Quick answer

Xero has embraced AI across its platform with JAX, their conversational assistant that handles invoices, reconciliation, and cash flow analysis through natural language. The platform includes smart bank reconciliation that learns from patterns, Hubdoc’s data extraction from receipts, and Analytics Plus for AI-driven forecasting.

Recent launches include automated tax filing for South Africa, the IntegraBalance.AI app for streamlined bookkeeping, and enhanced analytics with Syft integration. These features span all pricing tiers, though advanced capabilities require Growing or Established plans.

Does Xero have an AI agent?

Yes. Xero features multiple AI agents integrated throughout its platform.

The star performer is JAX (Just Ask Xero) – a generative AI assistant that works across desktop, mobile, WhatsApp, and email. JAX creates invoices, reconciles transactions, analyzes cash flow, and answers accounting queries using natural language. Think of it as having an accounting expert on speed dial.

Beyond JAX, Xero deploys specialized agents for bookkeeping automation, payment analysis, property management, and sector-specific tasks like healthcare accounting. These agents work behind the scenes, learning from user patterns to reduce manual work.

Visit the Xero AI Agents page for detailed feature breakdowns.

What are the latest Xero AI features?

Tax Filing Automation & Practice Management (Launched August 2025)

Xero rolled out comprehensive tax automation for South African businesses. The system handles provisional tax, VAT submissions, and complete tax return preparation without manual intervention.

Here’s what changed the game: accountants prepare returns through the dashboard, clients review everything via mobile apps, and payments flow automatically to tax authorities. The new analytics dashboard provides real-time business health insights, flagging potential issues before they become problems.

Small businesses save hours on compliance. Accountants reduce their error rates. Everyone wins.

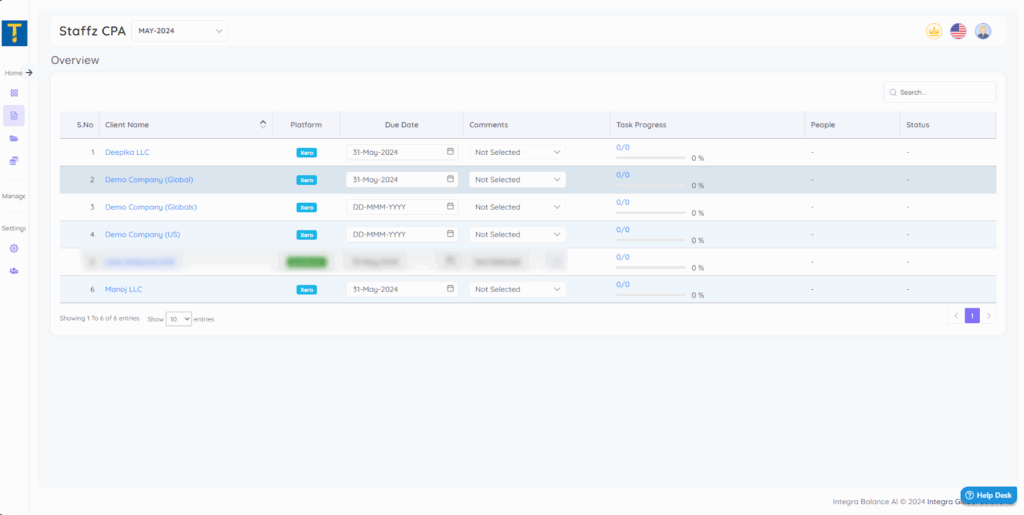

IntegraBalance.AI App (Launched June 2025)

This Xero marketplace app transforms bookkeeping for SMBs. IntegraBalance.AI learns from transaction patterns to automate categorization and speed up month-end reconciliation.

The AI spots anomalies that human eyes might miss. It suggests corrections. It reduces manual review time by up to 70% according to early user reports.

Best part? It integrates seamlessly with existing Xero workflows. No learning curve. No disruption.

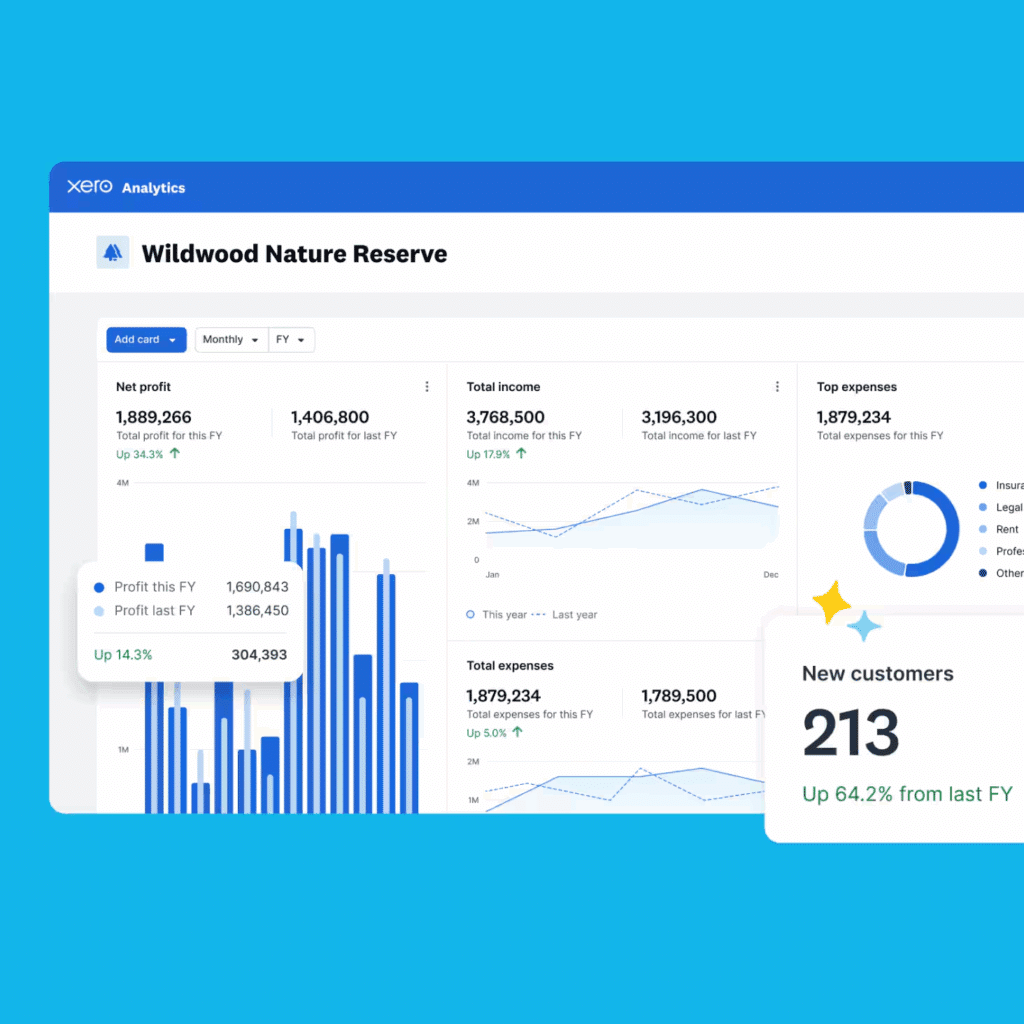

Analytics Plus & Syft Integration (July 2025)

Xero enhanced its analytics engine with Syft’s AI capabilities. The result? Smarter cash flow management and predictive business performance monitoring.

The system generates real-time projections based on historical data and current trends. It tracks expenses automatically. It flags upcoming bills before they surprise you.

Finance teams get the insights they need for strategic decisions. Business owners see the big picture without drowning in spreadsheets.

What are the popular Xero AI features?

JAX conversational assistant

JAX transforms how users interact with their accounting data. Type questions like “What’s my cash flow looking like?” or “Create an invoice for Client X” and JAX handles everything.

But JAX goes beyond simple commands. It proactively suggests next steps. After creating an invoice, it might recommend sending payment reminders for overdue accounts. It provides personalized business insights based on your specific data patterns.

The conversational interface works everywhere – desktop app, mobile, WhatsApp, even email. Business owners report feeling more confident about their finances because JAX makes complex data accessible through plain English.

Availability by pricing plans

Available across all pricing plans, with advanced analytics and business insights features exclusive to Growing and Established plans.

AI-powered bank reconciliation

Xero’s reconciliation engine learns from your past decisions. Every time you match a transaction, the AI gets smarter about similar future transactions.

The system flags unusual transactions for review. It suggests appropriate categories for new expenses. It cross-references payments with outstanding invoices automatically. Manual matching time drops dramatically once the AI understands your patterns.

Users report cutting reconciliation time by 60-80% after the first month of training the system. The AI becomes more accurate over time, not less.

Availability by pricing plans

Core reconciliation features available in all plans. Full automation and advanced analytics require Growing or Established tiers.

Smart data extraction (Hubdoc)

Hubdoc’s AI extracts transaction data from bank statements, receipts, and bills with impressive accuracy. Upload a photo of a receipt and watch the AI pull out vendor name, amount, date, and expense category.

The system validates extracted data against your existing records. It flags anomalies that might indicate errors or unusual transactions. Manual data entry becomes the exception, not the rule.

Integration with Xero happens automatically. Extracted data flows directly into your books, properly categorized and ready for review.

Availability by pricing plans

Included across all plans, with higher processing limits and unlimited usage on Growing and Established tiers.

AI-driven Analytics Plus

Analytics Plus uses AI to generate cash flow projections based on your real business data. Not generic industry averages – your specific patterns and trends.

The system monitors business health continuously. It alerts you about upcoming bills and expenses. It provides insights for hiring decisions, inventory management, and capital allocation.

Forecasting accuracy improves as the AI learns your business cycles. Seasonal businesses see particularly strong results once the system understands their patterns.

Availability by pricing plans

Exclusive to Established plans and available via Syft-powered add-ons for other tiers.

Common limitations of Xero AI

- Pricing complexity keeps growing. Users frequently mention rising subscription costs and confusing tier structures. Small businesses pay extra for advanced AI features, with periodic price increases making budget planning difficult.

- Feature overload frustrates simple users. While automation helps power users, some feel overwhelmed by feature bloat. Basic accounting functions get buried beneath advanced AI tools, creating a steep learning curve for those wanting simplicity.

- Performance lags during peak usage. Large invoice volumes or complex reconciliation jobs sometimes slow the system down. AI automation isn’t always optimized for high-transaction environments, causing delays during month-end or heavy usage periods.

- Support relies too heavily on automation. Limited phone support forces users toward self-service or AI-guided help. Complex accounting issues often need human expertise, not chatbot responses.

“Xero seems to have unlimited time and money to implement trendy AI bells and whistles, but has no interest in ‘boring’ core functionality.” — Xero Community Forum

“The sheer number of features can be overwhelming if you only need accounting basics.” — Capterra User Review

“Support is mostly automated and doesn’t always resolve specific issues for accountants.” — AccountingWEB Discussion

What are the alternatives to Xero AI?

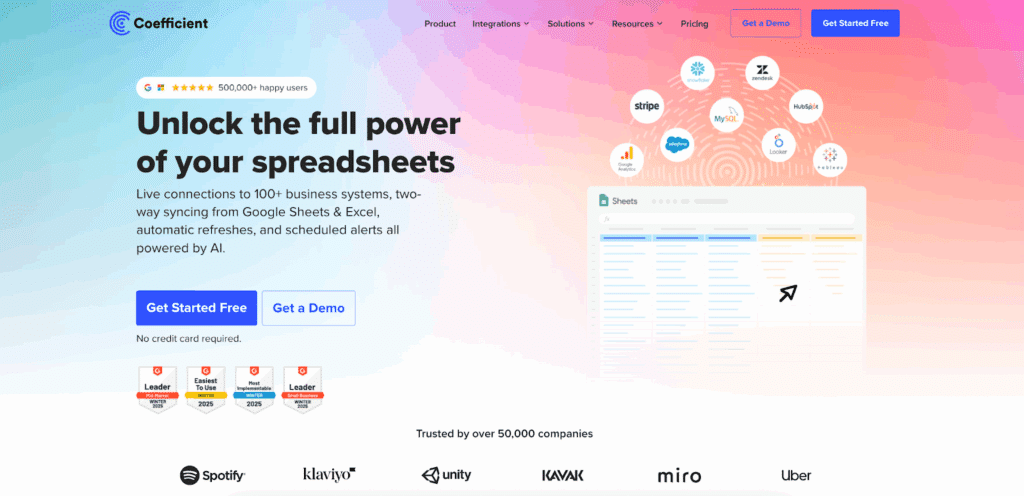

Coefficient AI

Coefficient’s AI Sheets Assistant brings accounting intelligence directly into Google Sheets. Instead of learning a new platform, work with familiar spreadsheet tools enhanced by powerful AI.

Use case 1: Financial dashboard creation. Ask the AI to “create a cash flow dashboard from this month’s transaction data” and watch it build charts, pivot tables, and summary metrics automatically. No complex formulas required.

Use case 2: Automated reconciliation analysis. Upload bank data to Sheets and let Coefficient’s AI identify patterns, flag anomalies, and suggest categorizations. The AI explains its reasoning in plain English, making audit trails clearer.

Unlike platform-specific solutions, Coefficient works with your existing Google Sheets workflows. Connect live data from 70+ business systems, including Xero itself, for real-time financial reporting that updates automatically.

Zapier

Zapier’s AI automation connects Xero with other business tools without coding. Their AI suggests workflow improvements based on your usage patterns.

Use case 1: Smart invoice workflows. Zapier’s AI can automatically create invoices in Xero when deals close in your CRM, then send personalized follow-up emails based on client history.

Use case 2: Expense categorization. Connect receipt apps to Xero through Zapier’s AI, which learns to categorize expenses correctly and route approval requests to the right team members.

Clay

Clay’s AI excels at data enrichment for customer and vendor management. While not accounting-focused, it enhances the business intelligence feeding into Xero.

Use case 1: Customer credit analysis. Clay’s AI researches new customers automatically, gathering financial health indicators and suggesting credit limits before creating them in Xero.

Use case 2: Vendor verification. Before setting up new suppliers in Xero, Clay’s AI validates business information, checks compliance status, and flags potential risks.

Ready to supercharge your financial reporting?

Xero’s AI features offer powerful automation for accounting workflows. But they work within Xero’s ecosystem alone.

Coefficient breaks down those walls. Connect Xero data with other business systems in Google Sheets. Build custom financial dashboards that update automatically. Let AI handle the complex formulas while you focus on strategic decisions.

The best part? You don’t need to learn a new platform. Work in familiar Google Sheets with AI that understands your business context.

Get started with Coefficient and transform how you analyze financial data.

FAQs

Does Xero have AI features?

Yes, Xero offers multiple AI features including JAX (their conversational assistant), smart bank reconciliation, and AI-powered analytics. These features automate routine tasks like data entry, transaction categorization, and cash flow forecasting. Coefficient offers an alternative approach by bringing AI capabilities directly into Google Sheets for more flexible financial analysis.

What features does AI have?

AI features in accounting platforms typically include automated data extraction from receipts, intelligent transaction categorization, cash flow forecasting, and conversational interfaces for queries. These capabilities reduce manual work and improve accuracy. Coefficient’s AI goes further by creating dashboards, building formulas, and analyzing data patterns within familiar spreadsheet environments.

Can AI do my bookkeeping?

AI can automate many bookkeeping tasks like transaction categorization, bank reconciliation, and data entry from receipts. However, human oversight remains important for complex transactions, strategic decisions, and ensuring accuracy. Coefficient’s AI assists with bookkeeping analysis in Google Sheets, helping you understand patterns and create reports while maintaining full control over your data.

What are the major features of Xero?

Xero’s major features include invoicing, bank reconciliation, expense tracking, financial reporting, payroll processing, and inventory management. Recent AI enhancements add smart automation to these core functions. For enhanced analysis and reporting flexibility, Coefficient connects Xero data to Google Sheets where AI can create custom dashboards and insights beyond Xero’s built-in reporting capabilities.