Open a new Google Sheet or use a template and input basic information: business name, address, and the statement period at the top

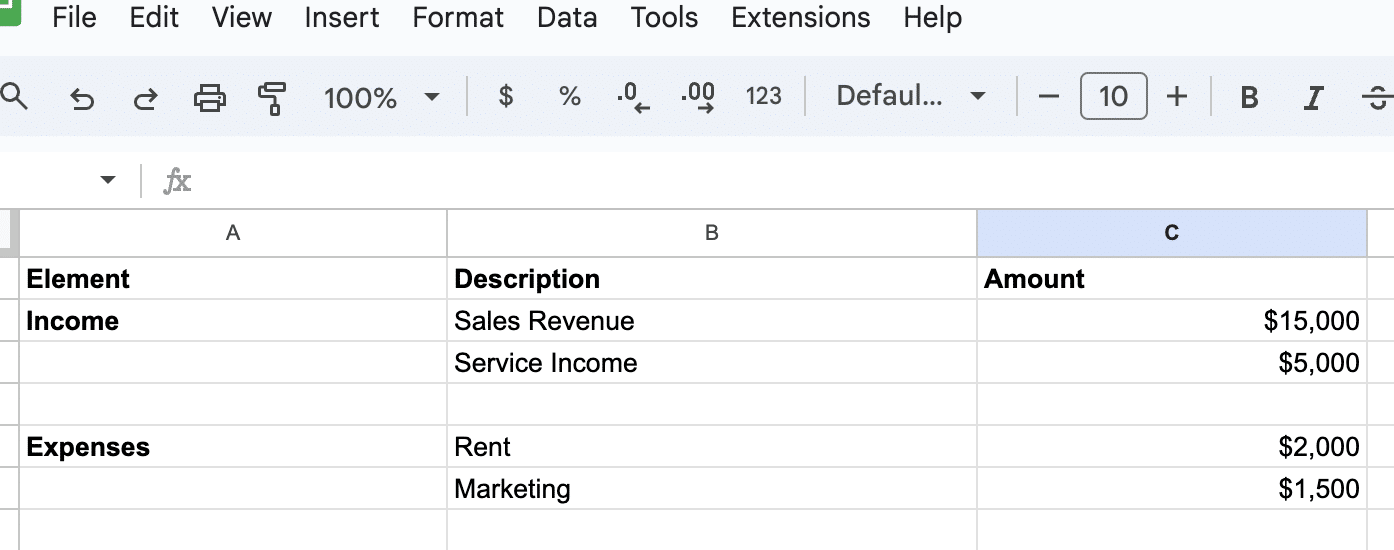

Create Income and Expenses Sections: customize categories relevant to your business, list all revenue sources in the

Income section using separate rows for clarity

In the Expenses section, detail all business costs

Use formulas to calculate the totals for both sections and the net profit or loss

Calculate Net Income: the final profit or loss, calculated as Total Revenues – Total Expenses

Creating a profit and loss statement in Google Sheets is more than a financial chore; it’s a strategic tool for business owners to track their financial performance.

It helps companies lay out income, expenses, and profit or loss over a specific period. Understanding the nuances of a profit and loss statement empowers you to make informed decisions for sustainable growth.

In this tutorial, we’ll navigate through the steps to craft a comprehensive profit and loss statement tailored for business operations teams in B2B SaaS companies.

Understanding Profit and Loss Statement

A Profit and Loss (P&L) statement, also known as an Income Statement, is a financial report that summarizes a company’s revenues, expenses, and profits or losses over a specific period. It helps businesses track their performance and make informed decisions.

Importance of Profit and Loss Statement

A well-organized P&L statement is essential for various reasons:

Supercharge your spreadsheets with GPT-powered AI tools for building formulas, charts, pivots, SQL and more. Simple prompts for automatic generation.

- Financial management: It allows business owners to monitor their company’s finances and identify areas where they can cut costs or increase revenue.

- Decision making: P&L statements provide valuable insights for making critical decisions regarding expansions, investments, and budget allocation.

- Tax reporting: Companies need a comprehensive P&L statement for accurately filing taxes and ensuring compliance with legal requirements.

- Stakeholder communication: Investors, lenders, and other stakeholders rely on P&L statements to understand the financial health of a business.

Key Elements of a Profit and Loss Statement

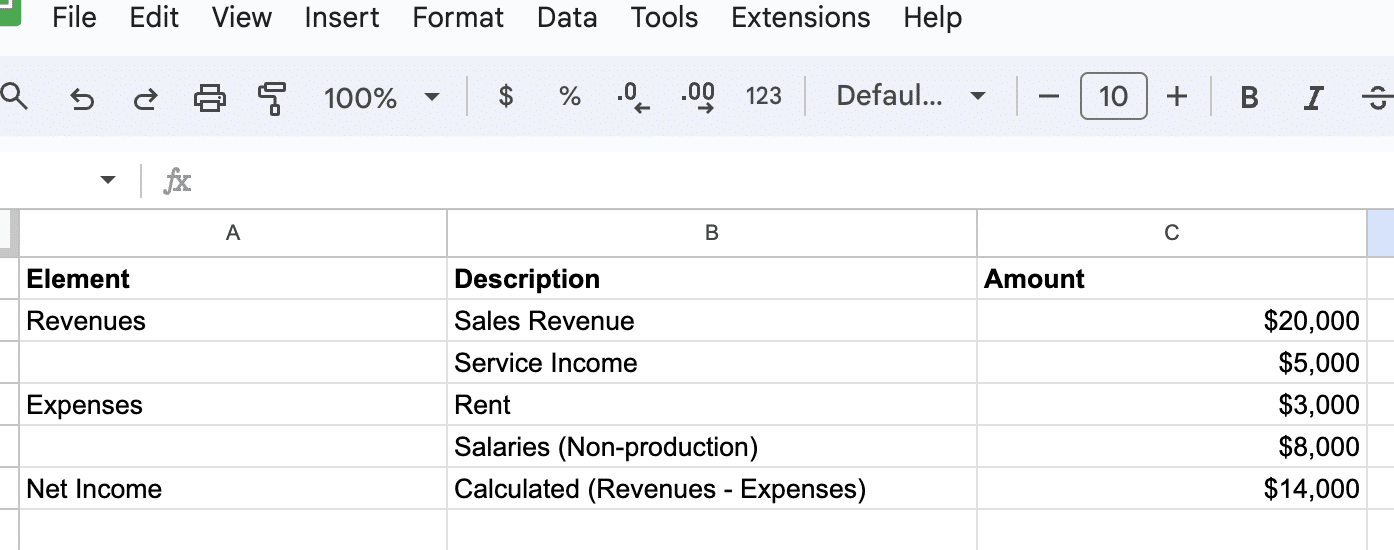

A standard P&L statement includes:

- Revenues: All income from sales, services, or investments.

- Expenses: Costs incurred, split into:

- Direct Costs (COGS): Directly linked to product/service production.

- Indirect Costs: General business expenses like rent and marketing.

- Net Income: The final profit or loss, calculated as Total Revenues – Total Expenses.

Creating a Profit and Loss Statement in Google Sheets

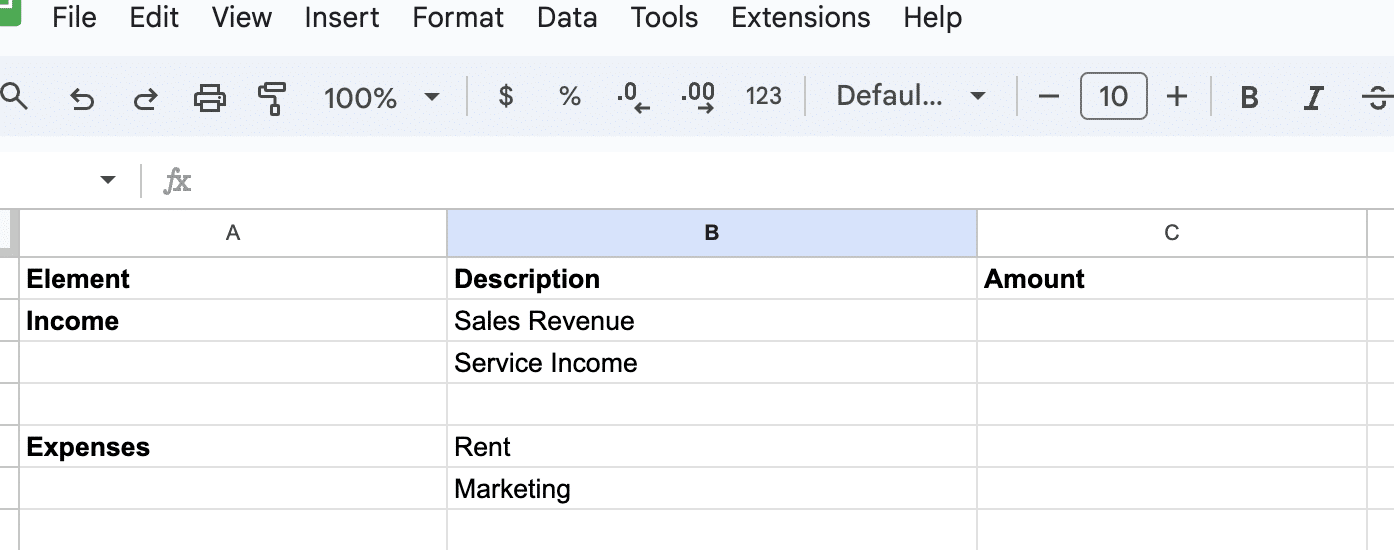

Setting Up Your Google Sheets

- Open a new Google Sheet or use a template.

- Input Basic Information: Business name, address, and the statement period at the top.

- Create Income and Expenses Sections: Customize categories relevant to your business.

Inputting Income and Expenses

- In the Income section, list all revenue sources. Use separate rows for clarity.

- In the Expenses section, detail all business costs.

Calculating Net Profit or Loss

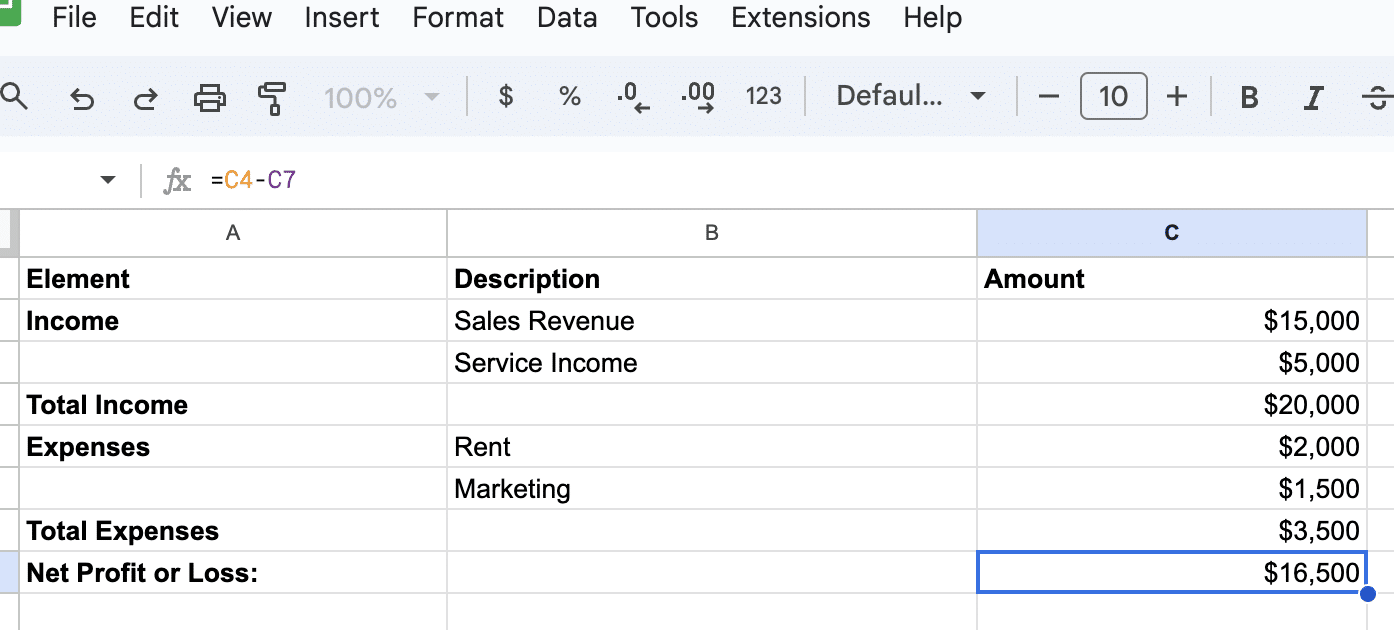

Calculating the net profit or loss is an essential part of creating a profit and loss statement. Subtract the total expenses from the total income to determine your company’s net profit or loss.

In Google Sheets, use formulas to calculate the totals for both sections and the net profit or loss. In this example:

- Total Income: =SUM(C2:C3)

- Total Expenses: =SUM(C5:C6)

- Net Profit or Loss: =C4 – C7

Conclusion

By mastering the creation of a profit and loss statement in Google Sheets, you can make well-informed financial decisions for your business.

Don’t forget to install Coefficient for seamless integration of live data into your spreadsheets, elevating your business