If Sales is the machine that drives a business, a well-structured sales compensation plan is its silent engine.

Not only do sales compensation plans reward hard work, they are pivotal in motivating and retaining top talent.

This guide offers insights into sales compensation, its importance to high-growth organizations like startups, and best practices to follow when building them.

Let’s dive in.

Sales Compensation

Sales compensation is the combination of incentives, base salary, commissions, and bonuses provided to sales reps as a reward for driving revenue at a company. It reflects a salesperson’s achievements in hitting targets aligned with company objectives.

What is a Sales Compensation Plan?

Sales comp plans are a structured strategy that details how reps are rewarded for meeting their sales goals. It’s tailored based on various factors, including the rep’s role, seniority, sales cycle length, and the nature of their sales engagements.

When structured effectively, sales compensation plans ensure salespeople are continually driven to meet or exceed their sales quotas and contribute to the bottom line.

Importance of a Well-Structured Sales Compensation Plan

- Motivating Sales Reps. A clear compensation plan is crucial for motivating your sales team. With a clear incentive plan tailored for performance, sales representatives are more driven to meet and exceed their sales quota.

- Alignment with Business Goals. The perfect compensation plan keeps the sales team on track with the company’s big objectives. Whether the focus is on bringing in new customers, holding onto current ones, or rolling out new products, the right rewards make sure everyone’s aiming for the same targets.

- Retention and Attracting Top Talent. Top performers are likely to stay with a company that rewards their efforts adequately. Moreover, a competitive compensation package can attract top sales talent to your organization.

- Flexibility and Fairness: A great plan can adjust to different sales cycles, making sure everyone gets fair pay, no matter the product or time frame.

Key Components of a Sales Compensation Plan

- Base Salary. The amount of money paid to sales reps regardless of performance. It provides predictability and stability to team members.

- On-target earnings (OTE). OTE is an estimation of total earnings if salespeople hit their targets. It’s a combination of base salary plus commission.

- Sales Incentives. Companies can offer other incentives outside of regular pay or commissions, including:

- Spiffs (Sales Performance Incentive Funds) or short-term motivators that encourage specific sales behaviors or outcomes. For example, you could give a a cash prize for the first rep to close a specific number of deals.

- Contests or competitions that might reward salespeople for hitting specific targets, like improving customer retention rates.

- Rewards can be monetary, like cash bonuses, or non-monetary, such as dinners, trips, or other experiences.

- Benefits and Perks. Beyond the monetary components, benefits and perks play a significant role in attracting and retaining top sales talent. These can include:

- Health and wellness benefits like health insurance, gym memberships, or wellness programs.

- Professional development incentives such as courses, workshops, or subsidies for further education.

- Flexible work arrangements can include remote work, flexible hours, or compressed work weeks.

- Retirement plans with or without matching 401(k) contributions.

- Other perks like company phones, car allowances, or regular team outings and events.

- Bonuses. Extra payouts that sales reps can earn based on their performance, achievements, or meeting specific criteria set by the company.

Sales Compensation Plan Examples

Trying to create a compensation plan but unsure of where to start?

Let’s walk through a few different types of sales compensation plans. Each example includes a free template for you to try out on your own!

Base Pay

Instead of rewarding sales reps for performance, base pay commission plans provide them with a fixed, regular salary. Base pay commission plans are generally liked for their predictability because they offer salespeople a consistent income.

Example: A salesperson earns a base salary of $3,000 per month.

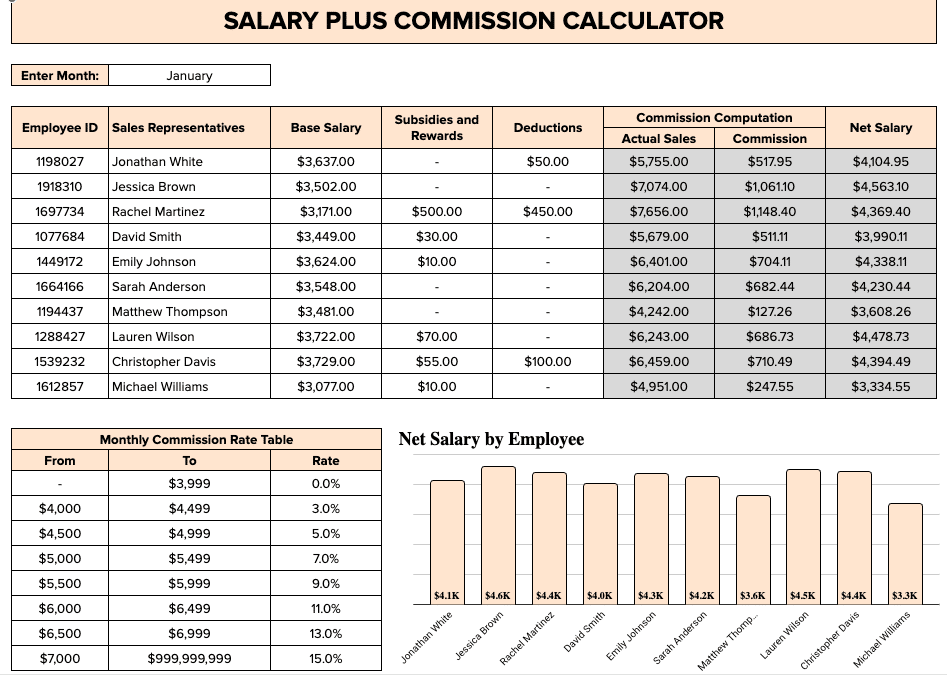

Base Pay + Commission

In addition to earning a regular salary, base pay + commission plans offer salespeople extra earnings based on their sales performance.

Example: A salesperson has a $3,000 base salary and a 5% commission rate. If they achieve $20,000 in sales, they’d earn an additional $1,000 commission, making their monthly earnings $4,000.

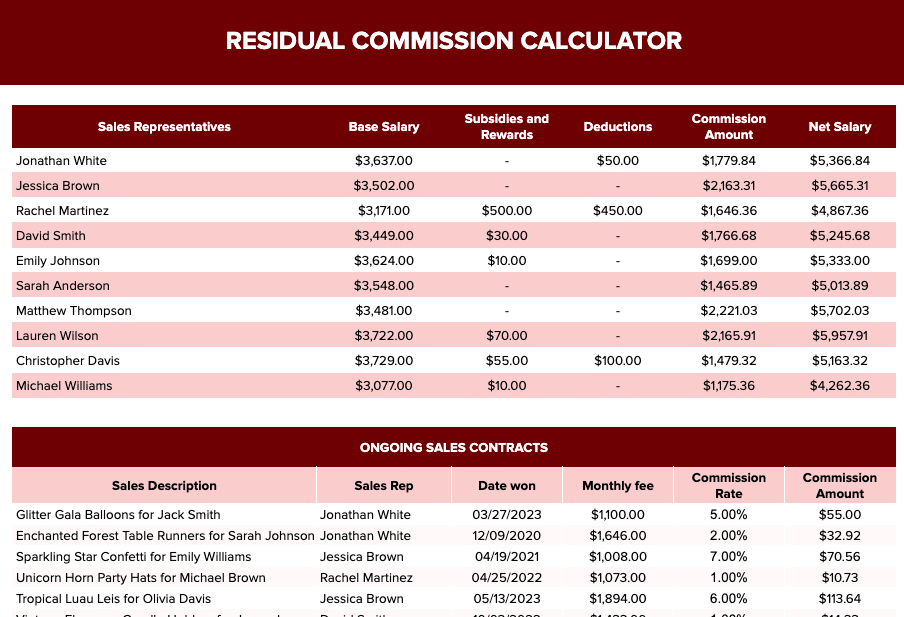

Residual Commission

Subscription-based businesses typically provide residual commissions on recurring sales over a period of time. It factors in base salary, rewards, and deductions to determine the net earnings.

Example: A salesperson sells a software subscription at $100/month, earning a 10% commission on the initial sale and an ongoing 10% for every subsequent month the subscription remains active.

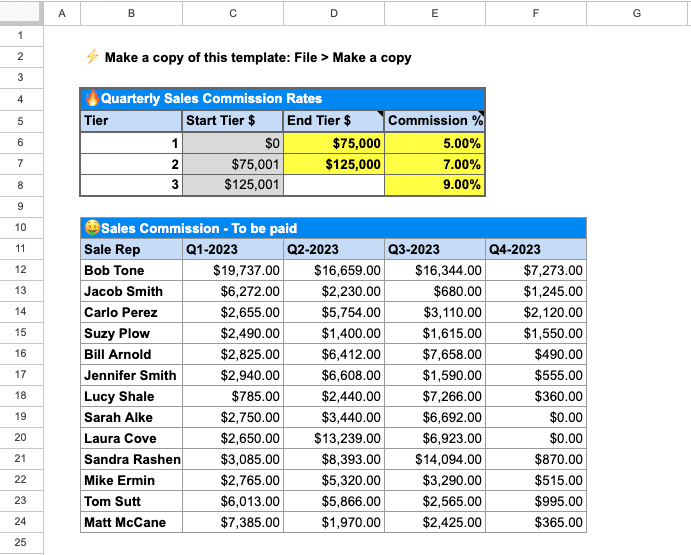

Tiered Commission

Tiered sales commission plans adjust commission rates based on sales volume, rewarding sales reps to exceed their sales quotas.

Example: A tiered commission plan is composed of three levels:

- Tier 1: 5% commission for sales up to $10,000

- Tier 2: 7% commission for sales between $10,001 and $20,000

- Tier 3: 10% commission for sales exceeding $20,000

If a salesperson makes $25,000 in sales, they earn 5% on the first $10,000 ($500), 7% on the next $10,000 ($700), and 10% on the remaining $5,000 ($500), for a total commission of $1,700.

Get the template here (Hubspot | Salesforce)

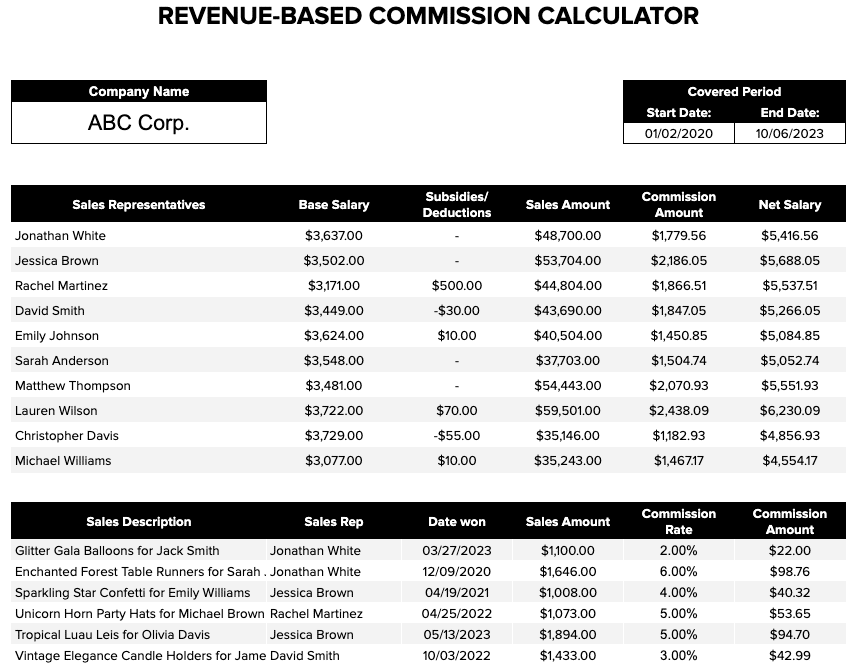

Revenue Commission

Revenue commission plans compensate sales reps directly based on the total revenue they bring into the company. In other words, rep compensation directly relates to company revenue, creating a direct alignment between individual effort and earning potential.

Example: If a salesperson sells products worth $50,000 in a month at a commission rate of 4%, they’d earn a commission of $2,000 for that month.

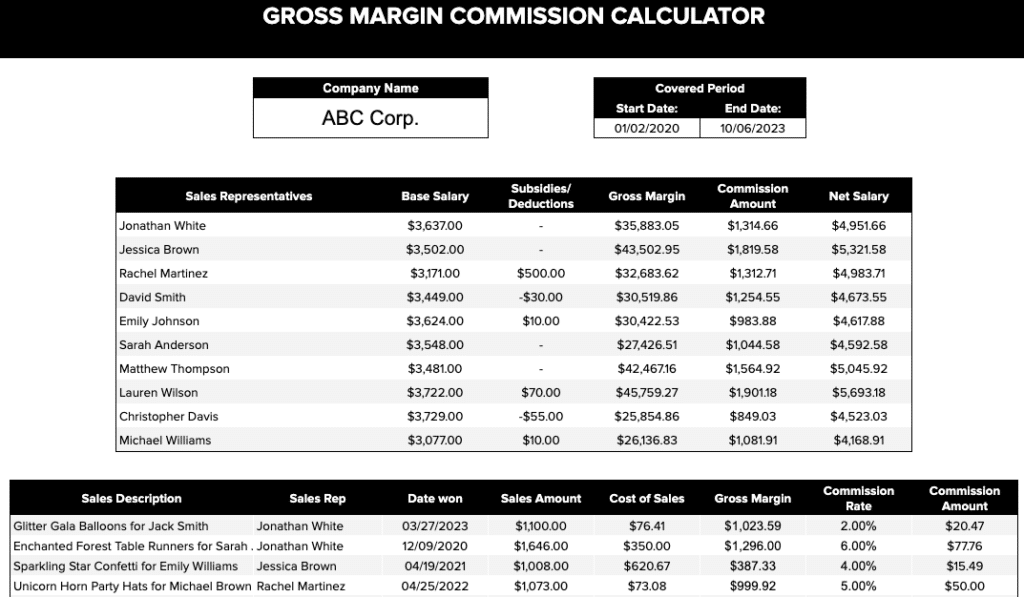

Gross Margin Commission

Gross margin sales commission plans pay commissions based on a sale’s profit margin instead of its total value. It incentivizes salespeople to sell more and maximize the profitability of each sale.

Example: A salesperson earns a 15% commission on the gross margin of their sales. If they sell a product for $1,000 with a COGS of $600, the gross margin is $400 ($1,000 – $600). The salesperson’s commission would be 15% of $400, which is $60.

Commission Only

Salespeople receive no fixed salary in commission-only plans, earning solely from commissions based on the amount the sell.

Example: A salesperson with a 10% commission rate would earn $500 from a $5,000 sale.

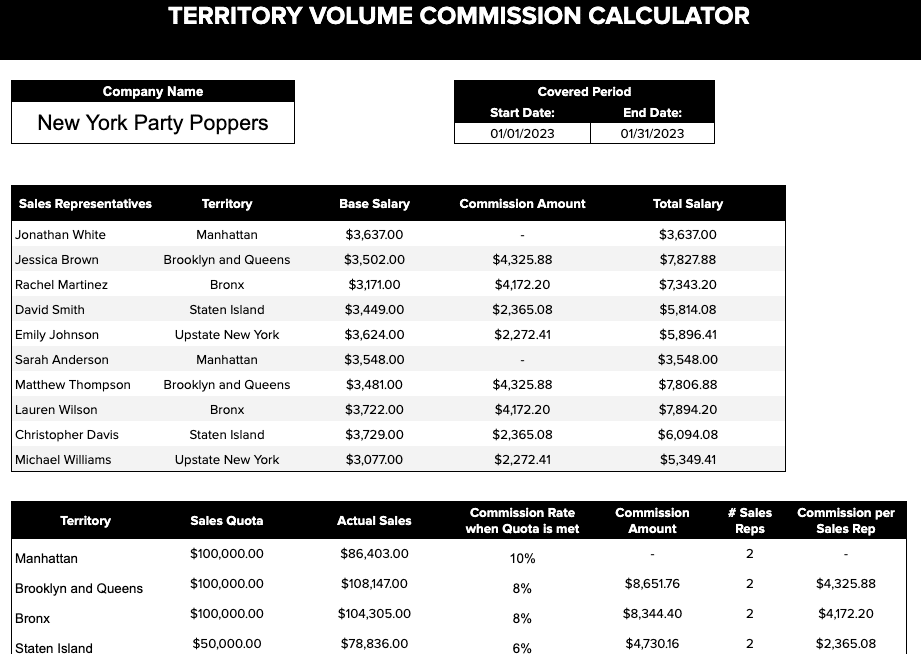

Territory Volume Commission

Territory volume commission plans calculate commission based on total sales volume in an assigned geographic or market area. They incentivize reps to maximize overall sales within their territory instead of high-value deals.

Example: A salesperson responsible for a specific region earns a 5% commission on all sales within their territory. If the total sales reach $100,000/month, they’d make $5,000.

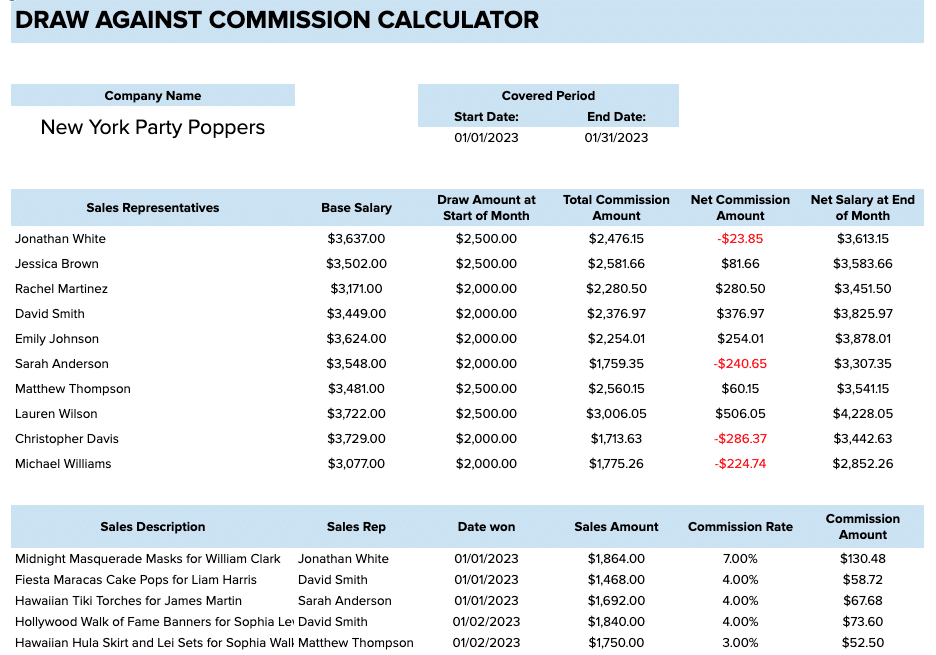

Draw Against Commission

In a draw against commission structure, sales reps get an initial “draw” or advance at the beginning of a pay period, reflecting anticipated commissions. As they make sales, this draw is balanced out by the actual commissions they earn.

Reps pocket the excess if their commissions surpass the draw, but if they earn less than the draw, they might have to repay the shortfall to the company.

Want to learn more? Dive deeper into each type of commission structure in our article: Different Types of Sales Commission Structure.

Otherwise, get the free draw against commission template here.

How to Create a Sales Compensation Plan?

- Gather relevant data. Before creating your plan, you must have an idea of past sales performance, a thorough understanding of your business goals, and the nuances of your sales cycle.

- Draft your plan. Set your target pay, base salary, commission, bonuses, and other incentives. From there, decide on the right pay mix – the base salary to incentives ratio. Adjust upside potential to reward sales reps who excel in closing deals and exceeding their sales quota.

- Get buy-in from stakeholders. Engage with executives and sales leaders to gather feedback on your plan. Their insights can ensure it aligns with organizational goals.

- Communicate your plan. Transparency is mission-critical. Organize a meeting to introduce the compensation plan to your sales force. Emphasize how it supports the business strategy and aligns with the sales cycle.

- Implement necessary tools. Use a mix of your sales platforms like CRMs and other tools to track sales performance. Ensure your finance and payroll systems can handle payouts so your reps are paid accurately and on time.

- Hold training sessions. Offer training sessions that get into plan specifics into how high-performance can maximize earnings.

- Monitor and report performance. Keep a close eye on sales performance metrics. Establish regular check-ins and provide sales reps with intuitive dashboards that display sales milestones, potential bonuses, and accrued commissions at a glance.

- Collect Feedback. Open the channels of communication. Regularly engage your sales force and solicit their feedback. Their hands-on experience with the plan can offer invaluable insights, spotlighting areas that might need recalibration.

- Review and iterate. As business goals evolve, the plan should too. Periodically review and adjust your plan against real sales performance data.

- Document and ensure compliance. Meticulously document every tweak, change, or overhaul of the plan and ensure that your sales compensation strategy is in strict compliance with industry standards and regulations.

Best Practices in Effectively Maintaining a Sales Compensation Structure

- Set realistic sales quotas. Sales quotas should be both achievable and competitive. Past sales performance metrics will give you an idea of realistic goals. Roughly 60% of the sales team should be able to meet the set quotas.

- Communicate clearly and often. Consistent and transparent communication is pivotal. Ensure everyone on the sales team understands the intricacies of the sales compensation plan. Detail any changes to the plan and emphasize the company’s goals.

- Track metrics diligently. Use sales dashboards and spreadsheets to monitor sales performance metrics, sales quota attainment, and compensation payouts in real time. This gives you the ability to course correct and adjust your sales strategy when needed.

- Conduct regular audits. Frequently check your sales targets and payouts to ensure reps’ payouts are accurate and in line with your compensation plan.

- Evaluate and adjust. Always collect feedback and benchmark against industry standards. This helps make sure your sales commission plan remains competitive.

- Collaborate Cross-Functionally. Involve teams like Finance, HR, and Sales Ops to get a well-rounded view and create a comprehensive compensation strategy.

Free Sales Compensation Calculator for Google Sheets

While creating the perfect sales compensation plan is challenging, accurately calculating and tracking against it can be even harder.

Make things easier for yourself with Coefficient’s Sales Commission Calculator for Google Sheets. It uses live data from Salesforce or Hubspot to automate commission tracking.

Sales Compensation Plans

A well-structured sales compensation plan can be your business’ growth engine – if you can leverage it effectively.

Coefficient allows users to streamline commission management by automatically tracking and calculating commissions in Google Sheets.

Don’t just take our word for it. Try Coefficient for free today to see it for yourself.