Bookkeeping is an essential service for businesses, but especially for small business owners and entrepreneurs, and there are numerous providers and accounting services that firms offer for growing businesses. Small businesses are the engine behind the economy, and proper financial records can provide those businesses with real insight into how their financial health is performing and areas where there are improvement opportunities.

Additionally, good basic bookkeeping can help ensure your business stays in compliance with all of the tax laws and regulations that may affect you in the regions you operate in.

In this guide, we will walk through the best online bookkeeping services for small businesses and how they can positively impact your business needs.

Detailed Guide: Best Bookkeeping Services for Small Businesses

Before diving deep into the best bookkeeping services for small businesses, it’s important to go through some of the areas of accounting that may be most beneficial to have a bookkeeper perform for your small business. In general, one of the biggest benefits of outsourcing your business’s bookkeeping is to allow you to focus on the operational and growth side of the business.

- Payroll – While not necessarily the core function of a bookkeeper, many bookkeeping services and accounting software have payroll capabilities through platforms like Gusto. Depending on what areas your business operates in, this can also become complex very quickly for the layman without a payroll or accounting needs background.

- Accounts Payable – Accounts payable is the process of receiving invoicing from vendors, sending them through the appropriate approval flows, and processing payment for those vendors.

- Billing/Accounts Receivable – Billing and accounts receivable is the process of generating invoices to send to customers for goods sold or services performed and then tracking payments received from customers and matching them against the invoices issued. Additionally, you may have a dedicated accountant actively follow-up with customers to see when you should expect payment.

- Financial Reporting – Financial reporting is the process of taking all of your financial transactions and formatting them in a meaningful way to share with internal and potentially external stakeholders. This typically comes in the form of financial statements including an income statement, balance sheet, or cash flow statement, although many small businesses also have customized reports that fit their specific industry or business need as well.

- Compliance – Compliance can often be scary for business owners who are not familiar with the rules and regulations that come along with payroll, business tax, state and local laws, etc. A CPA or bookkeeper can typically help alleviate some of the anxiousness that comes along with the unknown and help your small business stay compliant with the IRS.

Payroll

Payroll is an area that typically takes experience and knowledge to do efficiently and accurately. Most local tax services firms will provide tax preparation and payroll services for your organization. Additionally, if you have an in-house bookkeeper, there are several software solutions that are user-friendly and help perform payroll and actually do the tax filing and payments for your business so you don’t have to. Some of the most popular software options include:

- Gusto

- Paylocity

- Paycom

- OnPay

One of the benefits of a cloud-based payroll software is that they typically integrate with your small business accounting software. For example, Gusto will integrate with one of the most popular solutions – QuickBooks Online (QBO) via their integrated applications.

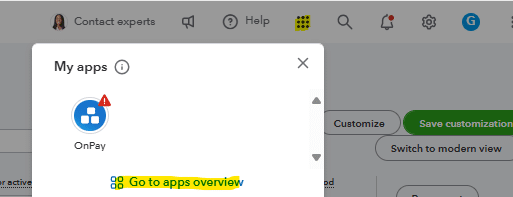

To search for apps that QuickBooks Online may already have a pre-built connection with, navigate to the nine dots in the top right of your QBO home page.

Once you’ve opened that prompt, select “go to apps overview” to review applications that integrate with QuickBooks. On this page, you can search for whatever application you want to connect.

If you’re using QBO and don’t yet have a payroll, invoicing, timekeeping, or other system, first check if QuickBooks Live has an existing connection with that application.

In this example, we searched and selected Gusto, which is a payroll and human resources application. After selecting Gusto, choose “get the app now” to connect it to your QBO instance.

For existing users, you’ll need to provide login credentials and other relevant information such as general ledger coding and financial data you want to import into QuickBooks Online.

Accounts Payable

Accounts payable is often a very paper-heavy and cumbersome task that may not interest, or be in a business owner’s skillset. This is an area where full-service bookkeeping services make sense for a small business.

Today, more than ever, there is risk in the accounts payable space with phishing and spam emails that can lead to fraudulent payments. Poor accounts payable practices can also lead to delayed vendor payments, which can cause you to lose key vendors and cause delays or lost sales.

Similar to payroll, there are several software services that can help small business owners process invoices and manage their vendors. Some of the most popular platforms include:

- QuickBooks Online

- Ramp

- Bill.com

- Xero

- Tipalti

One of the major efficiencies that you may see is selecting an accounting software that has accounts payable capabilities built into it. This is the case with most of the major cloud accounting systems such as QuickBooks Online or Xero.

If your business requires a more sophisticated accounts payable solution, or handles a significant amount of credit cards transactions, it may make sense to get a dedicated accounts payable solution that offers added benefits. For example, bill.com has a very robust expense module for travel and allows a rebate for your small business on credit card transactions that are run through their platform.

If your business is more simple and primarily invoice transactions, it probably makes sense to pick an accounting software that already has a capability to process those invoices.

Managing Accounts Receivable

Billing and the sales cycle is the lifeblood of your business. Without proper invoicing and collecting invoices from your customers, your business will likely experience a cash flow crunch or potential bankruptcy. Depending on the complexity of customer contracts and billing requirements with your customers, it may make this even more of an issue for your organization.

For businesses, particularly startups and growing businesses, it makes the most sense to invoice directly out of their system of record for the transactions they are billing. For example, if a trucking company is tracking all of their loads driven, miles driven, or other metrics in a transportation management system it would probably make sense to bill directly out of that system if possible. This will help reduce any manual intervention and errors from employees/bookkeepers.

If it’s not possible to bill directly out of your system of record, it would make sense for a small business to bill directly out of their accounting system. The advantage of billing directly out of your accounting system is that it will be a one-stop shop for the billing and corresponding payment from your customers.

One area where a dedicated accountant or accounting firm may also be able to help your business is with collections from customers. If you are not willing to consistently follow-up with customers regarding past due invoices, it will significantly increase your cash flow and working capital if you have your bookkeeper or software following up with customers.

Financial Reporting and Analysis

Financial reporting is probably the most common area that business owners and leaders think of when they consider bookkeeping services. When the right financial reporting is used by business leaders and it is received in a timely manner, it can help lead to growth and success for the business.

The best financial reporting services for small business typically mean having the right dedicated bookkeeper or accounting firm in place and the right software to go along with them.

Almost every accounting software for small businesses will have some sort of financial reporting capabilities built into it. The most basic bookkeeping software will have standard reports such as your income statement, balance sheet, and cash flow statement. The best accounting software will allow you to customize the financial reporting to better fit your business needs.

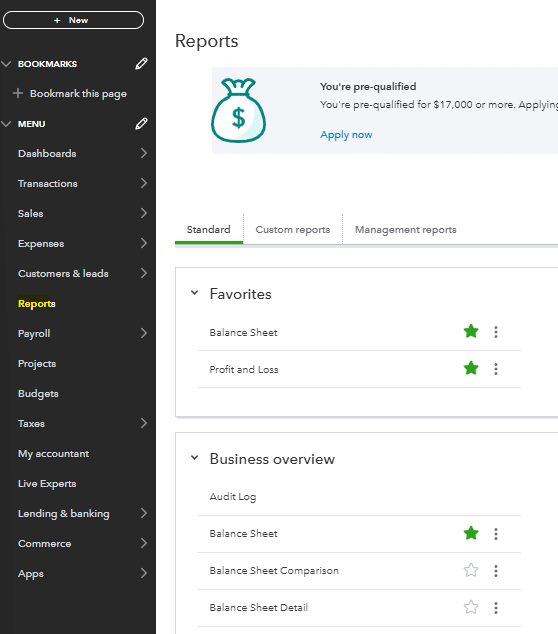

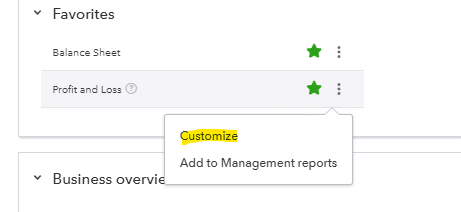

One of the best examples of this is QuickBooks Online. In QBO, you are able to customize accounts that are pulled into the report, filter by customers, add or remove columns and many more options. To customize QuickBooks Reports and also send them out on a regular basis to your internal and external stakeholders you can first select the reports option in the main menu of QuickBooks Online.

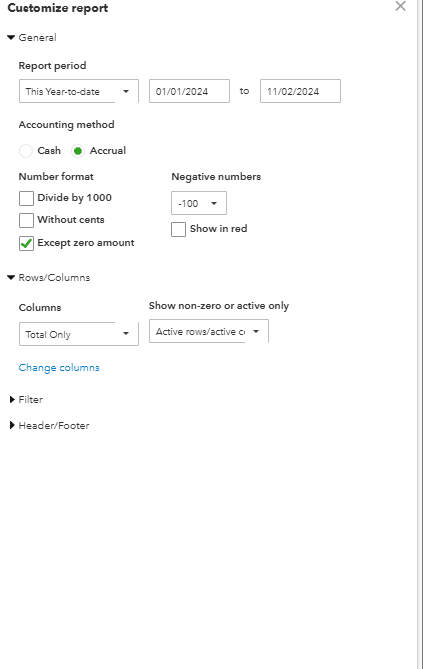

Once in the reports menu, you can select the report or reports that you would like to send out automatically. In this example, I’ve selected the profit and loss report and then hit customize.

Once in the customize report screen, adjust your time period and formatting to match your reporting needs. This creates near real-time access to financial data.

,

Stop exporting data manually. Sync data from your business systems into Google Sheets or Excel with Coefficient and set it on a refresh schedule.

Get Started

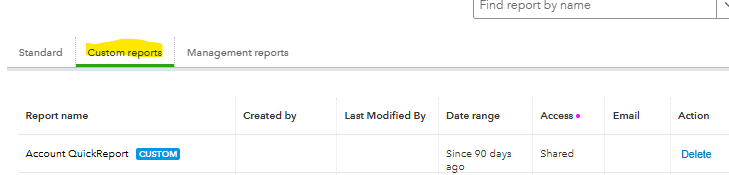

Once you’ve customized your report to your liking, you can navigate back to the reports list and select the custom report you created.

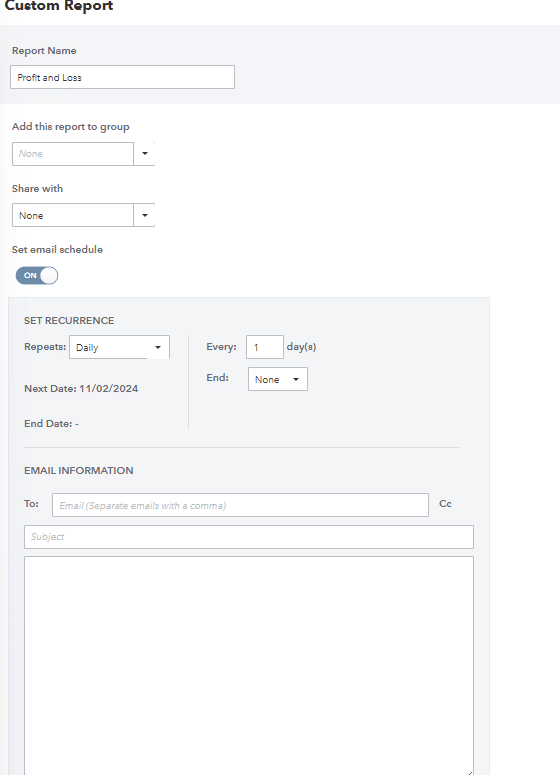

Next, select Edit in the action column for that particular report and toggle the set email schedule on.

Once toggled on you can set the recurrence, end date, recipients, subject, and message that are sent out on a recurring basis.

You will want to make sure you give yourself ample time to record all transactions in a timely manner before scheduling the report to be sent out. For example, if your month-end close process is typically 5 days, you will want to wait until at least day 6 to automatically send out the report.

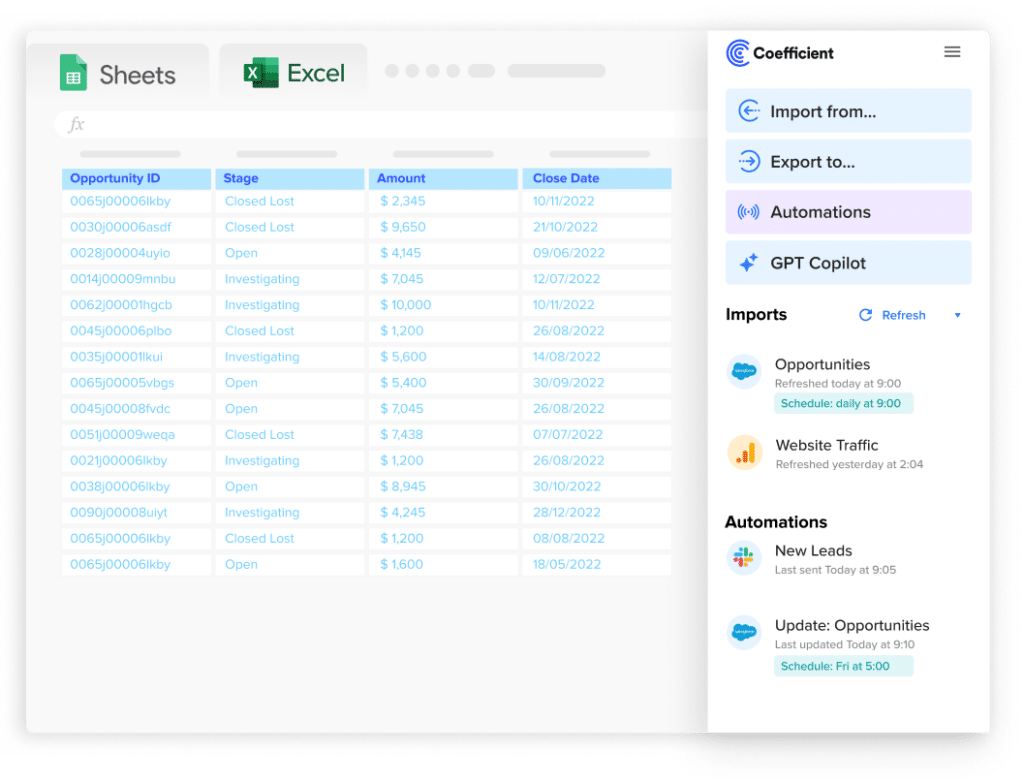

Additionally, to take your small business financial reporting to the next level you will want to look at integrating with an advanced financial modeling and analysis tool such as Coefficient. Coefficient is a very user-friendly and easy tool for bookkeepers that integrates with Quickbooks Online and allows you to pull in live financial transactions. It also allows more customization options than your typical out-of-the-box accounting software.

Compliance and Tax Services

Compliance is often a pain point for small business owners who are experts in their business, but not on the compliance side of the house. This is where bookkeeping services and public accountants can assist.

Most accounting firms that you can hire to perform bookkeeping services are also able to assist with compliance issues related to accounting. The most common compliance issues a bookkeeper can help with are tax preparation and sales tax. By appropriately tracking tax and remitting payment to the proper tax jurisdictions, a bookkeeper can help alleviate the burden of a business owner having to do this.

There are several software solutions that a small business can use for their tax services compliance including:

- Intuit TurboTax

- TaxJar

- Avalara

- Sovos

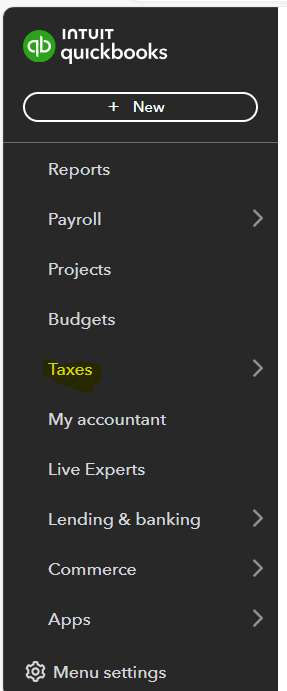

There are also tax services that are provided by most major accounting software including QuickBooks Online. To navigate to the tax portion of QuickBooks Online, you will want to navigate to the taxes section of the main menu.

Once in the taxes section there is a sales tax subsection. Within this section you will have the ability to automate your tax and ensure you are compliant by setting up the correct address and other tax jurisdiction information to ensure you are charging and paying the correct tax.

Additionally, an accounting firm or CPA may be able to tell you if you are tax exempt in any jurisdictions to ensure you aren’t overpaying any tax and saving your business money.

Use Cases for Bookkeeping in Your Small Business

Bookkeeping services can help small businesses:

- Focus on their business and growing it instead of back-office items

- Ensure the business is compliant with tax laws and the IRS

- Report financial results in a meaningful way to internal and external stakeholders

- Ensure payments are managed through proper accounts payable flows

- Ensure your accounts receivable are being properly managed

Improve Your Bookkeeping Services at Your Small Business

Small businesses are the lifeblood of the economy and bookkeeping is an essential function for those businesses to grow and thrive. By hiring in-house staff or outsourcing to external vendors to perform key bookkeeping services for your organization, your business leaders will be freed up to focus on growing their business and operational efficiency.

While it can be an added cost for small business owners, the right people and services will more than pay for themselves. Additionally, there are several solutions ranging from basic bookkeeping to full-service options that can help bookkeepers effectively communicate and display information to stakeholders. By using a tool such as Coefficient, paired with the right bookkeeping services, your small business will have timely and accurate financial records to help make key decisions.

Ready to grow your small business by implementing the best bookkeeping services?

Try Coefficient to seamlessly integrate your Excel with live data from various business systems, enabling real-time analysis and more advanced financial modeling.