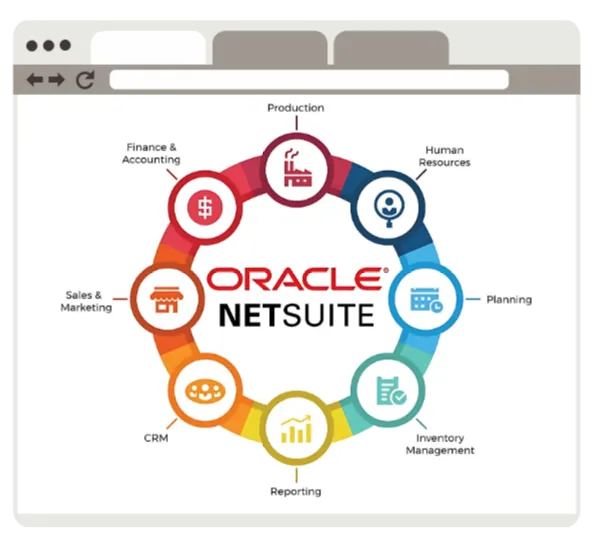

A successful NetSuite implementation is one of the biggest operational upgrades a growing business can make. Most teams follow a standard NetSuite ERP implementation process outlined in official Oracle guidance and partner checklists.

But while most teams focus on modules, integrations, and go-live timelines, there are a few critical areas that often get underestimated — and they tend to cause the most pain after launch.

If you’re planning a NetSuite migration (or you’re already in the middle of one), here are the top five things teams consistently forget to plan for — and how to avoid the fallout.

1. Your Reporting and Spreadsheet Connectivity

This is the most overlooked part of NetSuite implementation — and the one that hits finance teams the hardest.

Most companies rely on spreadsheets far more than they realize:

- Financial reporting

- Forecasting and budgeting

- Board and investor reporting

- Revenue analysis

- Department-level dashboards

During a NetSuite migration, teams often assume:

“We’ll deal with reporting after go-live.”

The problem is that once your old ERP is turned off:

- Custom spreadsheet connections break

- Legacy third-party tools may not support NetSuite

- Manual CSV exports quietly become the new normal

And financial reporting doesn’t stop during implementation. It continues daily, weekly, and monthly — go-live or not.

This is why many teams turn to tools like Coefficient during their NetSuite implementation — not to replace NetSuite, but to preserve spreadsheet-based reporting with out-of-the-box connectivity between NetSuite and Google Sheets or Excel. That way, reporting workflows don’t collapse while the backend system is changing.

What to do instead:

Before go-live, map every critical spreadsheet-based workflow and decide how NetSuite data will flow into those reports automatically. This single decision often determines whether your finance team stays strategic — or gets buried in manual updates for months.

2. The True Scope of Data Migration – Not Just ‘What,’ but ‘How It Is Used’

Most teams plan for what data is moving into NetSuite:

- Customers

- Vendors

- Transactions

- Historical financials

But far fewer plan for how that data is actually used day-to-day after go-live. This is where many NetSuite data migration challenges begin.

Common blind spots:

- Custom fields that don’t map cleanly

- Historical data that looks correct but no longer ties to reports

- Calculations that previously happened in spreadsheets, not in the ERP

When this happens, NetSuite may be technically “live,” but reporting accuracy becomes questionable — especially during the first few months post-implementation.

These issues align closely with broader ERP data migration risks that often surface only after the system is live.

What to do instead:

Plan migration based on use cases, not just objects. If a number shows up in a forecast, board deck, or KPI dashboard, trace it all the way back to its source before go-live.

3. Cross-Functional Impact (Not Just Finance)

NetSuite implementation is often treated as a finance or accounting project — but in reality, it touches:

- Sales operations

- RevOps

- FP&A

- Marketing ops

- Leadership and strategy teams

Each of these groups depends on shared reporting. When NetSuite replaces your old system:

- Sales loses visibility

- Marketing loses funnel data

- Leadership loses real-time performance views

If only finance is included in implementation planning, the rest of the org feels the disruption after the fact.

What to do instead:

Before go-live, identify every team that touches financial or operational data and document:

- What they access today

- Where they access it

- How often they need it

Your NetSuite implementation should preserve — or improve — access for all of them.

4. Post Go-Live Reality (Implementation Is Not the Finish Line)

Many NetSuite implementation plans treat go-live as the end of the project. In practice, it’s the beginning of:

- New reporting requirements

- Adjusted financial processes

- Learning curves for every team

- Continued optimization

Without a post-go-live ownership plan, teams often experience:

- Broken workflows lingering for months

- Repeated manual fixes

- Confusion over source of truth

What to do instead:

Plan for a 90-day post-implementation optimization window with clear ownership over:

- Data accuracy

- Reporting reliability

- Workflow improvements

5. The Cost of Temporary Manual Workarounds

The most dangerous phrase during a NetSuite migration is:

“Let’s just do this manually for now.”

Manual workarounds tend to:

- Become permanent

- Introduce errors

- Create burnout

- Undermine the ROI of NetSuite

What starts as a “temporary” CSV upload for reporting often survives for years.

This aligns with what leading analysts highlight around the cost of manual reporting in finance and the long-term gains from finance automation benefits.

What to do instead:

- If something must be done manually after NetSuite implementation, define:

- What the long-term solution is

- Who owns fixing it

- When it must be automated

Manual Exports vs. Automated NetSuite Connectivity

This is where many teams land by default after implementation.

What it looks like:

- Users export CSVs from NetSuite

- Upload into Excel or Google Sheets

- Rebuild formulas, pivots, and charts

- Repeat daily, weekly, and monthly

Trade-offs:

- ❌ High risk of human error

- ❌ No real-time data access

- ❌ Heavy manual labor during close

- ❌ Version control issues across teams

- ❌ Reporting delays for leadership

Manual exports work in emergencies — but they quietly drain time, accuracy, and trust in the numbers.

Automated NetSuite-to-Spreadsheet Connectivity

This is the model many finance teams move toward during or after NetSuite migration.

What it looks like:

- NetSuite data syncs automatically into spreadsheets using an automated, no-code data connector like Coefficient’s NetSuite connector for Google Sheets or Excel

- Reports update on a refresh schedule (or in near real-time)

- Dashboards stay live without manual uploads

- Multiple teams work from the same source of truth

Benefits:

- ✅ Always-current reporting

- ✅ No broken formulas after every export

- ✅ Faster closes and forecasts

- ✅ Clean handoffs to leadership and investors

- ✅ Less burnout for finance teams

For companies that still rely on spreadsheets as their reporting layer, this approach preserves continuity while NetSuite becomes the backend system of record.

Final Takeaway: NetSuite Implementation Shouldn’t Break Your Reporting Rhythm

A NetSuite migration is meant to improve control, visibility, and scalability — not introduce friction in everyday reporting. The teams that succeed are the ones that treat:

- Reporting continuity

- Spreadsheet connectivity

- Cross-functional data access

as core infrastructure, not afterthoughts.

If your implementation keeps reporting reliable while everything else changes underneath, you’ve done it right.