Sales tax collection is the tax that retailers charge and collect from customers, typically a percentage of the sales price of tangible personal property. Sales tax compliance is an essential area that the majority of businesses must deal with, but it’s even more prevalent for online sellers. Ecommerce business owners are typically shipping to multiple states within the United States, and each state has unique sales tax laws that your online business needs to follow.

While large businesses likely have entire departments of tax professionals dedicated to understanding and complying with the relevant tax obligations in each local jurisdiction, small business owners likely don’t have the resources to do so. This can cause tax fines and penalties along with wasted time by business owners that could be dedicated to growing their business.

In this guide, we will walk through sales tax requirements for online retailers and some areas to consider as they relate to sales tax collection.

Detailed Guide: Sales Tax for Ecommerce Business

Before diving into our sales tax guide for ecommerce business, it’s important to define a few key terms. These are essential to understanding how sales tax rates will impact your online store:

- Tax Authority – An area that writes its own tax policies for businesses that operate within the borders of their area. This could be federal, state department, county, cities, etc.

- Physical Presence – The physical nexus of a business is their physical location and connection between your business and the corresponding state sales tax jurisdictions in that physical location.

- Economic Nexus – The economic nexus is the level of connection your business has with a state and local tax jurisdiction that may require the business to collect sales tax.

Determine Your Sales Tax Nexus

Determining your sales tax nexus is crucial for online sellers. Depending on the state, sales tax can be taxed in two separate ways: origin-based sales, which is determined based on where the seller is located, or destination-based sales which is based on where the buyer is located.

Destination-based sales tax is more common, which makes determining your sales tax obligations more complex for ecommerce business owners. What destination sales tax essentially means for online retailers is that you are responsible for charging the correct sales tax to your customer based on where they live and where you are shipping the product. This means that an ecommerce business based out of Ohio may have nexus in 20 other nexus states they ship their product to.

To determine whether or not you have nexus in certain local jurisdiction, consider these factors:

- Is the state you are shipping from your business location or the destination state?

- Do you have inventory, employees, or any physical presence in another state?

- Track your amount of sales and number of transactions by state

- Once you’ve gathered your data, compare it with the economic nexus laws for that specific state

- Typically, if you’re above that state’s economic nexus threshold, you would have nexus and need to remit sales tax

Some examples of the thresholds for nexus in a state are:

Arkansas

- $100,000 in online sales in the current or previous calendar year

- 200 transactions in the current or previous calendar year

If either of these two metrics are hit, a seller is considered to have economic nexus in that state.

California

- $500,000 in sales in the current or previous calendar year

- Mixed taxing jurisdictions because of city, county, and state sales tax that are origin-based and district sales taxes that are destination-based

- Additionally, retailers are considered to have a physical nexus if they maintain inventory or office locations in California, have employees/representatives in California to make sales or deliveries, or lease equipment in California

Delaware

- No sales tax

As you can see, states significantly vary in the sales tax policy from the simplest of not charging sales tax to a complex code like California has and everywhere in between.

Sales Tax Permit Registration

Once you’ve determined the nexus states where you have presence, you will need to register to remit and file sales tax in those tax jurisdictions. Cost of applying for a sales tax permit can vary by state but is typically less than $100. This can be done online for most states through their department of revenue.

Depending on how many states you need to remit and pay tax to, you may want to consider sales tax software providers that specialize in tax compliance. Popular providers like TaxJar and Avalara will show what states you need to register in, pay, and then file your sales tax return.

Additionally, most sales tax software will integrate with your accounting system. One of the most popular systems is QuickBooks Online (QBO). To integrate your sales tax software with your QBO instance:

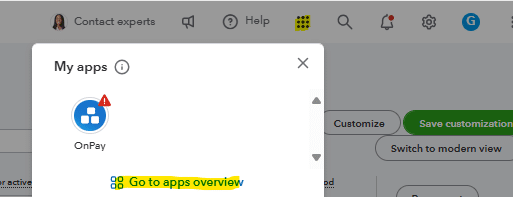

Search for apps that QuickBooks Online may already have a pre-built connection with, navigate to the nine dots in the top right of your QBO home page.

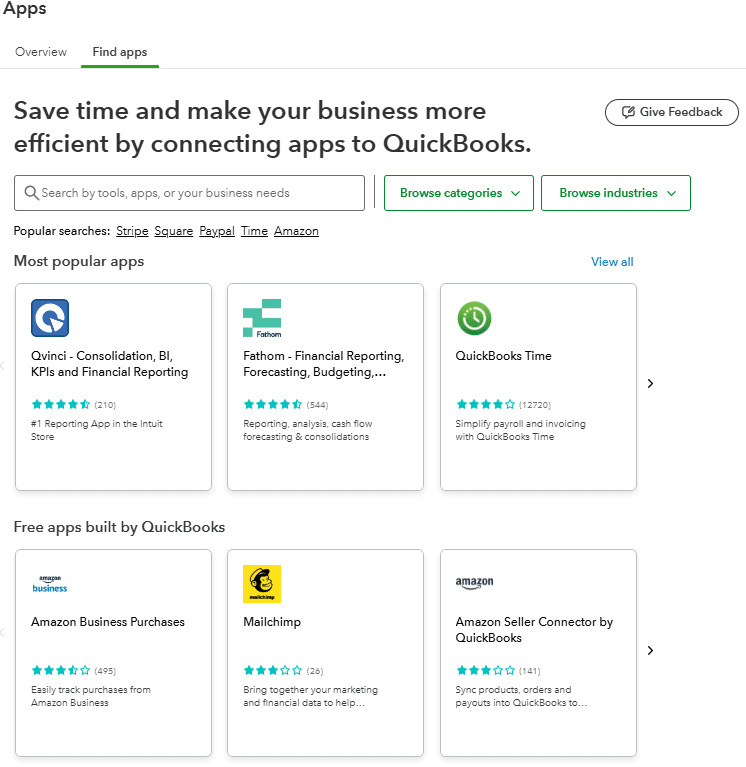

Once you’ve opened that prompt, select “go to apps overview” to review applications that integrate with QuickBooks Online. On this page, you can search for whatever application you want to connect.

In this example, we searched and selected Gusto, which is a payroll and human resources application. After selecting Gusto, choose “get the app now” to connect it to your QBO instance.

For existing users, you’ll need to provide login credentials and other relevant information such as general ledger coding and data you want to import into Quickbooks Online.

Sales Tax Exemptions

While ensuring you are tax compliant can seem daunting, there are several sales tax exemptions that your business may qualify for in a given state. Common exemptions include:

- Production exemption – Applies when specific tangible personal property is not taxable. These exemptions vary by state, with common examples including food, clothing, supplements, etc.

- Nonprofit exemption – Applies when specific customers are exempt from paying sales tax, such as schools, churches, government agencies, etc. To ensure your ecommerce business isn’t charged sales tax due to a customer exemption, present your sales tax exemption certificate to vendors.

- Reseller exemption – Applies when selling your product to a distributor who will then resell to the end-user. These transactions are typically tax-exempt so sales tax is only paid once by the end-user. You would need to obtain a resale sales tax exemption certificate.

For online retailers, the most common exemption would be a production exemption for products specifically exempt in particular states. Most ecommerce platforms like Shopify, Amazon, and Etsy have built-in features to handle these exemptions.

Additionally, some states have sales tax holidays. This is typically determined on a state-by-state basis. For example, a state may eliminate sales tax during holiday shopping seasons or for back-to-school supplies.

The sales tax software that we previously discussed will be able to assist and help to point you in the right direction.

Collecting, Reporting, and Filing Sales Tax Returns

Once you’ve completed the initial setup for your ecommerce business by determining your sales tax nexus, registering in nexus states, and identifying any sales tax exemptions, your business is ready to collect, report, and file returns to ensure tax compliance.

Stop exporting data manually. Sync data from your business systems into Google Sheets or Excel with Coefficient and set it on a refresh schedule.

Get Started

To collect sales tax, you’ll need to add the corresponding sales tax rates when you invoice your customer. This can typically be done in your ecommerce platform or accounting system. For example, in QuickBooks Online, navigate to the taxes section in the main menu.

Once you select the taxes section you will need to select the sales tax subsection of that category.

Once you’ve selected the sales tax section in Quickbooks Online you can mark products and services as taxable to ensure that you charge your customers sales tax.

Reporting is the second component of the ongoing sales tax compliance for e-commerce businesses. This is where outsourcing your sales taxes may make sense, depending on the size of your business. If you are a large business and already have a tax department in your business, you may already have the resources in place to collect, report, and file all of the applicable sales tax returns.

If you are a small business, it is recommended that you outsource your sales tax compliance. Whether that is to a firm to handle sales tax reporting and filing or just software that an employee in your business manages will depend on how comfortable you are with your sales tax processes.

The frequency of reporting and paying sales tax also varies by state. Some states are monthly, some are quarterly, and some are annual. Additionally, your frequency of reporting and payment could change based on how much business you are doing in that state. Typically, the more business you conduct in a state, the more frequently you will have to file and pay sales tax. States don’t want to wait for the sales tax revenue from bigger businesses, while they don’t want to burden smaller businesses with more frequent payments.

One additional step e-commerce business can take to help them appropriately track that they are staying compliant with the frequency of all sales tax returns is to create a schedule that can be shared amongst the employees in your business who are responsible for sales tax. This can help them set-up automatic reminders to file and pay sales tax for each state as it comes due.

On-Going Evaluation

After establishing your sales tax compliance processes, you’ll need to continually evaluate what new nexus states you may need to register in as your online business grows. For example:

- You might have sold to Colorado for years without meeting their economic nexus threshold

- Growth in sales might trigger new tax obligations

- Changes in sales tax laws might affect your tax collection requirements

- Opening new warehouses or attending a trade show might create new physical presence nexus

This evaluation should be continuous, especially for growing ecommerce businesses. This is why many online retailers use sales tax software that automatically tracks:

- State sales tax requirements

- Local sales tax obligations

- Changes in tax laws

- Economic nexus thresholds

- Filing frequency requirements

Benefits of a Sales Tax Compliance for an Ecommerce Business

Sales tax compliance is essential for online sellers to:

- Automatically charge customers and remit the correct tax to states

- Ensure the business is tax compliant without unknown liabilities

- Understand available sales tax exemptions

- Meet all due dates and filing frequency requirements

Improve Your Sales Tax Processes and Compliance

Online sales continue to grow as the internet enables more businesses to reach customers across states. While this growth benefits business owners, it creates complexity in sales tax compliance. Every state from New York to Washington has unique sales tax laws, and requirements vary dramatically between nexus states.

Following this guide and utilizing tools that help summarize tax data will help you communicate your position to stakeholders. One such tool is Coefficient, which allows you to pull your sales tax data from your accounting software to easily display and report tax information throughout your ecommerce business.

Try Coefficient to seamlessly integrate your Excel with live data from various business systems, enabling real-time analysis and more advanced financial modeling.