your Shopify accounting and reporting to the next level.

Ready to take your data analysis to the next level?

Try Coefficient to seamlessly integrate your Excel with live data from various business systems, enabling real-time analysis and more advanced financial modeling.