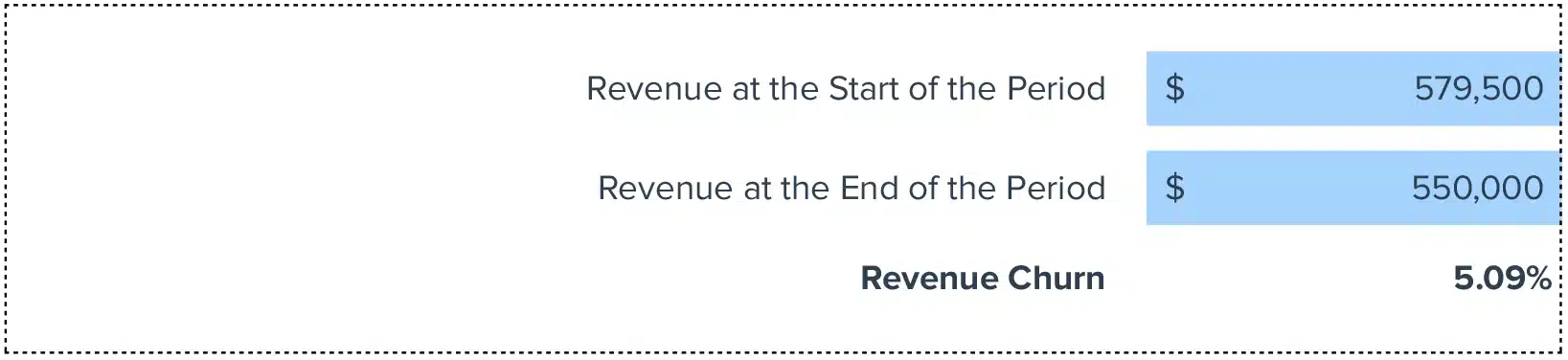

Revenue Churn Rate (%) = (Revenue at the Start of the Period – Revenue at the End of the Period) / Revenue at the Start of the Period * 100

How to Calculate Revenue Churn?

- Starting Point: Determine your Monthly Recurring Revenue (MRR) at the beginning.

- Churn Identification: Calculate the MRR lost due to churn and downgrades.

- Expansion Revenue: For net churn, factor in MRR gained from customer upgrades.

- Apply the Formula: Use the specific formula for either gross or net churn to finalize your calculation.

What is Revenue Churn?

Revenue churn quantifies the percentage of recurring revenue lost from customer actions such as cancellations, non-renewals, or service downgrades within a specified period.

It’s a pivotal indicator of customer satisfaction and loyalty, and it provides valuable insights into the stability and health of revenue streams.

The Significance of Revenue Churn

Understanding revenue churn is crucial for financial forecasting, strategic planning, and identifying the effectiveness of customer relationship management.

It underscores the areas needing improvement to enhance product value and customer service, directly impacting a company’s financial health and growth trajectory.

Real-world Example

For a company with a starting MRR of $10,000 and an ending MRR of $9,500, the revenue churn rate would be (($10,000 – $9,500) / $10,000) * 100 = 5%.

Strategies for Reducing Revenue Churn

- Customer Feedback Analysis: Leverage customer insights to refine your offerings.

- Pricing Strategy Adjustment: Align your pricing with the perceived value and customer expectations.

- Enhanced Customer Support: Address customer issues proactively to prevent churn.

- Loyalty Programs: Implement rewards to foster customer retention.

- Product Improvements: Regularly update your product based on customer feedback to meet evolving needs.

How to Calculate Revenue Churn in Google Sheets

- Set Up Your Spreadsheet: Label columns for Month, Starting MRR, Churned MRR, Expansion MRR, Ending MRR, Gross Revenue Churn (%), and Net Revenue Churn (%).

- Input Monthly Data: Enter values for Starting MRR, Churned MRR, and Expansion MRR.

- Calculate Ending MRR: Use =B2+D2-C2 to find the Ending MRR.

- Calculate Gross Revenue Churn Rate: Apply =C2/B2*100 to determine the churn rate.

- Calculate Net Revenue Churn Rate: Use =(C2-D2)/B2*100 to factor in both churn and expansion.

Navigating Revenue Churn’s Limitations

While revenue churn provides insights into customer retention and revenue stability, it doesn’t capture the full picture of business health, especially in terms of new customer acquisition and market expansion opportunities.

When to Apply Revenue Churn Analysis

Revenue churn analysis is particularly valuable for businesses with recurring revenue models. It offers a clear lens to view revenue retention trends and customer loyalty, guiding strategic decisions to foster growth and stability.