As an accounting professional that either owns or works at an accounting firm, automation is a constant topic in the industry. Whether it be making your organization more efficient to on-board new clients and grow, or doing more value-add work for your existing clients.

There are many shortcuts and tools that can be used to help automate your accounting firm and some of the processes within it.

This comprehensive guide explores how modern accounting software and automated accounting systems can help transform your accounting processes from time-consuming manual operations into streamlined, efficient workflows.

Tip 1: Automate Invoice Workflow

One crucial method of accounting automation for your accounting firm is automating invoice workflow in your accounting software or accounts payable system to avoid manual tasks. A popular solution is QuickBooks Online, a cloud-based accounting software from Intuit that helps small business owners manage their finances and is used by their accountants and bookkeepers.

To automate invoice matching in QuickBooks Online and streamline your accounting processes:

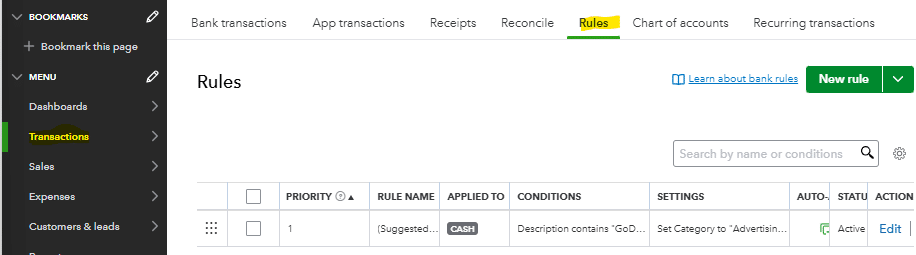

- Navigate to the transactions section of the menu

- Select the rules header

In the rules header, click the new rule button. This opens the create rule prompt where you’ll:

- Name the rule

- Define applicable transaction types

- Set up assignment criteria

- Specify coding preferences

For regular vendor invoices, set up the rule as a money out transaction with the corresponding description. This automation helps maintain consistent accounting processes across your business.

Next, configure your transaction coding preferences, including:

- Transaction type

- Expense category

- Payee information

- Cash flow tracking

Test each rule thoroughly before activation. Once set up, transactions matching your criteria will automatically code as they enter your QBO system, supporting efficient accounting tasks and accurate financial reporting. This reduces time-consuming manual data entry and potential human error.

This is one example of automation within Quickbooks Online, there are numerous other ways that automation can be built into Quickbooks Online if you are using that software at your Accounting Firm.

Tip 2: Cash Application and Collections

Another area ripe for process automation within your accounting firm is cash application and collections, which are essential components of your accounts receivable process.

Cash application is the process of applying cash receipts that a business receives from their customers and applying that payment to an outstanding invoice for that customer. In today’s world of automated accounting systems, this is typically done electronically, and the customer will send over a remittance that outlines what invoices that particular payment covers.

Collections is the process of following up with customers on outstanding invoices that they have with your business. This can be done proactively and prior to the invoices becoming past due, or reactively after the invoice has become past due.

To automate cash application for your accounting firm and their customers, you can implement various software solutions. Leading providers include Blackline, HighRadius, Billtrust, and others.

Once you have properly vetted and implemented the accounting software that best fits your business needs, all payments will be automatically matched to the corresponding outstanding invoice, assuming full payment and proper invoice documentation. This automation will free up significant time for your firm and customers.

Tip 3: Month-End Close

Another critical accounting process that can and should be automated for your accounting firm is the month-end close process. This automation can be implemented for both your firm’s internal accounting as well as accounting services you provide to customers.

Several reasons to consider automating the month-end close process include:

- Creating a standardized checklist across the organization

- Automating repetitive tasks

- Improving communication throughout the accounting department

- Identifying bottlenecks in the close process

- Enhancing collaboration between accounting teams

When you implement automated accounting systems for month-end closing, it can help reduce the manual tasks of validating account balances and reconciling items. If a customer struggles to close their books in a reasonable timeframe and has consistent errors, implementing a month-end close automation solution can significantly improve their accounting operations.

Tip 4: Financial Reporting

Financial reporting is the process of providing financial data about your business to relevant stakeholders. These stakeholders can be internal, or if the company is publicly traded or has investors, external. Financial reporting can communicate vital information to those stakeholders depending on what they need for informed decision-making. The most common financial statements are:

- Business segment reporting

- Profit and loss statement

- Balance sheet

- Cash flow statement

One way to automate financial reporting is to automate the coding of certain transactions as discussed in tip 1. This allows transactions to automatically flow into the correct revenue or expense account in the general ledger without manual data entry from an employee.

Another way to enhance your accounting workflow is to automate sending out reports to stakeholders. Most modern accounting software solutions, including QuickBooks Online, offer this functionality.

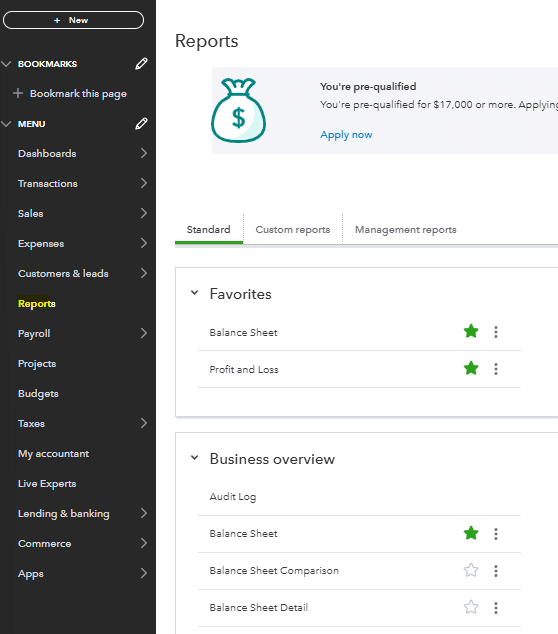

To automate sending a report out of QuickBooks Online, you first must navigate to the report section of the menu.

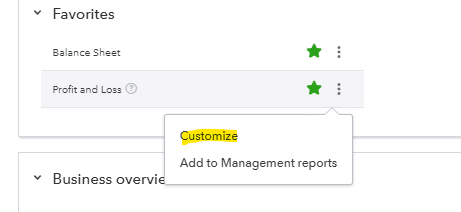

Once in the reports menu, you can select the report or reports that you would like to send out automatically. In this example, I’ve selected the profit and loss report and then hit customize.

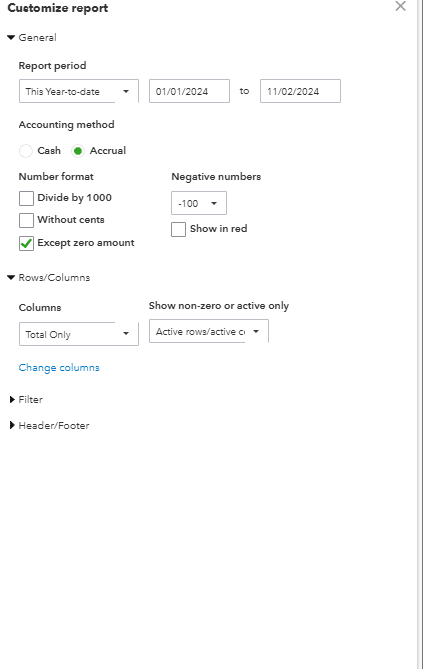

Once you are on the customized report screen, adjust your time period and formatting to match your reporting needs. This creates near real-time access to financial data.

,

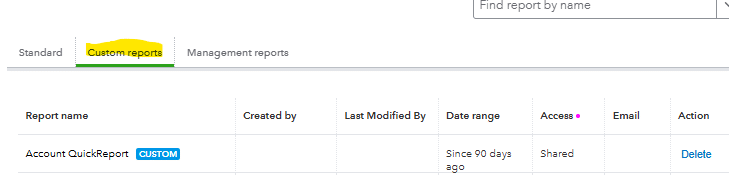

Once you’ve customized your report to your liking, you can navigate back to the reports list and select the custom report you created.

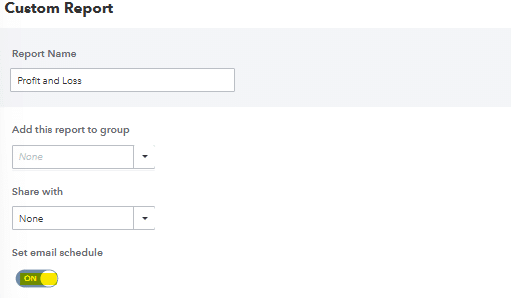

Next, select Edit in the action column for that particular report and toggle the set email schedule on.

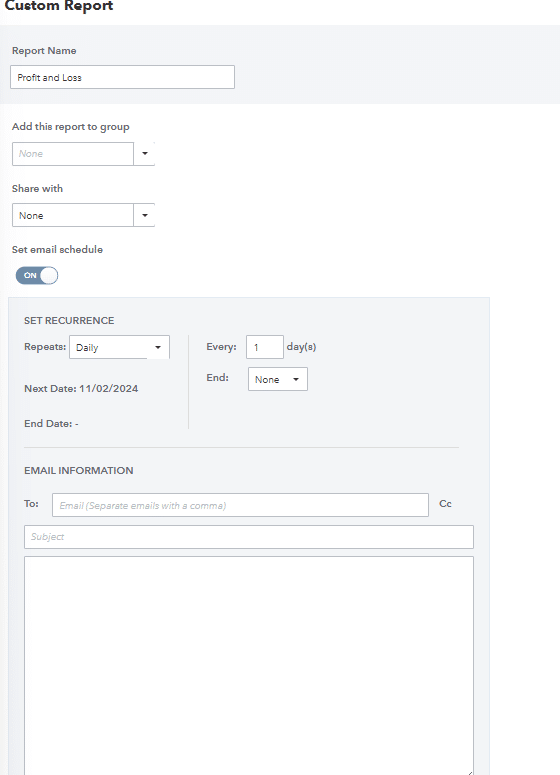

Once toggled on you can set the recurrence, end date, recipients, subject, and message that are sent out on a recurring basis.

You will want to make sure you give yourself ample time to record all transactions in a timely manner before scheduling the report to be sent out. For example, if your month-end close process is typically 5 days, you will want to wait until at least day 6 to automatically send out the report.

Another way to automate your financial reporting process at your accounting firm is to automate financial disclosures. If you are a publicly traded company or if your company has to have a financial audit performed under generally accepted accounting procedures (GAAP) financial disclosures are a must have. Financial disclosures accompany your financial statements and provide additional information that is more detailed than the summarized financial statements.

Stop exporting data manually. Sync data from your business systems into Google Sheets or Excel with Coefficient and set it on a refresh schedule.

Get Started

You can automate a lot of these financial disclosures within your accounting software, or you can also go out and get add-on software that is specific to financial disclosures. One major benefit of your accounting firm automating this is that it reduces manual error and provides an easy audit trail to see where information from that financial disclosure is pulling from. It also can increase the trust and reliability of the disclosures you are reporting because of the reduced risk of human error.

Tip 5: Payroll Management

Payroll is a vital area where accounting firms can provide guidance and services for their customers. It is a crucial component of accounting processes that, if not managed correctly, can create major issues within your organization—from employees not getting paid, receiving incorrect amounts, or lost funds from overpaying employees who are no longer with your organization.

A simple way to streamline the payroll process is to automatically import time punches for payment processing. Instead of having payroll processors perform manual data entry to process employee time, you can integrate and automate their timecard punches to flow directly into your pay platform, creating an efficient automated workflow.

In addition to automating the processing side of payroll, you can also automate the feed of payroll information into your accounting software or ERP solution. To accomplish this, create an integration point between your payroll system and accounting systems to automatically book and post payroll information to the correct accounts and cost centers in your general ledger.

This process automation helps eliminate manual tasks that increase human error in how payroll is coded and frees up your accounting team’s time for more value-add activities.

Tip 6: Expense Management

Beyond automating how invoices are processed in your accounts payable department, your accounting firm can also help automate expense management processes within your firm and the businesses that are your customers. Expense management is the process of oversight and controls of expenditures within an organization, including tracking, analyzing, and ensuring adherence to company expense policies.

One of the most common pain points ready for accounting automation in the expense management process is paper receipts. Often, employees within an organization must keep and turn in paper receipts for their expense reports, which can lead to lost documentation along with complaints and decreased morale from employees who must track these receipts. A modern software solution for paper receipts is implementing a cloud-based receipt uploading system that works through a cell phone. This allows employees to download their expense management application on their phone, capture images of corresponding receipts, and upload them to the application. Once completed, employees no longer need to keep and compile physical receipts to submit to their accounting department.

Another area that can enhance your accounting workflow is travel expense automation. Automating travel for employees can make it easier for both the employee and the back office finance teams to ensure compliance with company policy and integration with your expense management software. Many accounting solutions and accounts payable systems include travel modules or capabilities. This creates a one-stop shop where employees can book travel options that align with company policy. This automation makes your employees’ lives easier while ensuring adherence to your organization’s travel policies.

Tip 7: Tax Compliance

Another area where accounting automation can make a significant impact within your accounting firm is tax compliance. While not all tax issues can be automated, many common and straightforward tax compliance areas can benefit from automated accounting systems. Complex and unique tax compliance issues should be handled by experienced accounting professionals and CPAs.

One of the most straightforward tax compliance areas to automate is ensuring proper tax filing across all relevant localities and states where you operate. Each state has unique tax jurisdictions and laws that your accounting software should be configured to handle. Once automated, this provides you with a comprehensive list of required tax filings—whether income, withholding, sales, or other taxes—helping provide peace of mind that you haven’t overlooked any tax liabilities.

Another process automation opportunity within tax compliance is sales tax management. Many software solutions can help identify whether your business needs to remit sales tax for particular goods or services. These accounting tools can also help determine whether your organization qualifies for sales tax exemptions. Common examples of sales tax exemptions include:

- Retailers buying products to resell – sales tax is typically paid by the end user, so businesses reselling products are typically exempt

- Government entities

- Charitable or other non-profit organizations

Common Challenges in Manual Accounting Processes

Many firms still struggle with manual accounting processes that create unnecessary bottlenecks. Common issues include:

- Time-consuming data entry and reconciliation

- Inefficient payable process management

- Delayed month-end closing procedures

- Risk of errors in manual tasks and spreadsheets

- Limited visibility into business processes

- Difficulty maintaining consistent accounting workflow

Benefits of Accounting Automation for Modern Accounting Firms

Before diving into specific tips, it’s important to understand why accounting automation is crucial for modern firms. Accounting professionals and accounting teams can achieve significant advantages through automation:

- Elimination of manual data entry and human error

- Real-time access to financial data for better decision-making

- Improved cash flow management through automated accounts receivable

- Enhanced accuracy in financial reporting and financial statements

- Significant time savings in accounting tasks and bookkeeping

- Streamlined workflows for both accounting operations and client services

Automation Tips for Accounting Firms

Whether within their own business processes or for a customer accounting firms have numerous ways that they can automate. This is not limited to, but includes, accounts receivable, accounts payable, expense management, payroll, financial reporting, and so on. Automating within your firm can help make you more efficient and cost competitive, and provide you with a differentiator when trying to attract new customers for your accounting firm.

Ready to take your data analysis to the next level?

Try Coefficient to seamlessly integrate your Excel with live data from various business systems, enabling real-time analysis and more advanced financial modeling.